Completing The Million Dollar Journey

It’s been a long time coming, but we finally did it, we hit the million dollar net worth milestone.

Our million dollar journey started in 2006 with a family net worth of about $200,000. While that is a significant amount of money for a 27 year old, the balance sheet, or net worth statement, was full of consumer and student debt. My wife and I graduated in 2003 with about $45,000 in student debt.

Of course, we needed a new car to celebrate our new degrees, so we racked up an additional $25,000 in car financing. To top it off, we threw a new mortgage onto our first house (a two apartment house) all in the same year. Although we both graduated with professional degrees, our starting salaries were relatively low, so our cash flow was very tight after debt servicing.

Despite this, I had ambitions of becoming financially free while I was still young – that is, to have enough passive income to cover our living expenses. To achieve financial freedom, aggressive goals had to be established. So, in 2006, I started this blog to keep me accountable and set a lofty goal of becoming a millionaire by the end of 2014 at the age 35.

Are You Saving Enough for Retirement?

Answer your retirement savings questions with 4 Steps to a Worry-Free Retirement. The first online course for Canadian retirement.

Try Worry Free Retire With 100% Money Back GuaranteedThere are many paths to financial abundance. Inheritance and winning the lottery are a couple, but reserved for the lucky. What about regular working guys and girls like you and me? In my mind, whether you are an employee on salary and/or a business owner, the only sure fire way to build wealth is, wait for it… to spend less than you earn.

We’ve all heard that cliche a thousand times before, but it is tried and true. Living within your means helps generate positive cash flow which is a key ingredient to aggressively paying off debt and buying long term appreciating assets. With long term appreciating assets comes the power of compounding which can significantly accelerate wealth if used properly.

What really helped us accelerate our wealth is living a sensible lifestyle within our means and, at the same time, being open to ways to increase our means. As an example, when we graduated, we created a budget, found tenants for the basement apartment, I took a second job and my wife worked overtime when available to help build our cash flow. At that stage in the game, our focus was on debt repayment.

We attacked the car and student loans which were repaid within 5 years. During this time, we purchased another rental property which further generated cash flow. In 2005, I stumbled upon financial blogs, and decided to start my own in 2006. While it initially started off as a hobby and online journal to share financial ideas, Million Dollar Journey started to attract readers and soon became a healthy side business.

To help grow the personal finance community further, in 2009, I partnered with Canadian Capitalist to start Canadian Money Forum which also grew into a robust community. With the success in the blog and forum, the online business expanded further with online consulting and web site strategy. All of this while maintaining a 9-5 job and attempting to spend quality time with the wife and kids.

With the career and side business going strong, we maintained our lifestyle which helped continue pushing our net worth in an upward trajectory. Finances were good, but the hours that I was putting into the business was not sustainable.

I started to burn out, and being a Dad of two young children, my work/life balance was suffering. To help resolve this, I scaled back my online consulting business, and in May 2014, we made the tough decision to sell Canadian Money Forum.

While I can’t get into the details of the sale, the proceeds from my share of the sale was enough to help meet the million dollar milestone a few months before the deadline. While I can happily say that we reached our net worth goal, there is still a lot of work to do before we can call ourselves financially free.

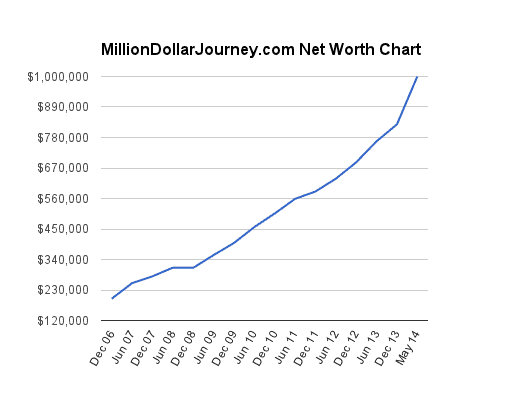

Readers have suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually. If you cannot see the chart, please click here to see my Jan 2014 Update.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

- December 2013: $827,300

- June 2014: $1,000,000

If you are on a similar journey, or would like to start, my advice would be to set a big goal for yourself, then break up that goal into baby steps and you’ll be surprised at what you can achieve. Just make sure to keep that goal in front of you – whether it’s on your computer/smartphone wallpaper, or sticky notes on your mirror, constant reminders are key.

Right now, it feels like a big transition point in my life. Selling the forum and completing our million dollar journey has me asking myself – what’s next? A better question is, what direction should I take this site? As I’ve mentioned, reaching the million dollar mark was a financial milestone within the longer journey of financial freedom.

My focus going forward will be building a portfolio of income producing assets to hopefully one day achieve financial freedom. Perhaps, rather than continuing net worth updates, I can share with you passive income updates and my journey towards financial freedom.

Since you are the ones who have kept me going over the years, what would you like to see on MDJ going forward?

Are You Saving Enough for Retirement?

Answer your retirement savings questions with 4 Steps to a Worry-Free Retirement. The first online course for Canadian retirement.

Try Worry Free Retire With 100% Money Back Guaranteed

I wish I had come across this website earlier! Im in he second part of my 40’s… :( Oh, man. I thought I would be okay with a defined employer pension plan but I no longer want to spend the rest of my working years there. I was putting a bit into RSPs to get a bit of a tax break and now have some in CI and some in Tangerine ETFs. I am just starting to learn about investments etc. This will be super helpful. Amazing project! Thank you.

Hope you find it useful Lilly!

I’ve been following your journey since about 2007 when I started tracking my monthly net worth. It’s really interesting to see your net worth graph above, unlike mine, your net worth didn’t drop much in the 2008 recession. Awesome journey, thank you for sharing it!

I did not know that MMM got divorced – that’s too bad. I’m not Frugal Toque, although that has a nice ring to it!

The MMM way is the 4% rule (ie. annual expenses x 25). While the 4% rule is valid, it’s generally only meant for portfolios to last 30 years with a min of 50% equities in the portfolio. The rules are different if 100% equities and spending only the dividends (which I plan on doing).

How are you doing on your financial freedom goal?

So, in 2006, I started this blog to keep me accountable and set a lofty goal of becoming a millionaire by the end of 2014 at the age 35.

If you take away your wife’s net worth, did you achieve your goal of being a millionaire? Or was your initial goal always to be part of a millionaire family…

Thx, RK

Hello Rahim!

Thanks for stopping by. Once a couple is married, there is no such thing as individual net worth – except of course if there was a pre-nup agreement and/or inherited assets that have been kept separate. To answer your question, it’s family net worth. In case you are wondering, if a couple gets divorced in Canada, assets are essentially divided by two.

Thanks for stopping by. Once a couple is married, there is no such thing as individual net worth – except of course if there was a pre-nup agreement and/or inherited assets that have been kept separate. To answer your question, it’s family net worth. In case you are wondering, if a couple gets divorced in Canada, assets are essentially divided by two.

Hello FT,

One of the greatest wealth builders is marriage so it works both ways ;)

Person A has a net worth of $525,000, they fall madly in love with Person B who has a net worth or $475,000. They get married and boom, Millionaire…

With two working married individuals, reaching a family net worth of a million dollars, is pretty easy in my mind. More impressive is becoming a millionaire individually in USD ($1.316 Million in CAD) or generating enough passive income from investments to fully cover family expenses.

Thanks, RK

Total agree. :) https://milliondollarjourney.com/financial-freedom-update-q2-june-2019-50660-in-dividend-income.htm

Yup, I’ve been following your progress and like I said before, my bet is that you will hit your target of $60,000 when you have a total of $1,500,000 invested in the market ;)

It’s the Mustachian way -> Annual Expenses x 25 = $ _______ in investments.

Speaking about Mustachian, It’s sad that Mr. Money Mustache is divorced. I’m sure you heard of him?

There was a Canadian fellow who would write on his blog sometimes, Frugul Toque. That’s not you right? You are Frugal Trader?

Senior Mustachian, RK

Have been following your journey for some time. Our journey started later and I thought worth sharing so even older folks can dream of hitting their goals.

After a bitter divorce that left me $20k in debt with no assets, I met the true love of my life and we began rebuilding our lives at age 35. We discovered index funds in 2006( thanks Moneysense), maxed out our RRSPs and TFSAs. It took 4 years to get back to even ground and 5 additional years to hit the $200k in 2009. We lived in apartments for 14 years and bought out first house together in 2014 for $295k. We both now have good paying jobs and in April of 2017 we hit the million dollar mark, coincidently, 8 years after the $200k mark. We increase our mortgage payments by 10% annually, make an additional monthly payment, and put 10% on the principal each year. We will be mortgage free in 2019.

In 2021 we plan to retire at age 55 to mark our first 20 years together.

Our favorite saying is this: the difference between a goal and a dream is a timeline and a plan.

So pick your timeline, make a plan to get there, and start living the dream.

Cheers.

Retiring early is more fun than it is perceived to be. I’m learning and playing 10 different sports I know I would not be able to if I retired @ 65 vs. 50 and have lost 20 lbs doing so. Spending time with the kids and joined a Symphony.

Its not just boring sitting around the house all day! You feel young again for sure…

John, I really enjoy hearing stories like that! My parents were also immigrants to Canada in the early 70’s. Did you start a business?

I’m guessing we came to Canada at the right time.

Basic timeline: April 1967 landed in Canada, 14 months of our arrival we purchased our first income property (a rooming house) that we lived in on the ground floors, with 2 floors above us 5 rooms tenanted paid by the week. The property was fully paid off in 6 years.

During that period we invested in private discounted second mortgages through a mortgage broker in the east end of Toronto on the Danforth.

We have owned several properties along our journey that included income producing.

First born 1978, second born 1986

We also emigrated twice more, living as PR’s in OZ & NZ in the early 80’s

It wasn’t till around 1986 that we first started investing in the stock market

We also had a small side electronics business which I would work at after work, wife also helped.

Although I never had to work since the 90’s, I really enjoyed my work life & retired from the daily grind in 2010

Recap, the real success came from real estate, no so much in the stock market. Today less than 10% of our cash is invested in anything, the rest is under the mattress, for the reason ‘we don’t need the income’ and the adult children ‘are just fine’

All (every last penny) of our expenses year over year is just under 30% of our income

Being old school, we paid off any debt including mortgages as fast as we could. We never did the ‘smith manoeuvre’

Thanks for the inspirational story John! Question for you, have you looked into discounted second mortgages lately? This is an investment strategy that a mortgage broker friend of mine has pursued with success thus far.

Haven’t looked into the discounted second mortgages. They worked for us when we did them. There is also a few MIC’s out there that have decent returns, not for a long hold, one just needs to time the buy & sell.

P2P nor Solarbonds interest me

Any investing that I would do today has to have an hedge

For discussion purposes only – lets take a blue chip (Bank or utlity BCE) that pays dividends and that has LEAP’s.

Buying at the top of the last 24 range, then selling a long contract (LEAP) ‘deep in the money’ (DITM) covered call as close as possible to 50% of the underlying stock price. So, say a $50 stock that is optionable at say $25 – $30 DITM out to Jan 2019. There will be little to zero premium (who cares) its the ‘collect more % dividends’, protected on the downside. Yes, I have done this and not been called till/to the contract expiry, for the reason I always expect stocks to go down in price. Best to do this as I mentioned when stocks are close or at the top of their range

FT, I followed you & MDJ in the earlier days pre-2010 & at that time made a suggestion of investing in ATM’s for passive income.

Doing a google today I remembered this forum to see any updates & was excited to see that you made the journey.

Congratulations to you & your family on the success

Thanks for stopping by John! It’s quite interesting looking back at old posts to see my ideas and concerns from back in the day. I didn’t invest in ATMs after, I just stuck with the basics of saving and investing. What about you? Has your financial picture improved since that time?

Hi FT, thanks for your reply.

How time flies & yes my wife & I achieved our goals early on, now aged 70, we are well & financially sound. We began our journey in 1967 as newly wed’s aged 20 when we emigrated to Canada with one suitcase and £100 each. We achieved what we wanted within the first 10 years in Canada.

Congrats. That’s awesome what’s your net worth at these days? Wish I started earlier but now is better then later =)

Hello

I ‘m a 29 yo girl who just recently started doing stock and ETF investing.

Love your blog and it really does motivate me to keep track on how my money goes.

Is your net worth combined with your wife or just yours?

Hi Jess, yes the numbers are combined.

I find your story very inspiring.

I have a personal goal to have a net worth of $1 million when I turn 32. So far I’m on pace but there’s a lot of things that could get in my way. Reader your blog has renewed my focus!