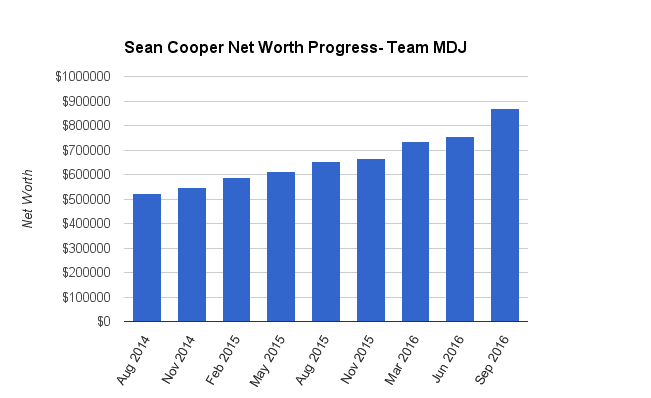

Net Worth Update September 2016 – Sean Cooper (+15.09%)

Welcome to the Million Dollar Journey September 2016 Net Worth Update – Team MDJ edition. A select group of readers were selected to be part of Team MDJ which was conceived after the million dollar net worth milestone was achieved in June 2014. Sean Cooper was selected as a team member and will post net worth updates on a regular basis. Here is more about Sean.

Profile:

- Name: Sean Cooper

- Age: 31

- Net Worth: $870,936

- Day Job: Employed with a major global pension consulting firm.

- Family Income: $58,050 (full-time job), $18,600 (rental income before expenses), $40,000 (approximate freelance income)

- Goals:

Mortgage paid off by 31, million dollar net worth by mid thirties. - Notes: Owns a house, rents out main floor. Most of net worth is in the principal residence. Paid off my mortgage in three years by age 30.

These last three months have been busy, even by my standards. Between my full-time job, my side hustle as a financial journalist, money coaching, Toastmasters (I’m on my sixth speech) and writing my book, I’ve barely had a moment to rest. I had to take a brief hiatus from going to the gym because it got to be too much, but I’m happy to say my schedule has slowed down slightly and is more manageable once again.

When I’m not at my full-time job, every spare moment is spent on my book. I’ve tweaked the title slightly – it’s now “Burn Your Mortgage: The Simple, Powerful Path to Financial Freedom.” After getting some helpful feedback from my friends, I rewrote a large portion of my book. The first draft was decent, but it just wasn’t the motivational, uplifting book I was looking to write. I realize most people aren’t willing to live without a smartphone like me (more on that later), so I’ve offered simple, practical advice most people can follow . My main message is that you don’t have to give up Starbucks and your iPhone to achieve financial freedom, but you do have to be smart on big purchases like a home and car.

Now that I’ve finished with the editing of my book, it’s onto the design. I happy to say I recently signed a deal with a trade distributor to get my book carried at major bookstores across Canada. This is a good first step, but there’s a lot more to be done. The success of my book will depend on positioning. To that extent, I’m hiring a PR firm. The book is tentatively set for release on March 1, 2017, so stay tuned. That may sound like a long way away, but there’s a lot of planning and work going on behind the scenes to ensure it’s a success. My dream of being a published author is almost a reality!

Since I paid off my mortgage, I finally broke down and bought a decent smartphone. Previously I had a BlackBerry Z10 (or as I like to call it, an “antique”). It was fine for a while, until I decided to write a book. I want to be active on Instagram and guess what? Instagram doesn’t support BlackBerry, so I broke down and bought a mid-range Android phone. Since I don’t have data on my phone, I bought a wireless router for $40. If you don’t have a wireless router at home for your smartphone, rush out and get one right away. It literally pays for itself in a month in the amount of data usage you’ll save on your phone. So far, so good with my new phone. I’d love to support a Canadian company like BlackBerry, but with their app support so bad, I had no choice but to switch to Android. I’m sure I’m not the only one who feels this way.

I’m really looking forward to my trip to San Diego for in September for FinCon. I’ve never travelled before (besides a trip to Wisconsin on the Greyhound bus), so I had no idea how costly the trip would be. The trip ended up costing me under $1,000, including flight and hotel – not bad! I could have saved more money by staying at Airbnb, but decided against it since my accommodations would be quite away from the conference (staying at the hotel at the conference will make it easier to network). It’s a four day conference, but I plan to arrive a little early to check out California and (hopefully) hit the beach. Readers, have you ever travelled to San Diego? Do you have any recommendations of places to visit?

I’m still trying to figure out my whole philosophy on travelling. My father being diagnosed with Parkinson’s disease last year was a real wakeup call. He planned to travel later in life, but now he can’t due to his illness. He ate well and exercised regularly. He had no way of knowing he would get sick. I don’t want to put off travelling my whole life because you never know when you could become sick too. Our health is something we often take for granted, but after my father’s health scare, I won’t make that mistake again. Going forward I’ll aim to take one big trip a year. With the Pound taking a tumble from the fallout of Brexit, maybe I’ll visit the U.K. next year. We’ll see.

On to the net worth numbers:

Assets: $870,936 (+15.09%)

- Cash: $50,095 (+20.58%)

- Registered/Retirement Investment Accounts (RRSP): $71,637 (+9.49%)

- Tax Free Savings Accounts (TFSA): $14,362 (+5.98%)

- Defined Benefit Pension: $49,845 (+41.34%) (commuted value adjusted annually in June when I receive my annual statement)

- Non-Registered Investment Accounts: $997 (+5.71%)

- Principal Residence: $684,000 (+14.00%) (purchase price adjusted for average selling price annually)

Liabilities: $0 (0.00%)

- Principal Residence Mortgage: $0 (0.00%)

Total Net Worth: ~$870,936 (+15.09%)

- Started 2016 with Net Worth: $736,382

- Year to Date Gain/Loss: +18.27%

Some quick notes and explanations to common questions:

The Cash

The cash is held in a no fee chequing account with PC Financial. I use my chequing account for regular bill payments, as well as making lump sum payments on my mortgage.

Savings

My savings are held in a savings account with Canadian Direct Financial. I mainly use my savings account as an emergency fund and to save towards the balance owing when I file my personal income tax return at the end of April. Even though I contribute the maximum to my RRSP annually, I still have a large balance owing to the taxman since I receive rental income and income from self-employment (I’m a freelance writer).

How Did I Pay Off My Mortgage in Only Three Years?

Due to the number of comments in Sean’s last net worth update, Sean has provided a more detailed explanation of his strategies.

Update August 2016 – Despite an annual salary of $55,000 when I paid off my mortgage in September 2015, I was able to pay off my mortgage in three years by age 30 through side hustle. I got the idea from the host of HGTV’s Income Property, Scott McGillivray, to live in the basement of my house and rent out the upstairs, earning $18,600 per year in rental income. By renting out half my home, half my housing related costs (mortgage interest, utilities, home insurance and property taxes) are tax deductible. I also worked part-time at a grocery store once a week, earning $5,000 per year.

I’ve received a few questions about how I was able to pay down my mortgage so quickly. It was mainly through my freelance income. I tend to be conservative with my estimate of freelance income, as it can vary a lot from month to month. For example, some months I earn $2,000, while others I earn $5,000+. For 2014, I ended up earning over $60,000 in freelance income (including my full-time job and rental income, I made over $130,000 before taxes in 2014). To help offset the taxes payable on this income, I claim home office expenses and maximize my RRSP contributions each year.

Through freelance income, I’ve been able to maximize the prepayment privileges on my mortgage. I made accelerated mortgage payments of $850 per week (most of this money went toward principal since my mortgage rate was only 3.04 percent). I also made a total of $38,250 in lump sum payments each year (15 percent of my original mortgage balance of $255,00); this money went straight toward the principal on my mortgage. I made lump sum payments whenever I received rent from my tenants or freelance writing cheques.

While I was paying off my mortgage, I lived super frugally, cutting my expenses to a bare minimum. The two most costly expenses for most after mortgage/rent are food and transportation. I spent only $100 per month on groceries (it helps that I’m a vegetarian). I also spent less than $1,000 a year on transportation by cycling to work.

Real Estate

My real estate holdings consist of my primary residence. I purchased my house in November 2012 for $425,000 with a mortgage of $255,000. As I live in Toronto, one of Canada’s most expensive housing markets, I’ve based the value of my principal residence on comparable properties that have recently sold in my neighbourhood. I also increase this number based on my property assessment value, which I receive every four years.

Pension

The pension amount listed above is the value of my defined benefit pension plan. I take the commuted value from my annual statement, which I receive by June 30th each year. I am fortunate to receive the commuted value on my annual statement, as most employers don’t provide it. This makes retirement planning a lot easier.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Another idea for Sean, since he loves to be uber frugal and pay off debt, is to max out a HELOC and buy public equities with the proceeds. He can spend the next 3 years slaving away to pay off that loan which will increase his net worth to an even greater hight as well as greatly diversifying his wealth. That, coupled with his rental income, would allow him to retire at age 35 as a Toronto bubble-priced home-owner as well as stock owner.

Think about it, dude.

Not a bad idea SST!

Also, max out that TFSA as others have said. $50k in a cash account getting charged interest when you can put most of that into a TFSA and avoid taxation on interest, let alone, build some cash flow from your investments tax-free, diversify away from just real estate, is a much better idea.

Advice to Sean:

Take a trip, enjoy your 30s for they will be gone before you know it. Life is also about experiences not about how big your bank account is. While you do need one for the other, it does not mean you should live so frugal that you aren’t having any “fun”. For someone without these wonderful life experiences will never truly be “rich” at all.

Best,

Derek

Agreed. Living in such a frugal way is not fun at all.

In Sean’s initial post you’ll find some interesting comments that summarize the deception of his whole story. See here:

https://milliondollarjourney.com/net-worth-update-november-2014-sean-cooper-5-21.htm

He’s made conflicting claims about his debt after graduation. See comment “James, January 10, 2015, 8:04 pm” in link provided. Now look at the comment Sean inserts 6 months later. See “Sean Cooper, Financial Journalist January 12, 2015, 11:57 pm”. “I told the TV producer that I graduated-debt free, but he said it would be “more compelling” if I said I had $50K of debt. I regretted saying this ever since, but I wanted to be on the show. I have been truthful about my finances ever since.”

In that same article he claims his income is “Family Income: $50,000 (full-time job); $18,600 (rental income before expenses); and, $20,000 (approximate freelance income)”. But in the same comment referenced above Sean responds, “Although I said I only earned $2000-$3000 a month in freelance income in the Financial Post article, it’s more like $5,000-$6,000 a month (before taxes).” Ok, that’s 2-3x what he’s been claiming. $2k per month is $24k per year. $6k per month is $72k per year. That’s a big difference. Something that a “Financial Analyst” should recognize as material.

Furthermore, the initial post linked above shows he had a down payment of $170k when he bought the house in 2012. He then discloses in a comment (See comment in this article, “Sean Cooper, Financial Journalist September 6, 2016, 6:08 pm”) that he had from savings. I just want to summarize the flows here to get an idea. I’ll assume round numbers and sole proprietorship for his freelance income.

2012

Sean has $195k of savings ($170k down payment + $25k he used for repairs). He buys a house for $425k with a $255k mortgage. Now let’s get into the flows.

Pre-tax Annual Income

$128k($50k full time job, $18k rental, $5kx12=$60k freelance)

After Tax Income

$90k (I used http://www.ey.com/CA/en/Services/Tax/Tax-Calculators-2016-Personal-Tax although it’s probably greater from a number of credits but this is close enough)

So take that after tax income from 2012 to 2016, let’s say ~4yrs. 4x$90k=$360k. Add in his paper gains for the house $684-$425=$259k

2012 Net worth = $195k

Cumulative After tax income = $360k

Home Gain = $260k (rounded)

Total: $815k

Throw in a DB plan and it’s not unreasonable. But it doesn’t fit with his narrative of living like a pauper. The real narrative here is “Make $130k per year, buy a house, have home prices increase 60% on paper over 4 years, and you too can get wealthy”. The catch 22 for poor Sean is that half of his income depends on him telling the pauper story. If he tells the pauper story, he gets to make $130k per year. If he tells the $130k per year story, he probably only makes half that because that story doesn’t sell books.

You can’t blame the guy for taking advantage of the gullible. I think the reason people get so upset is illustrated well by David. See “David December 7, 2014, 12:23 pm” from the article I link in the opening paragraph. MDJ was the second kind of personal finance guy: “genuinely want to help others and believe that “opening the books” will inspire others to do what they did”. Sean is the first kind of person: “want to generate a following and sell lots of books/advice teaching others how to do what they did” but are often found to be frauds.

The net worth value is not a sign of financial freedom. It’s good for the banks so they know what assets to go after.

What Sean needs to pay attention to is the growth of his investment portfolio or maybe he will just ride the gravy train of a defined benefit pension plan.

I passed the million dollar networth 2 years ago but it was ridiculous how much was from the home so I just track my investment portfolio. My journey is now the million dollar portfolio.

It’s interesting to see how MDJ leveraged his home to invest and Sean is doing the exact opposite. However, MDJ has more in investment assets to show for in the end. Will Sean ever leverage to invest? I stopped rushing to pay the mortgage with such low interest rates – I make way more by investing my money.

Sean has built up a decent amount of wealth so far. But most of his money is sitting in real estate. My suggestion to him is to consider diversifying his portfolio more into other asset classes.

Poor Sean. I think some of the commenters might be being a little hard on him. But at the same time, it sure looks like he leaves stuff out and makes puzzling moves.

Like why have $50k in cash and only $14k in a TFSA? Maxing out a TFSA is such a no-brainer. The move is doubly puzzling considering the fact Sean has a pension. By maxing out his RRSP before his TFSA, he’s adding another tax liability once he hits 65.

Sean does a terrific job of hustling, nobody is denying that. But perhaps he should spend more time managing what he has. What’s the point of getting rich if you’re so busy you can’t even find time to go to the gym?

Thing is, he isn’t “rich”. He has $65,000 and a house.

I would agree he is not “rich” yet, but you did not count his RRSP and his DB pension plan.

He is not poor for sure, compared to other Canadians who are 31 years old. He has time on his side to have more investments.

He lost “good years” on the stock market by putting all his money on his mortgage though.

I think that because rrsp contributions have a tax liability attached to them, people should account for the tax liability in their net worth statements. I think it’s a bit deceptive if you are sitting on a large rrsp portfolio but don’t account for the tax liability. This isn’t a comment aimed at sean cooper specifically but lots of people.

I am also part of a defined benefit pension plan. I may have maximized my RRSP contributions, but I have very little room due to the pension adjustment. Apologies for not making that clearer.

@Sean – House price was $600,000 on June 6, 2016 whereas it is now $684,000 on September 5, 2016. $84,000 has increased in just three months. Is it true?

@MDJ – Do you do any due diligence when someone publish their net worth or just simply publish it by using GIGO (Garbage In, Garbage Out)?

@WS As I explained above, my property value is based on my assessment value from the city. My house was recently assessed at $684,000 by the City of Toronto (MPAC). That’s why the value has increased by $84,000.

Sean

Curious why you choose to take such an optimistic assumption on the value of your house? Based on your August 2015 update youre including 24% growth which is based on your personal view of the value of your home relative to others in your area.

How do you calculate the value of your home each year?