Why the Long Term Growth of the Economy is Not Relevant to Investing

An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today. – Laurence J. Peter

Our last article explained why the economy is not relevant to investing – short term. If you want to forecast the stock market this year or next year, the economy is essentially irrelevant – because the stock market forecasts the economy, not the other way around.

More surprising for investors, however, is that even the long term growth of the economy is not relevant to investing!

Most investors mistakenly believe that, over the long run, stock prices rise because of growth in profits brought on by the economy. Specifically, the belief is that the long run stock market growth = economic growth + change in multiple (normally expressed as P/E, or Price/Earnings multiple).

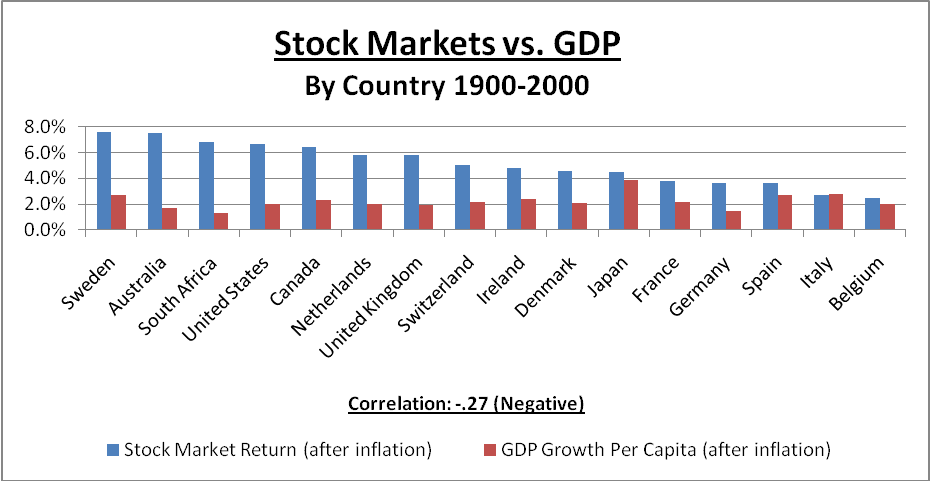

This is widely believed, even though it is obviously false when you look at the numbers! The actual stock market growth in most countries is many times the economic growth long term (see chart below).

A related “conventional wisdom” is that countries that have a strong economy will have a strong stock market. This sounds perfectly logical – it’s just not true. In fact, the opposite may be true!

For example, many news stories gloat about the high growth of the economy of China at about 10%/year. This is used to claim that investing in China will be a good investment. Recently, other news stories speculate that the US and Canada may have slower growth for a few years, and this is used to suggest that the stock market returns may also be lower.

However, in-depth studies comparing countries with high growth economies show this does NOT translate to higher stock market growth. In fact, if anything the opposite is true!

The most in-depth study we have seen is in the classic investment book on global stock markets “Triumph of the Optimists”, Dimson, Marsh & Staunton. They analyzed the correlation of GDP growth to the stock market in 17 major countries from 1900-2000 and found:

Correlation of GDP Growth to Stock Market

| Time Period | Correlation | What it Means |

| 1900-2000 | -.27 | Negative correlation |

| 1950-2000 | -.03 | No correlation |

Note that “negative correlation” means that they tend to move in opposite directions – higher GDP growth generally resulted in lower stock market growth, and vice versa. Higher GDP does NOT mean it is a better place to invest.

Their conclusion:

“Since 1900, low-growth economies have superior stock market performance. Historically, buying into equity markets with a high GDP growth rate has given a return that is below the return of markets with a low GDP growth rate. There is no apparent relationship between equity returns and GDP growth.” – Global Investment Returns Yearbook 2005, Dimson, Marsh and Staunton.

Figure: Higher stock markets generally were in countries with lower GDP growth in their economy. Source: “Triumph of the Optimists”, Dimson, Marsh & Staunton.

In another study, Jeremy Siegel compared GDP growth to stock markets from 1970-97 and came to the same conclusion:

Correlation of GDP Growth to Stock Market

| Type of Country | Correlation | What it Means |

| 17 developed countries | -.32 | Negative correlation |

| 18 emerging markets | -.03 | No correlation |

Jeremy Siegel also did a 107-year study from 1900-2006 with the same conclusion:

“The results are striking. Real GDP growth is negatively correlated with stock market returns. That is, higher economic growth in individual countries is associated with lower returns to equity investors.” – Jeremy Siegel, Stocks for the Long Run.

Ken Fisher (star fund manager and columnist for Forbes) in his myth-busting book, “The Only Three Questions You Need to Ask” explains:

“A major error investors make in foreign investing – developed countries as well as emerging markets – is assuming a country with a growing GDP must have good stock returns. By the same logic, a flat or negative GDP is often assumed to lead to poor stock returns. This easily debunked Question One myth has been a major cause for investor interest in China over the past few years.”

This myth is popular because people like to have very simple methods of understanding what is going on and because human beings are wired to see correlations whether or not they exist. Economic data is widely covered in the news with many news stories trying to relate it to the stock market. For investors that do not have an in-depth knowledge of stock markets and market history, the economy provides a simple way to talk about the market in broad generalities.

Bottom line: Countries with lower GDP growth generally have better stock markets.

The economy and the stock market are different like “chalk and cheese”. The reasons that slower growing economies generally have higher stock market growth are not fully understood, but here are the most likely reasons:

1. Expectations of the economy are built into prices of stocks:

Jeremy Siegel believes it is because the higher economic growth is built into stock market prices ahead of time and that it is often overly-optimistic. The price investors are willing to pay for a stock or mutual fund includes their expectations for how good an investment it will be. Therefore, investments in countries or sectors that are expected to perform well will tend to be at over-valued – which means their future returns will likely be lower.

2. Companies have many ways to grow profits:

Our opinion is that companies are able to adjust their operations to continue to grow their profits, whether or not the economy is growing strongly. Management is focused on annual targets to grow their profits and can do this in many ways – cost cutting, more efficient systems, new products, new technology, selling unprofitable divisions, buying competitors, gaining customers from competitors, new marketing/advertising programs – or replacing the management. Management is expected to grow profits regardless of the economy.

3.The economy is based on gross and the stock market is 15 times net:

As an accountant and a finance guy, it is easier to see why they are not a proper comparison. The economy is related to the “total output” of the country, which includes the sales or income of companies (and governments, etc.), while the stock market is normally based on a multiple of the profits or bottom line of companies (typically 15 times).

A comparison to your personal budget could be that the economy is like your salary (your gross), while the stock market is like 15 times the money you have saved/invested or have left over at the end of the month (your net).

When you think of them this way, you can see why they may grow completely differently for many reasons. For example, if you get a 10% raise, does that mean you will have 10% more money left over at the end of the month? Maybe/maybe not. If you reduce an expense (pay off a loan or buy a cheaper car), your bottom line soars (especially when you multiply it by 15), even though your salary/income did not change.

This is why the formula is false: stock market growth (15 times net) = economic growth (1 times gross) +/- change in multiple. You can’t compare 1 times gross to 15 times net!

4.The stock market is linked to the total of all shares, not to the average price per share.

Jeremy Siegel also believes that “economic growth influences aggregate earnings and dividends favourably, economic growth does not necessarily increase the growth of per share earnings or dividends. This is because increased growth requires capital expenditures…” (Stocks for the Long Run). He believes that it costs money to support higher growth. This is either borrowed, which lowers profits, or financed by issuing new shares, which lowers the profit per share.

5.The economy and the stock market are like “chalk and cheese”.

Companies and the economy are just different. For example:

- Ken Fisher, “The Only Three Questions You Need to Ask” explains: “Prices are determined by shifts in supply and demand, which may or may not parallel whether GDP growth is strong, weak, or nonexistent.”

- Some factors affect them differently. For example, high unemployment is clearly bad for the economy, but is arguably good for companies in the stock market. It means that some consumers are less likely to spend money, but on the upside, it also means that there is an available workforce, less pressure to increase wages, and that they are more likely to keep their best employees.

- The stock market is not the same companies over time. Obsolete or unprofitable companies are replaced by more profitable, innovative companies, especially in a slower economy.

Conclusion

The economy is not really relevant to stock market investing – short term or long term.

I realize this belief is very ingrained in the thinking of many investors, who may find it difficult to understand the stock market without thinking of the economy. However, a growing body of evidence continually confirms that economic growth is not necessary for good stock market returns – and in fact lower economic growth may promote good stock market returns.

The stock market does what it does – grows significantly long term with 1 or 2 bear markets per decade – generally regardless of what happens in the economy.

If you are an investor, your limited time is best spent on things that are definitely relevant, such as understanding stock market history and researching the quality of your investments. Forecasts and conjecture about the short or long term economic outlook or growth rates for the economy, sector or country may amount to just “market noise” or distraction to be avoided in your investment decisions.

Reader Poll

Since the reasons that slower growing economies tend to have faster growing stock markets is not fully understood, which of the 5 explanations do you believe is correct (or do you still believe that growth of the economy is necessary for the stock market to grow)?

About the Author: Ed Rempel is a Certified Financial Planner (CFP) and Certified Management Accountant (CMA) who built his practice by providing his clients solid, comprehensive financial plans and personal coaching. If you would like to contact Ed, you can leave a comment in this post, or visit his website EdRempel.com. You can read his other articles here.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Very intereresting study. Thanks to Ed.

In both Dimson and Siegels’ studies, the -0.27 and -0.32 correlation co-efficient for the developed countries shall not be interpreted as the stock market and the economy was going in opposite direction. It shall be interpreted as the studies were simply inconclusive. Period. In general, any correlation co-efficient between +/- 0.1 to +/- 0.5 shall be interpreted as inconclusive.

On the other hand, Siegels’ study in emerging markets is conclusive. The economy and stock market growth in these markets was very independent of each other.

The analysis seems to show that the stock market over-estimates the growth of high growth economies and under-estimates the growth in low growth economies.

I have read a few times that there is a belief that equity investors and equity fund managers place higher growth economies in favour, likely overly so. This would explain the reason for the results of the study. So, I guess I believe reason #1 is fairly accurate at explaining the results.

I think that earnings are certainly correlated with GDP. However, stock market performance depends on the over/under performance of earnings compared to expectation and not earnings themselves.

The title of this post and the article itself are a little misleading.

There are good reasons to think why current indicators of macroeconomic performance will not help you choose which assets and in what proportions to include in your portfolio. Some of them have been discussed here – e.g. the complexity of the relationship between the macroeconomy and individual assets.

However.. the long run growth of the economy does ultimately determine the overall performance of financial assets.

Imagine that the stock market was the only means of generating capital for any investment. This means, absent bubbles and ‘leaks’ out of the system to other countries, that the current market cap (value) or the entire stock market is the value of all the physical capital in the economy.

In the long run, with several simplifying assumptions, the marginal product of capital – that is the return to holding a unit of capital – is equal to the growth rate of the economy. (cf. solow model)

So in a world where equities have all the claim on the returns to capital, when the long run growth rate rises, the returns to capital, and therefore the returns to stocks, rise. When the growth rate falls, the returns to capital, and therefore stocks, fall.

The real world is more complex – stocks are not the only means of raising capital and paying for investments. Nor are changes in the growth rate likely to be the only cause of booms and slumps – though the jury’s still out on all the causes of business cycle.

In the short run, the growth rate might be pretty useless for predicting investment performance. In the long run, while it might not help you with your investment strategy, the long term growth rate will be the key determinant of the returns to capital.

Great article, and interesting facts to back it up. In general, I support the idea that conventional wisdom can be very wrong, although I also think it’s fair to be skeptical since there’s many “sensational” articles that claim to have a “hidden secret” that goes against conventional wisdom.

In this case, the facts do seem to back up the claim.

I think all 5 reasons make sense and play a part to some degree. But if I had to case my vote for one of them, I’d choose #1 which I would guess to be the greatest contributor.

@Ed: You meant “coefficient of determination”. This measure only detects linear relationships. None of these measures can tell you if two quantities have a nonlinear relationship. Try typing a column of integers -10,-9,…,-1,0,1,…,9,10 into Excel and a second column equal to the squares of the corresponding entries in the first column. The CORREL() function will tell you that the correlation is zero. Yet the entries in the second column are obviously completely determined by the first column. Looking at correlation cannot tell you that there is no relationship between stock returns and GDP. It can only tell you the degree to which there is a linear relationship.

Hi Ed,

What is your take on the Japanese economy? The Nikkei 225 index which includes:

Foods, Automotive (like Honda, Toyota), Manufacturing (Yamaha) Mining, Pharmaceuticals, Construction, Electronic Machinery (Sony,Cannon,Sharp) and many more industries.

The 15 year average (Globe Hysales) (no fees) is -3.66% So 15 years ago a $10,000 investment would be worth $5,719 (at the end of July).

Interest rates are near zero, debt (government) is high, real estate has been falling for years.

Another story (August 11, 2010)

(Reuters) – China has been buying record amounts of Japanese government debt because it is less risky than U.S. debt, at least in the short term, a Chinese government economist said on Wednesday.

Hi Everyone,

The score by my count so far is:

Reason #1: 2

Reason #2: 0

Reason #3: 0

Reason #4: 0

Reason #5: 1

Still believe in the correlation: 5

Ed

Hi Michael,

A correlation of zero might mean that 2 items move the same half the time and opposite half the time, but it could also mean that they move randomly and differently from each other 100% of the time.

For example, if the stock market moved through normal cycles while the economy did not change at all, that would be a correlation of zero. They moved the same none of the time, but they also moved opposite none of the time.

The stat that shows the portion of movements you explained by a different factor is called the “correlation of determination” and shown as R-squared. It is the square of correlation.

Therefore, a correlation of .33 actually means that only 11% of movements of one factor can be explained by the other.

In any event, you are right that nobody has perfect insight into the future of the economy, so predictions based on it are essentially useless.

Don’t forget that the 33% correlation is a 1-year lag with the economy next year vs. the stock market this year. This article gives a different story that long term lower growth of the economy generally leads to higher stock market growth.

Thanks for the vote for #5.

Ed

Good article. For us, we invest for the long term and 20 years down the road the world economies will be much different than they are today.

I think this is a well written article and i can appreciate the value in exposing common mis-conceptions about investing in the stock market.

At the end of the day it’s all speculation. Very few people have ever constantly outperform the stock market, so the easy answer would just be index funds, but there’s little excitement in that, which is what investors in the stock market are after.

Otherwise, there are other options to comparable returns without the speculation, timing and risks of traditional investments.