CI Direct Trading (Formerly Virtual Brokers) Review 2025

Virtual Brokers Review Summary

-

Fees and Pricing

-

Account Options

-

Non-Resident Accounts

-

Customer Service

-

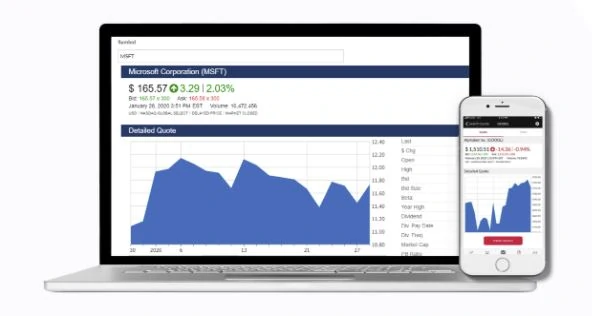

User-friendly platform and mobile app

Virtual Brokers Review Summary:

CI Direct Trading, formerly known as Virtual Brokers, consistently ranks as one of Canada’s top discount brokerages. One of the reasons why is that it offers free ETF purchases, which is something not all Canadian self-directed brokerages do.

So, if you are the buy and hold type, this can save you hundreds of dollars over time, leaving you with more to invest.

In terms of buying and selling other securities, such as individual stocks and options, the fees are somewhat standard. For example, you’ll pay $7.99 to buy and sell options and 1 cent per share to trade equities.

While the brokerage has its appeal in terms of low fees, both its web and app platforms are not super functional, and its customer service is lacking. When compared to our top recommended brokerage, Qtrade, CI Direct Trading fails to compete on the same level.

In this CI Direct Trading review, we’ll dive into the details to explain what CI Direct Trading offers, what fees you’ll expect to pay, how it compares to other online brokerages and more.

Pros

- Very competitive fees, similar to industry leaders

- Good solution for Canadian expats

- Has a variety of trading platforms for various levels of investors

- Robo-advisor access for the CI Direct Investing platform

Cons

- New pricing structures make it less appealing

- Difficult to navigate investment research centre on the platform

- $1,000 minimum investment to start

- No promo offers for new signups

CI Direct Trading Overview

In 2009, Virtual Brokers came out onto the scene as one of Canada’s best online discount brokerages with a commitment to offer rock-bottom prices to help investors cut costs to the bone.

In 2021, Virtual Brokers rebranded, becoming CI Direct Trading.

Three years later, CI Direct Trading continues to shine when it comes to fees and pricing for self-directed investors. It continues to offer zero cost ETF and mutual fund purchases. Unfortunately under the new management, it’s just not as competitive compared to other low cost brokers.

With a $1,000 minimum investment, annual fee, a $7.99 per trade options fee, and up to $24.95 per quarter administration fee, CI Direct Trading’s costs can add up fast.

CI Direct Trading Fees and Pricing

When it comes to CI Direct Trading, it’s similar to the former Virtual Brokers’ fees and pricing, there are a few different levels of costs that you have to be aware of. There are different models for ETFs, Options, Active Traders, and Non-active Traders.

It should be noted here that there is a minimum deposit of $1,000 GBP, USD, or EUR to get started, which compared to some of the other free-to-open accounts out there, makes CI Direct Trading a little less desirable in comparison.

Virtual Brokers No Fee ETF Purchases

Just like many other brokers, Virtual Brokers allows investors to purchase ETFs for free if they trade on the Toronto Stock Exchange (TSX).

They do charge a fee when you sell ETFs, but it’s a mere $0.01 per share for a minimum share price of $1.99 up to max $7.99 per trade, so even if you’re selling your ETFs, it’s not a huge cost to you. That said, most passive investors who use basic vanilla index options such as all-in-one ETFs are not likely to sell any ETFs until they are retired and withdrawing from their portfolio.

You have to have accumulated quite a substantial nest egg before you can’t re-balance your asset allocation simply by purchasing more of one ETF than another (if you’re not using the all-one-one options).

Virtual Brokers Trading Fees

There are two different paths when it comes to trading fees at Virtual Brokers.

The first path is the one that 98%+ of the people reading this article will choose, and that’s the basic penny-per-share model. This CI Direct Trading pricing model applies if you make less than 150 trades per quarter. The investors who prefer Canadian dividend stocks or who are putting the Smith Manoeuvre into action will likely make 5-30 trades per quarter, and are often investing $1,000 – $5,000 at a time.

Under this model, it’s a penny-per-share that you purchase, with a minimum cost of $1.99 (even if you buy less than 199 shares) and a maximum cost of $7.99 (even if you buy more than 799 shares). There are some very small fees tacked on in addition to this amount on most trades (usually a couple of pennies, at most).

The second path is for folks who are investing big time money and/or making many trades each quarter. It allows ALL trades to go on at the flat rate of $3.99. You can only access this rate if you made more than 150 trades last quarter. If you do some basic math, you’d have to be buying and selling a lot of shares to make that level of activity worth it.

We wouldn’t recommend going down that route.

It might be worth mentioning briefly that the CI Direct Trading fee for options trading is $7.99 per trade + $1.25 for the options contract. That drops to $3.99 + $1.25 if you do 150+ trades per quarter. We’re personally not into options trading, but some folks love that adrenaline rush.

Virtual Brokers/ CI Direct Trading Platform Fees

The vast majority of people reading this will be fine with the free dashboard and mobile app that Virtual Brokers provides. They do offer a wide variety of other options for more advanced traders, however.

Below is a complete breakdown of the CI Direct Trading Fees.

Platform | Monthly Fees |

CI Direct Dashboard Web-Based and App | FREE |

VB Wave | $75.00 CAD |

VB Mobile | FREE |

PowerTrader Pro | $250.00 USD |

RealTick | $400.00 USD |

ITS Trader Lite | $580.00 USD |

IRESS | $1120.00 USD |

CI Direct Trading Admin and Account Fees

One area where discount brokerages like to bury some of their overall pricing is the account administration fees, and CI Direct Trading is no different. The two costs that really stand out to me are the RESP administration fee and USD RRSP/USD TFSA quarterly fees (multiply by four to get the per-year costs).

See the below table for the complete look at Virtual Brokers’ Account Admin fees.

Item | Fees |

Account Transfer-In | FREE |

RRSP, Spousal RRSP, LIRA, RIF & LIF | FREE |

TFSA | FREE |

Deposit-Bill Payment (CAD Only) | FREE |

Deposit-Wire Transfer (CAD/USD) | FREE |

Withdrawal-Electronic Fund Transfer (EFT) | FREE |

Partial Transfer out | $50 per account |

Account Transfer Out | $150 per account |

Withdrawal-Wire Transfer (CAD/USD)-Canada | $50* |

Withdrawal-Wire Transfer (USD)-International | $100 |

US RRSP, US Spousal RRSP & US LIRA | US $15 per quarter |

UK QROPS | US $150 per year |

US TFSA | US $15 per quarter |

RESP | $25 per year |

US RESP | US $15 per quarter |

Account Administration Fee | $24.95 per quarter |

Electronic Trade Confirmation (e-Confirmation) | Free |

Cheque Cancellation Fee | $50 |

Electronic Monthly Statement (e-Statement) | FREE |

Paper Trade Confirmation | $3 |

Paper Monthly Account Statement | $5 |

Copy of Tax Statement | $35 per account per year |

Copy of Monthly Statement | $20 per account per month |

Virtual Brokers TFSA, RRSP and Other Accounts

Like all of the leading Canadian discount brokers these days, Virtual brokers offers all of the usual accounts including:

- Non-registered accounts (both CAD and USD)

- RRSP (both CAD and USD)

- TFSA

- RESP

- RRIF

- LIF

- LIRA

- Non-registered (All-in-One) Accounts include Options and Margin capability

Canadian Expat Non-Resident Investors

The one area where CI Direct Trading really shines is their commitment to Canadians who live overseas. Many discount brokers don’t want to take on expat clients because of the increased paperwork involved. CI Direct Trading doesn’t gouge you on extra administration fees and their pricing is still very low.

While there is no minimum amount needed to get started with CI Direct Trading in Canada, non-residents are required to have $25,000 CAD to open an account. They will also pay additional fees for trading equities and options that residents do not.

This makes sense considering the increased administrative burden they are taking on with expat clients. Given how expensive non-USA discount brokerages are to use around the world, I know that many non-residents are happy they have the CI Direct Trading option back home in Canada.

CI Direct Trading and Wealthscope – a New Addition

With several of Canada’s leading online brokerages adding a portfolio analysis tool to their platforms in 2020 and 2021 CI Direct has not been left behind. Their partnership with Wealthscope has provided CI Direct users information about their portfolios appropriate risk level, diversification, market exposure, and fees.

The Wealthscope features offer a great way for those who already have a CI Direct Trading account to try out robo-advisor services, if that is something that interests them.

Kambiz Vatan-Abadi, CEO and President of Toronto-based BBS Securities Inc. stated, “With this new partnership, Virtual Brokers’ clients have access to a data-driven, state-of-the-art portfolio level analysis, one account at a time, or combined for a big picture view.”

The tool also allows investors to answer some of their own questions when it comes to retirement target setting, RESP goals, and probabilities of future returns based on past results (which is admittedly of questionable value).

What Is the CI Direct Kickstart Investors Program (KIP)?

One of the more unique programs that Virtual Brokers has implemented is their Kickstart Investment Program (KIP). The idea is to get investors used to systemically building their wealth through automation.

In order to give investors an added incentive, Virtual Brokers is willing to allow a small amount of free share purchases each month. Here’s the steps that have to be taken in order to get the benefits of the KIP program:

1) Fill out a form that allows Virtual Brokers to automatically debit (withdraw) a specific amount from your main chequing/savings account each month.

2) Decide on up to 5 ETFs or Canadian Stocks that you want to automatically buy each month.

3) Understand that you won’t be able to determine which stock gets a specific amount of money or anything like that – it’s all automated (like a robo advisor).

4) The price for this program (assuming you’re not a student or recent graduate) is a flat rate of $50 per year.

It’s a pretty cool way for Virtual Brokers to nudge investors towards index-based couch potato investing.

CI Direct Trading Review: FAQ

Who is Virtual Brokers / CI Direct Trading Best For?

Active traders who would benefit from the extra features and functionality of the high-ticket PowerTrader Pro, Realtick EMS or ITS TraderLite might find CI Direct Trading an attractive option.

The majority of Canadian investors, however, are looking for ways to save money on their investments using a platform that is convenient and easy to use.

That being said, CI Direct Trading is likely not what the majority of Canadian investors are looking for, unless of course you are a Canadian living abroad.

For most Canadian investors, Qtrade would be a much better option due to the high quality of its outstanding platform and customer service, the fact that you can buy and sell over 100 ETFs for free, and its attractive welcome offer of $2,100 in bonus cash.

Another great alternative for those that value low cost and value is Questrade. You’ll pay nothing to buy ETFs, and if stocks are more your thing, you’ll only pay $4.95 plus ECN fees. Check out our full Questrade review for more information, as well as our Questrade vs. CI Direct Trading comparison for a point by point breakdown, both of which are similar to this CI Direct Trading Review.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Perhaps in 2021 CI direct investing allowed expats to sign up, but as of today (June 2023). They do not. I had to go through the whole sign up process only to get a rejection letter a day later. What’s strange is expats can invest in their robo-advisor program, though.

VB does NOT PROVIDE REAL TIME QUOTES in their trading module, although they say they do. There are real time quotes available, but you cannot get those updated real time quotes when trying to trade with their online module. This is a MAJOR DRAWBACK, not being able to get quick reliable real time quotes while accessing the Trade module. Seems incredible in this day and age NO REAL TIME QUOTES when trying to make a trade!

I’ve had about 20 interactions with their technical people, have sent them many emails, and they finally figured out THAT I WAS RIGHT. They said they were working on it. I DO NOT BELIEVE this, they are not working on it, all they have to do is pay for the quotes, and they refuse to do it. This is a MAJOR and incomprehensible failure on there part. They should never get a rating about 2 or 3 out of five because they DON”T PROVIDE REAL TIME QUOTES WHEN TRYING TO MAKE A TRADE.

Had to convert currency today and Virtual brokers charge 1.95% to convert USD to CAD, and i think that is ridiculous

You write, “Just like Questrade, Virtual Brokers allows investors to purchase ETFs for free if they trade on the Toronto Stock Exchange (TSX).” I don’t know about VB, but Questrade does not offer no-fee purchase free ETFs exclusively to those listed on the TSX. It’s for all ETFs. From the QT website: “You can buy any Canadian or U.S.-listed ETF in the Questrade trading platforms and skip the commission.“