Net Worth Update November 2013 (+1.27%)

Welcome to the Million Dollar Journey November 2013 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – soon!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the Money Tips Newsletter.

Lets start off with one of the favorite topics here on MDJ – the stock market. In October, the market was particularly strong which somewhat carried over to November. The TSX took a baby step to new highs with a 0.8% gain over the month. The S&P500 also continued the climb to new highs with a strong 2.4% gain and the MSCI EAFE (international) index returning 1.8%.

How has my portfolio performed during the month? A mixed bag of results. Even though my RRSP has a large portion of US dividend stocks, it lagged the S&P500 by about 0.8%. My CAD dividend stocks portfolio, however, trumped the Canadian index by about 0.6%, and reached an all time high balance of $135,000. My trading account took a bit of a hit where I dabbled a bit with long call options which didn’t work out in my favour. My U.S non-registered trading account, which I use as my fun money account, has been performing very well this year where I have been trading mostly technology stocks.

In addition to our investments, our savings rate remains status quo. Savings has been our biggest driver of net worth growth over the years and likely to be the biggest driver going forward. The higher the savings rate, the faster financial independence comes as indicated in the post “how much do you need to save for early retirement?”

In the big picture, for the November 2013 update we are up 1.27% for the month and 18.09% for the year. We are up to $922k in assets and up to $815k net worth milestone with about 13 months left in the Million Dollar Journey deadline!

On to the numbers:

Assets: $922,700 (+1.15%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $168,000 (+1.63%)

- Tax Free Savings Accounts (TFSA): $53,500 (+0.94%)

- Defined Benefit Pension: $47,200 (+0.64%)

- Non-Registered Investment Accounts: $185,000 (+2.78%)

- Smith Manoeuvre Investment Account: $135,000 (+1.50%)

- Principal Residence: $309,500 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $107,400 (+0.28%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $107,400 (+0.28%)

Total Net Worth: ~$815,100 (+1.27%)

- Started 2013 with Net Worth: $690,400

- Year to Date Gain/Loss: +18.09%

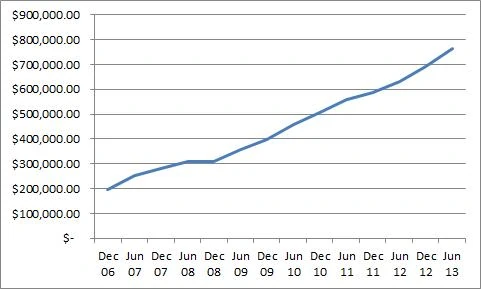

Readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hey I love your website, would you stop posting articles if you cross the million dollar threshold :O

@Sukun, even after my goal, this site will continue!

Awesome work and a great inspiration to many FT.

I recall following your blog in the “early years”. Now, you’re getting so close.

Looking forward to seeing you on national media coverage after you hit the big milestone :)

Keep the pedal down and great work.

Mark

good job! I started posting my net worth and have noticed it growing at an accelerated rate myself so thanks!!!

When is your birthday CC? You need to start a countdown on these monthly reports…

About 6-8 months left correct? At this pace you’ll make it, but market returns have been above excellent this year so a slowdown or downturn might delay the goal. Have you thought about what you will rename your blog to starting next year?

@SST, fully concur. With enough savings, most people really don’t need to invest, but I fully believe investing in equity markets is a way to accelerate the pace.

@Sampson #9: my point is that WITHOUT the deposits of FT, his portfolio returns would have been in and around the same as the index returns. So, yes, save the time and money of picking and simply buy the index.

What’s got FT better-than-index growth is the infusion of additional capital — call it his own personal QE. :)

Quick question regarding calculation of net worth. I notice that most people do not account for the anticipated tax liability of registered accounts, particularly RSP or RPP. When calculating a basic asset – liability = net worth, is it not prudent to anticipate this liability in the calculations?

When calculating my net worth I’ve always felt it “cheating” to use the full value of my RSP when I know it’s really about 30% less than that due to what my tax rate will (hopefully) be when I retire.

I know it’s a downer, as it makes the goal a little further away, but I figure it’s more realistic.

Thoughts?

@Big Bird, you are right, that is more realistic. For us though, we will be likely retiring early so we’ll withdraw from the RRSP in a very tax efficient manner, so it is difficult to determine the amount of tax payable. Technically, I could put in a tax liability at 30%, but then, I could also jack up my home value to market value, defined benefit pension value to commuted value, include my cars etc. I think it just evens out in the end.

The first million is the hardest… the next one is easier :)

Not sure of your point SST.

That stock picking is not the way to go?

Returns, market beating or not, are better positive than 0. The strategy has beaten out and all cash portfolio so FT is doing better than that.

Also don’t know what any of this has to do with a QE induced bubble, if one exists. Nothing from FT’s NW updates show any evidence of a bubble, or am I missing something?

Pshaw! There is no QE bubble! ;)

2013 Investment Gains vs. Savings Gains:

RRSP: +25% (11% savings, 14% returns)

TFSA: +31% (27% savings, 4% returns)

NRIA: +36% (14% savings, 22% returns)

TSX: +7%

S&P: +23%

MSCI EAFE: +14%

DJIA: +19%

As you can see, FT’s returns don’t really beat the market.

Savings are his saving grace.

(Assumptions: $45,000 saved, equal distribution, TFSA maxed @$11,000, difference deposited into NRIA.)

You are close but you could be far as well… perhaps 20% or more of your investments could be an illusion of the QE bubble… I say “your” but really for all of us… and not all bubble crash recuperates within a year like the 2008-09 did.

@Stephen, it has been quite a journey indeed. But as I mentioned in a previous comment, the million dollar net worth is a milestone towards a a bigger outcome.

@Goldberg, very true point, investment gains are a significant part of our net worth (and likely a lot of you). We can’t control what the markets do, so we just keep our eyes on the horizon.

@SST, I will be getting into my XIRR returns in December. But yes, savings have been a huge part of our net worth growth over the years.