How to Take Advantage of the Market After the Crash of 2008

“It’s never happened in the World Series history – and it hasn’t happened since.” – Yogi Berra

2008 was a difficult year, producing results not seen in recent history. In past bear markets, some sectors and significant groups of investors still made money. In 2008 only 4 of 3,438 equity mutual funds showed a profit.

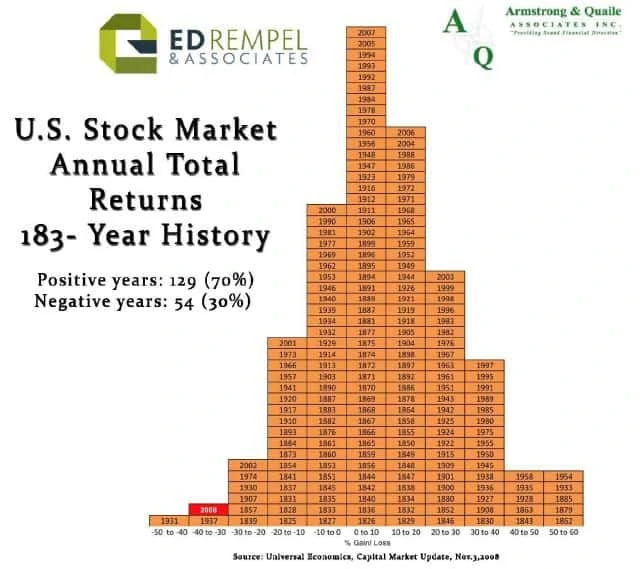

The attached chart below (click on image for full size) with 183 years of market history puts a lot of things into perspective. It shows how many years the market returns were in each percentage range. By the time the year had ended 2008 found its place at the second column from the left at -37%.

What can we see from history?

- 2008 was an extremely unusual year. It was not a typical bear market. The only years with losses that high were in the 1930s – The Great Depression. However, the problems we have today are minor compared to the 1930s, when unemployment was over 30% and the total production of the economy fell by 30%. It appears that governments have learned from their previous mistakes and are focused on bailouts and not making matters worse by cutting spending and raising taxes like they did in the 1930s.

- Years with large losses tend to be followed by years with large gains, usually within 1-2 years. Note that only two years after 1931, great gains were made in 1933 (50-60% column), 1937 was followed by 1938 (30-40%), and most of the years with losses of 20-30% also had good gains within a couple of years.

- Large gains are much more common than large losses. There are 25 years with gains over 30%, but only 3 with losses over 30%.

- The markets do make money over time, including these bear markets. Note that 70% of all years are gains, large gains are much more common than large losses, and the most common returns are gains of 0-10% followed by 10-20%.

What should we do now?

- Don’t panic. Stick with your long term goals. The markets have always recovered and gone to new highs. This is the most important time to stick to your plan. If you don’t have a financial plan, this is the best time to start one.

- Disregard what is in the news. The recovery will not take 10 years. This is not the end of the world. While very unusual. It is not “different this time”. The panic is subsiding and companies will adjust their operations to become profitable again.

- Don’t turn paper losses in actual losses. If you sell now or invest more conservatively, you will likely miss out on much of the inevitable recovery. If you want to invest more conservatively, wait until after a good recovery. Studies consistently show that trying to get out and time getting back in rarely works.

- Buy low. Sell high. As Warren Buffett says “Be fearful when people are greedy and greedy when people are fearful.” Remain optimistic and focus on the inevitable recovery. I realize that it is difficult to be optimistic with all that is happening, but our fund managers are telling us they have never seen the market so cheap (even one who is 83 years old!). If you can ignore your emotions, and take advantage of it, this period will probably be the best buying opportunity of your life.

Ed Rempel is a Certified Financial Planner (CFP) and Certified Management Accountant (CMA) who built his practice by providing his clients solid, comprehensive financial plans and personal coaching. If you would like to contact Ed, you can leave a comment in this post, or visit his website EdRempel.com.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hey FT. Thanks again for noticing.

I don’t profess to have any great insight. Buying in after a large decline is the one, easy market timing strategy that works. Other than the 1930’s, every annual decline of the S&P500 of more than 20% was immediately followed by a gain of more than 20%.

All that was required to see early 2009 as a wonderful buying opportunity is faith in the stock market long term.

I just read an article that people are more scared of investing in the stock market than they are of speaking in public or even dying. I think this is a gross misunderstanding of stock markets.

Stock markets have consistently recovered from all declines because they are a bunch a huge companies that have all kinds of methods to get their profits up – cutting costs, new products, sales promotions, buying another company, selling unprofitable divisions, restructuring debt, etc. As long as they can eventually get their profits back up, the stock market will also eventually recover.

Early 2009 may be the best buying opportunity of our lifetime. I think it was quite obvious for people with faith in the market long term, though.

Ed

@Ed, just going through the archives and looks like you made the right call here as well!

Hi Amanda,

Yes, I cut it out of my diet years ago…

Jim Rogers has been bullish on nearly all commodities for years. Commodities always require proper timing, since they don’t normally rise over time. There might be cases in the future when they do because of a genuine, permanent shortage, but any bull markets tend to be short-lived.

Given that there are thousands of companies at irrationally low prices these days, why invest in something that is not really cheap at all?

It may seem scary to invest in the stock market today, but that is where the great deals are.

Ed

i agree with post 2008 as an opportunity of a lifetime. However, what should we invest in is the question; indices or specific stocks or sectors? I have been thinking of investing in agriculture based on Jim rogers recommendations, in particular sugar due to chinas raging demand. any views? read an article suggesting its not quite time to invest in sugar – not sure what to make of it but i think if one were to stick with Jim Rogers suggestions, you cant be too wrong. do u have a view on sugar ed? http://theinflationist.com/agriculture/how-to-invest-in-sugar

Hi Bob,

The main purpose of asset allocation is reducing risk, not increasing return. If your purpose is to have the highest long term return, you should stick with 100% equities.

However, your figures show that rebalancing can work. If you had just invested with a 50%equity/50% bond allocation, you would end up with $143,917. With rebalancing, you ended up at $148,798.

Rebalancing, in your example, would reduce the equity allocation after 6 years of superior equity returns, so that there would be less equity before the big down year.

Not surprisingly, however, the 100% equity portfolio had a higher return. It also meant higher volatility. In the last 30 years, bonds have had 1/3 of the return of stocks, despite interest rates declining from historic highs to historic lows. Declining rates produce higher returns for bonds, so this period was ideal for bonds, yet stock returns were still 3 times higher.

Asset allocation will reduce your long term return, but also reduce your risk. The right answer, therefore depends on your long term goals and risk tolerance.

Rebalancing mostly reduces risk, but also tends to produce higher returns than buy-and-hold of your original allocation.

Ed

hi,

regarding asset allocation..

i was looking at 6 years from 2003 to 2008

TD -e funds

TD equity index e fund TDB900 gave

26.6,14,23.3,16.9,9.6,(-32.9)

TD bond index e fund TDB909 gave

6,6.5,5.7,3.6,3.2,5.7

these were their respective 6 years return

if i had invested $100,000

100% equity – portfolio would be $152,985

100% bond- portfolio would be $134,848

if instead i choose a 50%-50% portfolio with a yearly rebalance portfolio would be $148,798

all the returns(dividends) are being reinvested

equities comes up better even after losing 32.9% in the last year..

is asset allocation with periodic rebalancing required? it does’nt seem to do any good.

thanks

Hi Sampson,

Good comments. Most investment decisions seem very complicated when you look short term. However, your long term view makes the decisions obvious.

There are periods of time when the markets are down or have low returns, but long term the returns are very good. The reasons for it are that, underneath all the short term sentiment, there are big, solid companies that can always adjust their operations to make profits. As long as companies can continue to produce rising profits over time, the markets eventually go up.

One more point in your debate with Paul. Short term, you can compare the returns of debt repayment vs. investing in the stock market. However, when you look at your financial plan and what you need in your life, there is a big difference.

The difference is that you cannot finance your retirement purely on debt repayment. Once your debt is at zero, then what? Eventually, most people will need a significant nest egg to finance their retirement.

Managing debt effectively is part of a financial plan, but no financial plan is complete without a sound investment strategy.

Ed

Hi Paul,

When we do long term projections of the Smith Manoeuvre, typically the benefit is approximately 25% from the tax refunds. Most of the long term projected benefit comes from the compound growth of the investments.

The Cash Dam is only a tax strategy, with no investments involved. So, it obviously makes money 100% of the time, just like the claiming of any other tax deduction. You are right though that the projected benefit of the Cash Dam is relatively small compared to the Smith Manoeuvre.

Ed

“Mr. Hoye thinks the market is tracing a similar pattern this cycle, heading for a fall of 80 per cent or so, peak to trough.”

Has anyone checked the markets in the last few days of trading? I think Mr. Hoye was on to something and I am glad I continue to be fearful. I think over the next couple of weeks we are going to see lows that make November 20/21, 2008 look appealing. Hopefully you have enough cash on hand to take advantage!

Your advice is devoid of reason (“ignore the news”!) and your chart is a self-serving manipulation of statistics.

If only there were true certification for “certified financial planners”, then we’d see a lot less of this kind of crap trying to lead the sheep astray.