Helping Canadians with Personal Finance Since 2006

Learn how to save money, build an investment portfolio, and become financially independent - from a middle-class Canadian who has actually done it!

As Featured On

Toronto Star

Forbes

CBC

The Globe and Mail

Global

The Financial Post

Most Recent Articles

Best Canadian Robo Advisors 2026

As we wrap up the 2026 RRSP season the best robo advisors in Canada are soon ending their best promo cash back offers for the…

Wealthsimple Review 2026

What is Wealthsimple? Wealthsimple was founded in 2014 by Michael Katchen, Brett Huneycutt, and Rudy Adler. I’ll be upfront about my bias here. I liked…

Questrade vs Wealthsimple – Which is Better in 2026?

The Wealthsimple vs Questrade battle for Canadians’ investment dollars has become much more prominent over the last few years as each company has upped their…

Questrade Review 2026

Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through…

Best Canadian Online Brokers – March 2026

As we wrap up the 2026 RRSP season, Canada’s major online brokerages are giving you one last crack at their best offers of the year.…

Qtrade Review 2026 – Canada’s Best Broker

Current Qtrade New Customer Promotion In 2026, brokerage promotions only matter if they put real money in your pocket. Free trades don’t count anymore since…

Best 2026 Broker Promo

Up To $5,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: $250 when you invest $1,000!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by March 31, 2026. Qtrade promo 2026: CLICK FOR MORE DETAILS.

About Us

Thanks for Stopping By...

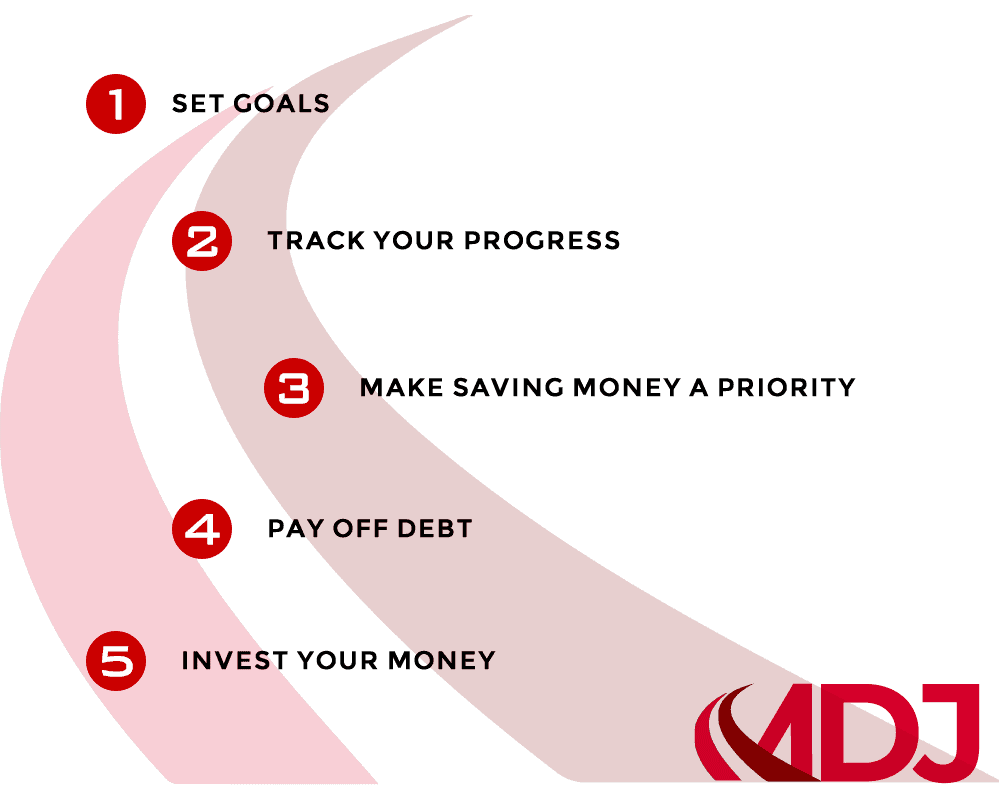

If you're new around here, I go by Frugal Trader and I started this site back in 2006 to set goals for myself and track my learning progress. Over the last fourteen years, I've publicly shared my path to financial freedom, from what discount brokerages and high interest savings accounts I use, to the unique ways I've found to save money.

The Million Dollar Journey team is proud to now include writers from all across Canada, representing a diverse array of backgrounds and unique points of view.

If you want to learn more about me and my team, check out our About Page. If you want to learn more about Canadian money stuff like RRSPs, TFSAs, and daily savings tips, start with our Financial Freedom 101 section. Finally, if you want to receive the free eBook I recently wrote about how to organize your Canadian life and portfolio for retirement at any age, simply sign up below.

Highest Rated Product Reviews

Qtrade Review 2026 – Canada’s Best Broker

Current Qtrade New Customer Promotion In 2026, brokerage promotions only matter if…

Questrade Review 2026

Is Questrade Safe & Secure? One of the most common questions that…

Wealthsimple Review 2026

What is Wealthsimple? Wealthsimple was founded in 2014 by Michael Katchen, Brett…

EQ Bank Review 2026

EQ Bank Account Options and Interest Rates Account Type Interest Rate Best…

Dividend Stocks Rock Review 2026

Investing on your own is not an easy task. From mutual funds…

Neo Financial Mastercard Review 2026

The new Neo Financial Mastercard or “Neo MastercardTM” is the next big…

Justwealth Review 2026

Why Justwealth? As I’ve updated my Justwealth review over the years, they…

Community is everything.

Million Dollar Journey.com began back in 2006, and boasts nearly 50,000 comments. Benefit from their collective wisdom and read what our community has to say about Canadian finance in 2026.

It’s only a good deal If they pay the bonuses that they promise. I’m on one of their existing promos…

March 2, 2026 on post Qtrade Promo Code 2026Is the Complete Estate Plan good for two people, husband and wife, or need to buy another one? If needs…

February 19, 2026 on post Legal Wills Review: Canada’s Best Online Will KitThank you for sharing this comprehensive list. Being a mother of two who just started on my FIRE journey last…

January 25, 2026 on post 49 Best ETFs in Canada – January 2026Where can I find the quest wealth portfolio questionnaire?

January 19, 2026 on post Questwealth Portfolios Review for 2026i have TD DI / CIBC IE / Questrade / BMO Investor’s Edge with years of experience, my recommendation is…

January 14, 2026 on post CIBC Investor’s Edge Broker Review 2026Hey Paul, FT doesn’t really stop by the comment sections these days, but there is definitely some validity to that…

January 13, 2026 on post Best Canadian Dividend Stocks – January 2026Can you comment on the argument that focusing on “dividend” stocks distracts from companies that do not pay dividends but…

January 12, 2026 on post Best Canadian Dividend Stocks – January 2026

Final notes for your journey

Get free instant access to our #1 article each week!

We've got a ton of information here , and after helping thousands of Canadians get started over the years, I know the information overload can be a bit intimidating.

Every journey begins with just a small step! If you are unsure where to start, check out these index investing strategies or Canadian dividends guide, two of my most useful money making methods over the years. Or read my net worth updates to see exactly what I did to reach the million dollar mark.

Be good with your money and thanks for being a part of the MDJ Community. Don't forget to sign up below so that you'll get our "Monday Morning Coffee" email that will fill you in on the writing we have done that week.

- FT and the Million Dollar Journey Crew

Neil

The devil is in the details. If you’re a typical DIY investor then this might be good. But then, a…

March 3, 2026 on post Qtrade Promo Code 2026