Dogs of the TSX Dividend Stock Picks

The “Dogs of the TSX” dividend investing strategy for Canadian stocks has been a focus of mine for the past 14 years. I don’t follow the “Dogs” strategy with a majority of my portfolio, but it is a key factor when I look at my relative weighting of Canadian stocks at the end of each year. My key Dogs pick for 2024 and 2025 was Power Corp – and man did they make me look smart last year! (More on that in a second…)

I want to make it clear that the Dogs of the TSX is not something that I created. In fact, it’s actually an American idea. Michael B. O’Higgins wrote a book called the Dogs of the Dow back in 1991, and the idea was later adapted to the Canadian market. I first came across the “Dogs” method of stock picking when MoneySaver magazine started a column titled BTTSX – short for Beating the TSX – dividend stock strategy. (Click here to skip directly to my 2026 picks).

The theory behind the Dogs of the TSX strategy is to look for solid cash-flow positive stocks that have fallen out of favour for one reason or another. In other words, you’re looking to take advantage of short-term market inefficiency when it comes to the pricing of blue-chip Canadian stocks. A low price and a high dividend results in a high dividend yield.

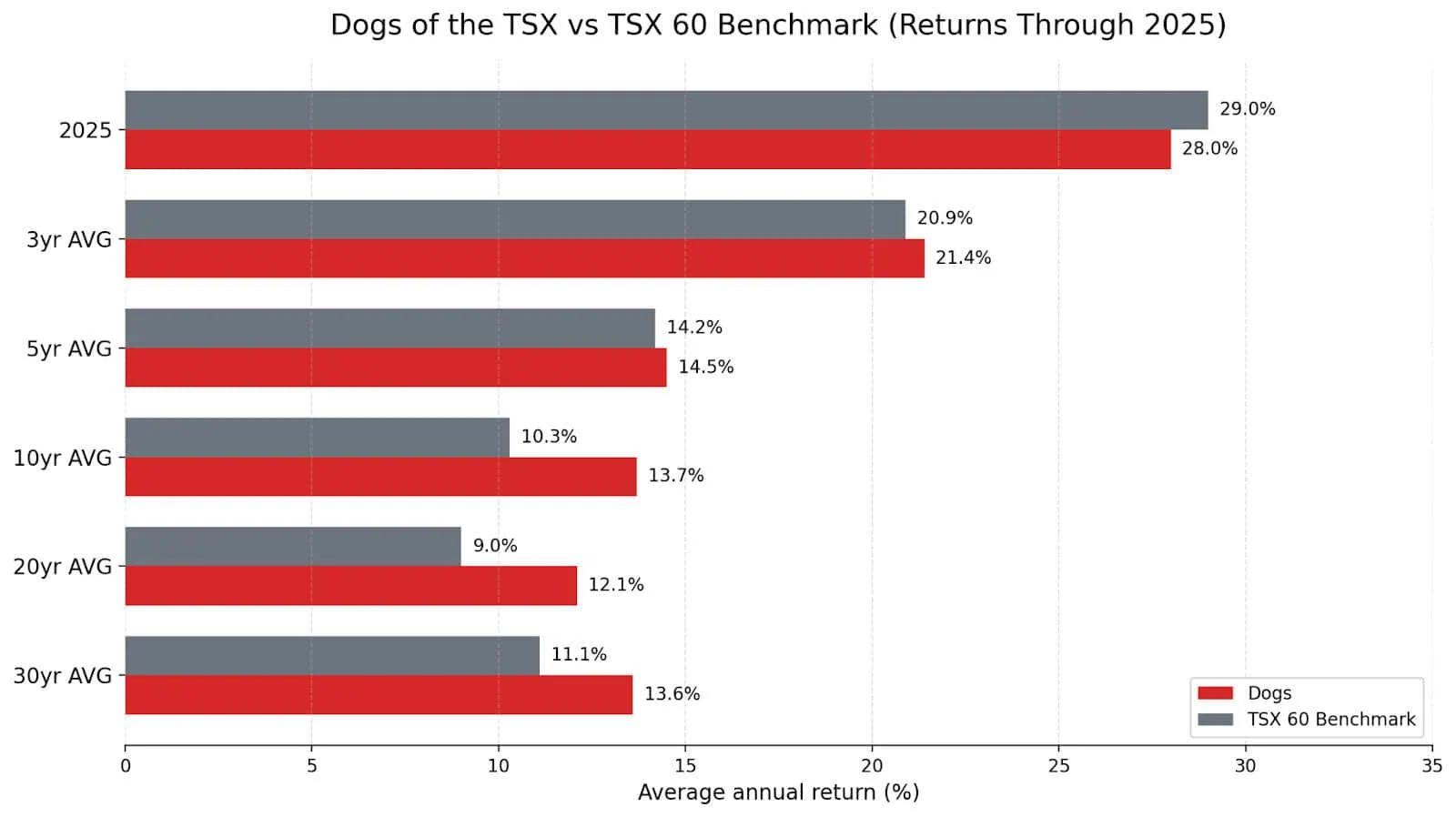

The chart below illustrates the total return (dividends plus price capital gains) versus the TSX 60 benchmark over the years. Looking at 2025, our Dogs of the TSX portfolio of 10 stocks was very similar to the overall TSX 60 index. In fact, the average return lead that the BTTSX strategy has over 3- and 5-year periods is fairly minor. That said, when we look out over the longer terms, we see consistent outperformance in the range of 2-3% per year.

If you had $100,000 invested 30 years ago, the constant difference in compounding would have left you about $2 million richer today had you followed the Dogs of the TSX BTTSX strategy.

When we look back over the last year, the banks had a great year, and the telecommunications companies continued to get beat up. Consequently, we’re going to lose TD off of the list this year (its share price has finally caught up to its dividend payout).

In its pure original form, the Dogs the TSX strategy simply involved ranking the companies in the Toronto Stock Exchange 60 index (aka: TSX 60) by their dividend yield. The highest yield gets the top spot. Then you simply invest equal amounts in all top ten dividend yield stocks.

The idea is that investing in companies that have relatively high free cash flow – but relatively low share prices – is an excellent way to systemically outperform the broader market. No need to pick stock winners with any sort of fancy algorithm – just choose dividend stocks that are out of favour and consequently have high yields.

The average yield for the stocks making the 2026 Dogs of the TSX is about 5.26%. That’s down about 1% from last year – showing that valuations on these companies have raced ahead of their free cash flow and dividend payouts. (In theory, it could also be the case that these companies cut their dividends, but since only BCE did that, we can eliminate that theory.)

In my own implementation of the BTTSX strategy I often eliminate Real Estate Investment Trusts (REITs), and any stocks that have cut dividends OR have insanely high payout ratios (foreshadowing a future dividend cut). Those rules helped me avoid the Algonquin disaster in years past. I didn’t trim much of my BCE holdings before the cut, and I have to admit that I’m getting nervous about Telus – but haven’t pulled the trigger yet.

You’ll notice that my Dividend Dogs of the TSX list has a lot in common with my Best Canadian Dividend Stocks list that I update monthly. There’s obviously a lot of overlap in selecting value-driven, stable, Canadian company stocks.

Top Canadian Dogs of the TSX Pick for 2026: Emeara (EMA)

My 2024 and 2025 Dogs of the TSX picks were identical to one another: Power Corp (POW).

While I looked pretty average in January last year, I look pretty darn smart today! That’s because Power Corp saw a total return of over 75% last year!!

In fact, the share price has done so well, that it has outpaced the dividend, and dropped POW right off the BTTSX list for 2026. The biggest driver was Great-West Life’s robust earnings. On top of that, IGM has quietly stabilized its asset base, and Wealthsimple continues to expand its footprint, with more rumours swirling about that Schedule 1 bank licence approval. Investors are finally pricing in the fact that Power Corp isn’t just a stodgy old financial holding company. It’s a well-run, diversified business with growth levers in both traditional finance and the fintech space.

The other stock I highlighted as a Dogs of the TSX stock to watch was TD Bank – and again, TD did so well (total return of about 70%!) that it’s not on the list this year!

It is nearly impossible to duplicate those results going forward. Those two picks both hit the perfect tailwind, and while I believed they were significantly undervalued 12 months ago, I would have told you that you were crazy if you said they’d have total returns of more than 50%, nevermind 70%!

Now, I’m not nearly as bullish on the overall market going into 2026 as I was in 2025. I don’t see any screaming “buy now” deals out there. That’s why my 2026 Dogs of the TSX pick is Emera.

It’s definitely not a stock that’s going to light up Reddit boards. What it is, is a regulated utility with a high starting yield, visible growth, and a US-expanding business mix that I think the market is still undervaluing.

At its core, Emera is a regulated electric and gas utility operator. More than 90% of its earnings come from regulated sources, and roughly 96% of its assets sit inside rate-regulated frameworks. That price stability is exactly what you want when you’re building a dividend-focused portfolio in a market that feels a bit stretched.

Emera operates across Canada, the U.S., and parts of the Caribbean, but the business is much simpler than the geographic footprint suggests.

The short version is this: Florida’s data center growth is the story. Canada is secondary. Everything else is noise.

Emera’s crown jewel is Tampa Electric, which sits under its TECO Energy subsidiary in Florida. That operation benefits from population growth, constructive regulation, and a steady stream of capital investment tied to grid hardening, electrification, and storm resilience. If you believe Florida continues to grow and data centers continue to put pressure on electrical grids (and all signs point that way), Emera has positioned itself very well.

One of the reasons Emera stands out to me right now is management’s five-year, $20 billion capital plan, announced late in 2025. This isn’t vague guidance. It’s a detailed roadmap that extends 7–8% consolidated rate base growth through 2030, with nearly 80% of that capital earmarked for Florida.

That’s meaningful growth for a regulated utility. And importantly, it’s growth that regulators expect and allow utilities to earn returns on.

Canadian assets (which are mostly through Nova Scotia Power) do introduce some political and regulatory friction. But when I look at where Emera is allocating capital, it’s clear management understands where the best risk-adjusted returns are coming from. The payout ratio is pretty darn high, and the balance sheet carries too much debt for my liking. That said, with interest rates coming down in the US, and regulations coming off the books, I like the short- and medium-term prospects.

In a market where many stocks feel priced for perfection, Emera feels priced for caution. That’s what I’m looking for in 2026.

Dogs of the TSX Dividend Stock Strategy Implementation

Here is the step by step procedure of how this strategy is implemented:

1. Sort the TSX60 by dividend yield.

2. Purchase the top 10 positions with equal dollar amounts but remove former income trusts (maybe some exceptions) and stocks that have a shaky dividend history (ie. dividend cuts, cyclical companies, pausing dividends etc).

3. Hold your positions until the new year at which point you check the list of top 10 yielding blue chips on the TSX again. If there are any differences, you swap out positions until they match.

4. Repeat annually going forward.

While it may sound like a lot of portfolio churn, since the TSX is fairly small, the top 10 list doesn’t vary much from year to year.

It also turns out that a number of the largest dividend stocks in Canada are also dividend growth stocks. While the traditional method of picking these positions is to buy the top 10 while removing former income trust and companies that have cut their dividends in the past, I prefer to pick stocks that also have a history of dividend increases (most of them do).

Performance of the BTTSX Strategy

As magical as it may seem, this strategy has been outperforming the TSX over the long term. Mind you, the strategy does not outperform every single year, but it has outperformed over the long term (however, note that past results do not guarantee future returns).

According to the Beating the TSX Wiki page, between 1987 and 2017, the BTTSX had an average return of 12.4% vs the TSX which has returned about 9.6%.

As you know, small improvements in portfolio performance can lead to a significant difference in portfolio size over the long term. Note my article on improving your portfolio performance by 1.7% through reducing your portfolio MER can lead to a 60% difference in portfolio size over 30 years. It also helps to use a low-cost online broker.

I like this strategy in that investors are getting the highest possible yield out of the largest blue-chip stocks in Canada with the possibility of dividend increases.

The downsides are that there is annual turnover (usually minimal) which can result in a tax hit in non-registered accounts and potential lack of diversification depending on the year. For example, one year, it could be a high concentration of financial stocks in the portfolio, and the next could be utilities.

Beating the TSX Dividend Stock Picks For 2026

Alright, so after applying the Dogs of the TSX strategy for the beginning of 2026, here are this year’s buys:

- Telus (T)

- Enbridge (ENB)

- Pembina Pipeline (PPL)

- BCE (BCE)

- Canadian Natural Resources (CNQ)

- TC Energy Corp (TRP)

- Emera (EMA)

- Bank of Nova Scotia (BNS)

- Sun Life (SLF)

- Canadian Tire (CTC.A)

If you’re curious, here’s what stocks I bought last year as part of my BTTSX strategy:

- Enbridge (ENB)

- BCE (BCE)

- TC Energy Corp (TRP)

- Canadian Natural Resources (CNQ)

- Bank of Nova Scotia (BNS)

- Telus (T)

- Pembina Pipeline (PPL)

- Emera (EMA)

- TD Bank (TD)

- Power Corp (POW)

And 2023:

- Algonquin Power and Utilities Corp (AQN)

- Enbridge (ENB)

- TC Energy Corp (TRP)

- Bank of Nova Scotia (BNS)

- BCE (BCE)

- CIBC (CM)

- Power Corp (POW)

- Pembina Pipeline (PPL)

- Manulife (MFC)

- Telus (T)

And 2022…

- Enbridge (ENB)

- Pembina Pipeline (PPL)

- BCE (BCE)

- TC Energy Corp (TRP)

- Manulife (MFC)

- Algonquin Power and Utilities Corp (AQN)

- Power Corp (POW)

- Suncor (SU)

- Bank of Nova Scotia (BNS)

- Telus (T)

Overall, the 2026 Dogs have changed a bit from last year. We now have 2 telcos, 2 financials, 1 utility, 1 retailer, 1 energy company, and 3 pipeline utilities (or “mid-stream” energy companies). For a complete portfolio, we would also need to look at materials/resources, real estate, technology, and consumer stocks. If you want to round out your dividend portfolio, check our top dividend stocks for 2026.

My top 10 holdings after 14 years of doing the BTTSX stock strategy are:

- Enbridge (ENB)

- BCE (BCE)

- TC Energy Corp (TRP)

- Telus (T)

- Bank of Nova Scotia (BNS)

- Power Corp (POW)

- TC Energy Corp (TRP)

- Pembina Pipeline (PPL)

- Manulife (MFC)

- Emera (EMA)

My Overall Top 2026 Dividend Picks After Adjusting for Dividend Growth

Ticker | Sector | Div Streak | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio | P/E | |

Fortis | FTS.TO | Utilities | 52 | 3.60% | 6.15% | 5.26% | 5.02% | 74.53% | 21.11 |

Toromont Industries | TIH.TO | Industrials | 36 | 1.24% | 7.90% | 14.45% | 10.90% | 31.06% | 27.66 |

Canadian National Railway | CNR.TO | Energy | 29 | 2.55% | 4.47% | 8.70% | 9.07% | 48.07% | 18.87 |

Canadian National Resources | CNQ.TO | Communications | 25 | 5.39% | 17.98% | 4.76% | 22.55% | 74.30% | 13.80 |

Emera | EMA.TO | Utilities | 17 | 4.33% | 8.37% | -4.87% | 3.07% | 167.81% | 18.31 |

National Bank | NA.TO | Finance | 16 | 2.84% | 9.96% | 10.53% | 10.79% | 45.77% | 17.33 |

Alimentation Couche-Tard | ATD.TO | Business | 16 | 1.17% | 10.73% | 2.15% | 21.88% | 19.58% | 19.42 |

Brookfield Corp. | BN.TO | Finance | 16 | 0.49% | 3.93% | -28.67% | -5.59% | 104.65% | 102.42 |

Waste Connections | WCN.TO | Finance | 15 | 0.82% | 11.43% | 25.52% | 10.73% | 48.94% | 72.47 |

?????? (Hidden, click for access) | (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ?.??% | ?.??% | ?.??% | ?.??% | ???.??% | ??.?? |

Taking Dividend Investing to The Next Level

Most of my picks are based on the information I get from Dividend Stocks Rock (DSR). They offer a free newsletter full of excellent advice that will help you maximize your yields.

On top of that, the optional paid subscription gives you access to a bunch of excellent tools, as well as expert advice tailor-made for your specific portfolio!

DSR is managed by fellow blogger Mike from the Dividend Guy Blog since 2013, and his results during that time have been nothing short of amazing. Read our detailed DSR review, or sign up now by clicking the button below to get 33% off.

Dogs of the TSX FAQ

Final Thoughts

As you can see, the BTTSX strategy has been outperforming the TSX over the long term. Mind you, the strategy does not outperform every single year, but it has outperformed over the long term (however, note that past results do not guarantee future returns).

Perhaps it’s the fact that large-cap stocks on the TSX tend to beat Canadian small caps, which at times can act as a drag on the overall index (Canadians love their oligopolies with large barriers to entry after all). Another reason may be that as yields rise for blue chips, it may mean that their stock price is relatively low which can equate to a form of value investing.

If you are considering the Dogs of the TSX strategy, I would recommend using it as part of your Canadian exposure and using all-in-one ETFs for added diversification.

Using an all-in-one ETF can give you instant international exposure, and is especially key for getting some of your money into areas like tech and healthcare where Canada doesn’t have many champions.

Canadian dividend stocks have historically been an excellent value (and I honestly believe they represent one of the best places to build your nest egg) but a responsible investor knows that diversifying risk is essential to long-term success. See my Canadian dividend stocks list for more information on what I’m putting new money into these days.

Thoughts on AQN with its recent cuts? Does this one get dropped going forward? Probably doesn’t even make the list anymore with its yield. Are you going to sell it off?

FT updates the list annually Vic. For now, it stays. It’s a “Dog” – but maybe the valuation is good at the current point?

Article could use some clarity ; which is final list for building starting now a dogs of the tsx prtfl and which is his personal, seems quite a diff and some of title work does not clearly differentiate if he is talking exclusively about the beating the tsx ie dogs of the dow and his pure dividend pritfolio = left scratching my head…..

last should day “dogs of the tsx”

nice one will all the ROGERS + SHAW drama do you think Shaw can be a good choice at this point? or should it be swap with something different ?thanks

If any one is interested, there is a Canadian site dedicated to Beating the TSX:

DividendStrategy.ca

It has the annual list, plus updates to the portfolio monthly for those needing up to date information. There is also a complete list of the TSX 60 stocks organized by dividend yield.

BTSX has a long history of generating returns in excess of the benchmark. Interestingly, a recent post shows how Beating the TSX has out-performed the index over various time periods after recent market crashes, which is especially helpful given the current situation. If you’re not sure how to implement the strategy in a practical way, there is information on that too. All of the information is free.

I have some of these. The yields are great and these companies have been paying divs for decades.

My big worry right now is the Canadian ecomy is in trouble, 6 million jobs have been lost. I don’t think the full ramification of this is yet know, let alone priced in.

In a conservative approach, which of this would be the most secure to

1- continue paying divs?

2- not depreciate in price substantially?

Hello MDJ, I have ~120k of room between me and my wife’s TFSA account.

Do you think investing the 120k in the TFSA or RRSP account is a better choice right now?

We have the cash sitting in Questrade and I am trying to decide what to do.

Thanks

I will go for TFSA when market is down and RRSP when is up.