Net Worth Update December 2013 – Year End Summary

Welcome to the Million Dollar Journey December 2013 year end Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth, hopefully by the time I’m 35 years old (end of 2014 – soon!). If you would like to follow my journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the Money Tips Newsletter.

Lets start off with one of the favorite topics here on MDJ – the stock market. 2013 was a very strong year for the market which has helped to keep the net worth growing at a steady pace. The TSX advanced a respectable 11.1% (via XIU.TO), the S&P500 had a monstrous gain of 29% (via SPY) and the MSCI EAFE (international) index finishing strong with a 23.2% gain (via XIN.TO).

How has my portfolio performed during the year? A mixed bag of results. The RRSP accounts did well with around a 20% gain. The account consists of US dividend stocks an international index ETF and a big bank income fund that consists of Canadian dividend stocks and bonds. While I hoped this account will track the S&P500 a little better, I have to do some adjusting to my holdings and clean up the account.

My CAD dividend stocks portfolio also did well and returned 16.9% trumping the Canadian index by 5.8%. The account also reached an all time high balance of $137,500. My fun money trading account, which focused on high momentum US technology stocks, also did well in 2013. The trading account grew from around $6k to $11.8k, and after contributions, the XIRR return works out to be 58.4% (not counting capital gains tax payable).

The only real disappointment with regards to investing was with our TFSAs. It ended the year with no gains as it sat most of the year in cash and short term bonds. I have recently started moving some cash into REITs, so hopefully we will be rewarded in 2014.

In addition to our investments, our savings rate remains status quo. Savings has been our biggest driver of net worth growth over the years and likely to be the biggest driver going forward. The higher the savings rate, the faster financial independence comes as indicated in the post “Ultimate guide for early retirement‘.

In the big picture, for the December 2013 update we are up 1.47% for the month and 19.83% for the year. We are up to $935k in assets and $827k in net worth with about 12 months left in the Million Dollar Journey deadline! We added about 137k to our net worth in 2013 which means there is $173k left before hitting the big $1M milestone.

It has been a great year for investors, hopefully some of this momentum can carry into 2014! Some closing notes, another $5,500 can be deposited into your TFSA starting January 1st. For those of you with children, if you deposit $2,500 into an RESP, you’ll maximize the government matching portion and receive $500. If you have missed previous years of contributions, don’t worry, you can still catch up, more details on the carry forward RESP room here. One last thing, the RRSP deadline for 2013/2014 is March 3, 2014, so you still have lots of time.

On to the net worth numbers:

Assets: $935,000 (+1.33%)

- Cash: $4,500 (+0.00%)

- Savings: $20,000 (+0.00%)

- Registered/Retirement Investment Accounts (RRSP): $173,500 (+3.27%)

- Tax Free Savings Accounts (TFSA): $52,500 (-1.87%)

- Defined Benefit Pension: $47,500 (+0.64%)

- Non-Registered Investment Accounts: $190,000 (+2.70%)

- Smith Manoeuvre Investment Account: $137,500 (+1.85%)

- Principal Residence: $309,500 (+0.00%) (purchase price adjusted for inflation annually)

Liabilities: $107,700 (+0.28%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off in 2010!)

- Investment LOC balance: $107,700 (+0.28%)

Total Net Worth: ~$827,300 (+1.47%)

- Started 2013 with Net Worth: $690,400

- Year to Date Gain/Loss: +19.83%

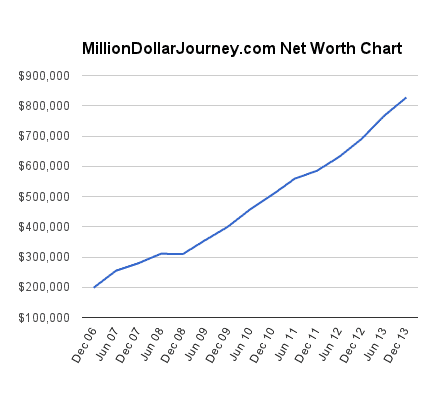

Readers suggested to chart my net worth progress over time. Below are the net worth values since Dec 2006 with data points taken semi annually.

- December 2006: $198,500

- June 2007: $254,695

- December 2007: $279,300

- June 2008: $310,483

- December 2008: $309,950 (rough second half)

- June 2009: $355,850

- December 2009: $399,600

- June 2010: $456,910

- December 2010: $505,800

- June 2011: $558,713

- December 2011: $585,228

- June 2012: $631,400

- December 2012: $690,400

- June 2013: $766,300

- December 2013: $827,300

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments – ie. our credit card bill). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker has proven useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Where Does the Savings Come From?

We don’t live a lavish lifestyle (how we save money), and we do not carry a mortgage or any other bad debt. The only debt we have is an investment loan (which pays for itself), so we end up pocketing a majority of our earnings. Our earnings come from salaries, private business income (via dividends to shareholders), and eligible dividends from publicly traded companies.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis. The commuted value of the pensions are not included in the statements as they are difficult to estimate.

Updated 2013 – My wife has recently changed her job position which has resulted in switching from a defined benefit plan to a defined contribution plan. This amount will be added to the RRSP totals going forward.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

Have a Happy, Safe and Prosperous New Year!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Congrats, looks like you are going to make it to the million.

The 20.9% increase you need this year isn’t too far off from the 19.83% you had this year. Good luck finding that extra percentage point!

Hopefully the markets will be nice to you as well.

@Frank, I just use my own google spreadsheet. Here is basically how I did it:

https://milliondollarjourney.com/how-to-create-a-stock-watchlist-with-google-spreadsheets.htm

@FT. Great work on the performance. I’m not sure if this is noted somewhere else but do you use a software package to track your performance? I use Quicken which does a good job for Canadian transactions (Stocks, RE) but it’s not very good for US ones. What do you use? What about others?

@FT, I’m trying to look up the benchmark performance for XIU.TO.

I found this:

http://ca.ishares.com/product_info/fund/performance/XIU.htm

How did you get 11.1%? I’m seeing 13.25% for 2013.

@Bryce, if I don’t make it, it will be close. As for the end game, $1M is more of a milestone than a final destination. Still have a ways to go before I can call it quits from my 9-5.

@Greg, you have been paying attention. :) I will likely be including business cash (after dividend tax) in future updates as it’s getting more significant. I may adjust net worth to account for future RRSP tax liabilities as well.

With about $500,000 in liquid assets it’s going to be tough to gain the remaining $173,000 in a year. A 13% return on investments and a 3% inflation adjustment on the residence would leave a $100,000 gap to fill with savings.

I’m predicting that some currently off the balance sheet business value will come into play, you heard it here first! (well, maybe not, there have been hints :)

Wow, impressive! 827K is SERIOUS money at your (or any) age. Have you considered taking it all out as cash for a day and swimming around in it a la Scrooge McDuck? Maybe not the most efficient use of capital, but still!

What’s your endgame look like? You have one year left and 173k to go. Are you projecting you’ll make it?

This year I have followed your lead after reading your blog for a while. While my net worth is not as large (13.87%) it is a start. My TFSA was the biggest gain with 21.67% over the year (no-contributions). I get the RSS feed and enjoy it everyday with my morning coffee. Keep up the great work!

Thanks for the kind feedback guys and all the best in the new year!