Best Options Trading in Canada 2025

Options are one of the best ways to capitalize on market trends and enhance profitability – if you get your prediction right. While buying options has a limited downside on a per contract basis, it is also one of the “best” ways to lose your money in the market – or as WSJ put it “More Men are Addicted to the Crack Cocaine of the Stock Market”.

Options trading is not for the faint of heart, and shouldn’t be used by novice traders. Honestly, the average Canadian investor has no need to ever look at options trading, as they would be much better served using one of the Best ETFs in Canada to execute a low-fee index investing plan.

However, if you’ve made up your mind to trade options, it’s another one of those areas where finding the most suitable broker can make a lot of difference.

This guide will help you understand the basics of option trading in Canada, walk you through how to use stock options to speculate on market outcomes, as well as how to hedge other investments, and how to use options as a means of generating fixed income. Finally, we’ll help you discover the best platforms and apps in Canada for buying and selling options.

Best Options Broker in Canada Comparison

These platforms offer both Canadian and US options:

$1 per contract/$6.95 Min.

$0*

$1 per contract/$6.95 Min.

$0*

$1.25 per contract/$9.99 Min.

$0*

No Available Promotion

$1.25 per contract/$9.95 Min.

$0*

No Available Promotion

$1.25 per contract/$1.50 Min.

$10**

No Available Promotion

$1.25 per contract/$0 Min.

$0*

No Available Promotion

$1.25 per contract/$6.95 Min.

$0*

No Available Promotion

*See our full Canadian online brokers review for details on easy ways to drop account fees to zero.

**IBKR has a unique fee structure where you will either pay $10 per month or $10 in trading fees.

Best Option Trading Platforms in Canada – Reviewed

Trading platforms may be similar in that they allow investors to buy and sell stocks, options, bonds and more, but there are a number of key differences among them.

Understanding these differences will help you choose the best options trading platform for your particular needs at a price you are willing to pay. Let’s dive deeper into how they compare.

Qtrade

Qtrade, in our opinion, is Canada’s best broker for a number of reasons. Buying and selling with Qtrade is easy, cost effective, and the customer service is stellar. The platform offers a large selection of commission-free equities, and they continuously enhance their product lineup.

When it comes to options trading, Qtrade charges competitive fees which have been decreasing year over year. Right now, if you have an “Investor Plus” account, then you can enjoy a minimum of $6.95 per purchase + $1.00 per contract. Options assignments cost a flat $30.

They’ve also introduced a new tool called Options Lab, similar to a product of the same name from Interactive Brokers. This tool is highly useful, breaking down pricing components, showing potential results at various strikes (option trading simulator of sorts), and even helping beginners find a tailored strategy with a simple questionnaire.

The fact that Qtrade continues to adjust its options fees and release products aimed specifically at options traders demonstrates that they view this segment as both meaningful and valuable. Qtrade offers web-based and mobile app trading, both of which are simple and easy to use, along with extensive research tools beyond the Options Lab – which are especially helpful for advanced traders or speculators. You can read why it tops our list of Canada’s Best Brokers in our Qtrade review.

Questrade

Questrade is one of the top Canadian online brokerages. It offers a safe and secure way to invest in a wide range of financial products, including options trading.

The fee for trading options on Questrade will cost you a $9.95 minimum and $1 per contact. While it’s not the cheapest option out there, you can rest assured knowing that Questrade has excellent customer service. This may just come in handy, especially if you are at the beginning of your options trading journey.

With Questrade you can complete transactions using web-based Questrade Trading, QuestMobile, Questrade Edge and Questrade Global. To learn more about the platforms, fees and more, check out our full Questrade review.

TD Direct Investing

TD is one of Canada’s most trusted financial companies with a long track record. There is a good chance that you or someone you know has a TD account for investing. TD offers options trading, but it’s definitely not the most cost effective. Still, it’s the best options out of the big banks.

Options trading with TD comes with a $9.99 minimum, plus $1.25 per contract, making it one of the more expensive options out there. When it comes to trading platforms, TD Direct Investing has three options. Most options traders starting out will be using the TD app or TD WebBroker.

They also offer a wealth of educational tools to help investors learn and improve their skills. To find out more, check out our full TD Direct Investing review.

BMO InvestorLine

BMO InvestorLine is one of the best bank-owned brokers in Canada. While that does sound good, it simply isn’t good enough to top our list as one of the best brokerages in Canada.

That being said, BMO can be a good choice for options trading if in fact you are already a BMO customer and like the convenience of having everything in one place.

When it comes to cost, BMO InvestorLine charges a standard $9.95 minimum, plus $1.25 per contract, which is pretty much the industry standard. There is a quarterly fee of $25, but it will be waived if your non-registered account is $15,000 or more, or your registered account $25,000.

BMO InvestorLine offers both an app and web-based platform, making options trading as simple and straightforward as possible. Unlike some other banking apps, the BMO InvestorLine app has decent ratings on both the Google Play store and the App Store. Find out more on our BMO InvestorLine Review.

Interactive Brokers

Interactive Brokers (IBKR) is a global favorite among day traders, forex traders, futures traders and also – option traders.

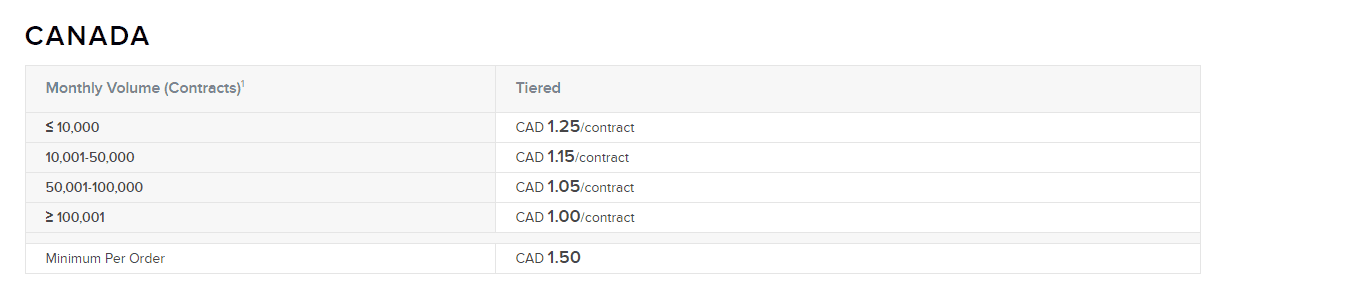

The platform offers every speculation tool you can think of, and then some more. You have Options, Futures, Future Options, and CFDs readily available. Interactive Brokers also has the lowest minimum set at $1.5 (USD) but a higher cost per option than Qtrade if you don’t trade in high volumes, as detailed below:

The platform offers extensive option trading tools but the level of usability has much to be desired. These tools can prove quite useful for advanced traders, but aren’t really sufficient for those who do this in a professional capacity, while we found them to be confusing for those who want to make “simple speculations”.

Another thing about Interactive Brokers is that 0DTE options (options which are expiring on the same day as buying them, one of the speculator crowd’s favorite dishes) is problematic. They can independently decide to sell your position based on your account’s margins which defies the purpose of 0DTEs.

Read more on why in our full Interactive Brokers Review.

National Bank Direct Brokerage

We have to hand it to National Bank Direct Brokerage (NBDB) for being the first Big Bank to offer free brokerage accounts to its customers. For those who are already NBDB customers, this might be a convenient way to begin your options trading journey.

While there is no commission fee to trade options with NBDB, there is a $6.25 minimum fee and a charge of $1.25 per contract.

NBDB’s options trading fees might be less than other brokerages, they make up for by charging a $100 annual fee for accounts holding less than $100, or that makes less than 5 trades per month.

The other downside is that NBDB does not currently have a mobile app version, making it less convenient for those who need to trade on the go. Read more about the pros and cons of NBDB in our full National Bank Direct Brokerage review.

CIBC Investor’s Edge

Another Big Bank option, CIBC Investor’s Edge, offers a range of financial products at a lower cost than other Canadian Big Banks.

That being said, it’s still not even close to the best choice for options trading in Canada, or any other trading for that matter. CIBC Investor’s edge charges an annual $100 account fee. This might make sense if it offered excellent service, but that is definitely not the case.

CIBC Investor’s Edge regular trading accounts will cost $6.95, plus $1.25 per contact. For active traders, it charges a lower $4.95.As far as platforms go, CIBC Investor’s Edge offers both web-based and mobile platforms, both of which got a refresh not so long ago.

Now users have a wider range of tools and resources to help them make the best decisions. This can be very beneficial, especially when it comes to options trading. Check out our CIBC Investor’s Edge review for more details.

Demo Accounts Are Available

With Qtrade, Questrade, and Interactive Brokers, you can open a demo account to test your strategies before venturing into the deep and oftentimes murky waters of options trading.

We strongly recommend doing so by opening a few positions and observing the boom-or-bust nature firsthand, prior to risking any of your hard-earned money on leveraged and volatile trades.

Why Trade Options?

Option trading is definitely a more complex type of investing from where most investor’s start their journey, such as all-in-one ETFs and Canadian dividend stocks. As part of an overall options trading trading strategy, we’ll also be sharing how to somewhat protect your portfolio from market volatility.

There’s debate over whether options are truly a “zero-sum game,” but recent market turbulence, coupled with a wave of new traders, has drawn the attention of savvy, typically passive investors. These investors, who generally favor long-term index or dividend strategies, are now exploring the potential benefits of options trading.

The goal? Capitalize on volatility and earn what some might call “free money” by strategically betting on market movement. But while long-term investors only need to predict which companies will be worth more in the future, options traders must correctly answer two questions:

- How much will a company be worth in the future?

- When, exactly, will it reach that value?

That timing piece is very key to understand.

Why Trade Options (2)

The secondary reasons to trade options, which we will touch on further below, include hedging your portfolio (to limit downside – at the cost of limiting upside), hedging a certain position (reduce the volatility of a component in your portfolio that changes too rapidly), or sell options on an asset that you’re holding to collect premiums (if you think the premiums in the market are higher than what you’re expecting to make of that asset).

I understand these concepts can be confusing without further elaboration, but what I’m trying to say here is that there are people who utilize options as a means to balance their portfolio rather than add risks. They just have to really know what they’re doing when they do that.

What are Options?

Very simply put, options are contracts that give the trader a right to buy or sell a financial instrument, such as stocks, for a specified price and for a specified period of time. Options are known as financial derivatives, as their value is derived from an underlying asset.

Options, as the name implies, make it optional for the trader to actually buy or sell within the timeframe of a contract. It is simply a guarantee for the price and the timeframe set in the contract.

Options are available for a range of financial products, such as securities/stocks, ETFs, and indices (or Futures).

What is an Options Trading Platform?

An options trading platform is simply a brokerage account that allows you to conduct financial trading activities as an individual investor.

This means that the same platform you use to buy and sell stocks, ETFs and other financial products might also be the same platform you use to buy options.

This is not the case for all Canadian brokerages. For example, Wealthsimple Trade is an online brokerage but at the time it does not offer options trading.

Also, it’s important to keep in mind the fees for trading options are generally on the higher side. If you make a successful purchase during your options contract, then the fee could be worth it. If you don’t end up making a purchase during your contract due to unfavorable market conditions, that’s money down the drain.

How Options Work

The first thing to note is that OPTIONS generally come in two flavours: CALL OPTIONS and PUT OPTIONS.

Both of these flavours differ significantly from their distant cousin EMPLOYEE STOCK OPTIONS – which are financial instruments issued by companies to their employees. EMPLOYEE STOCK OPTIONS are an employee benefit that represents the ability to purchase treasury shares right from the company at a specified price for a specified period of time (usually 2 years or thereabouts).

For now, we’re going to focus on the more common type of stock options trading, pertaining to CALL option and PUT option varieties.

Options are both a very simple concept, and at the same time, a very versatile and complex portfolio management tool. There are very conservative option strategies and VERY risky option strategies. More press is given to the riskier strategies unfortunately. Every time I explain some simple option strategies to investors, eyebrows are raised and questions are asked… there just isn’t enough information and investor education on options out there.

Let’s begin by talking about Call Options. Options are a type of “derivative” – and a derivative is a security “whose value is derived from the value of something ELSE.”

What it means in this case, is that when you purchase a call option on a stock – you haven’t actually bought the stock – but the value of the option that you just bought IS related to the value of that “underlying” stock. I’ll spare you the academia from this point on and just get right to the nitty-gritty…

When you buy a Call Option, you are buying the OPTION to purchase a stock in the future for a set price, for a set period of time.

This would be advantageous if you thought the stock was going to go up in the future. Because, if that happened, you could now buy the stock at the old – lower – price, and your portfolio would now have an asset that was worth the new – higher- value.

Also of note, is that call options provide for a degree of leverage (allowing you to increase your potential returns).

Let’s examine a typical Call Option quote on the stock ABC, which has a current stock market price of $50:

Buying Call Options?

Discover Canada’s best online brokers below and avoid overpaying on a derivative which is expensive to begin with.

| Option Type | Security | Expiry | Strike Price | Premium |

|

Call | ABC | Apr | 55 |

2.50 |

Reading from left to right: This quote is for a CALL OPTION on the security ABC. The option contract EXPIRES IN APRIL. The STRIKE PRICE of $55 is what the option holder can purchase the shares of ABC for anytime up until the 3rd Friday of April. To purchase the ability to do this would cost the option holder $2.50 per contract per share.

It’s not quite as easy as a typical stock quote and certainly some quirks too!

Probably the thing that sticks out most is that all options expire on the third Friday of the month listed. That means the option holder has the ability to exercise their option up to and including the third Friday of the month – otherwise the option expires on the Saturday.

The second thing that I want to point out is the “strike price”.

If you were to purchase this option contract, you would have the option of buying 100 shares of ABC for $55 per share, no matter what the stock was trading at.

Obviously it would make no sense to “exercise your option” and purchase shares of ABC for $55 today when they are only trading for $50 on the open market. If, on the other hand, ABC was trading at $70 before April, you could still buy it for $55, since that is the option you have bought. Clearly, that’s a no-brainer quick win.

Thirdly, note that I mentioned the quantity of 100 shares. Each option contract is specified for 100 shares of the underlying stock. So even though the premium (the price to buy this Call Option Contract) is $2.50 – your outlay will be $250 ($2.50 x 100 shares).

Fourthly, when the value of the underlying stock starts trading ABOVE the Strike Price, the option contract is said to be “IN-THE-MONEY”. When the stock price is equal to the strike price, it is “AT-THE-MONEY”. And finally, when the stock price is BELOW the strike price – the option is “OUT-OF-THE-MONEY”.Option contracts would be used as followed in financial parlance: I own an April 55 Call on ABC.

Practical Examples for Call and Put Options

Okay, so we’ve gotten the semantics out of the way now, so let’s look at some examples of purchasing the above call option contract with three different outcomes:

- Stock goes up

- Stock price doesn’t change

- Stock goes down.

Scenario 1: ABC goes up to $60 before the Expiry Date

In this case the option contract becomes “in-the-money”. Since you could sell shares of ABC in the open market for $60/share – it would make sense to exercise your option to buy the shares at $55/share and then immediately sell them for a $5/share gain.

But, that being said, many people don’t actually exercise their option – rather, they just sell the option contract itself. The option contract’s price will fluctuate with the underlying stock’s value – and when the contract is in the money, the option contract’s price rises in lock-step. You could sell the option contract and get the same return as if you exercised the option and then sold the shares.

If ABC is trading at $60/share, then the Apr 55 Call will be trading for very close to $5. Remember you only paid $2.50 for it – so if you sold the option, you will have doubled your money (bought the option contract for $2.50 and sold it for $5.00 = a $2.50 gain x 100 shares = $250 gain). If you did it the hard way, then the math would look as follows:

You bought the contract for $2.50, which multiplied by 100 shares = $250 (cost).

You exercise your option so you buy 100 shares at $55 = $5,500 (cost).

You then sell your shares immediately for the market price of $60 x 100 shares = $6,000 (proceed).

$6,000 – $5,500 – $250 = $250

So the math on doing it either way is equivalent.

If you compare this to the regular method of being long a stock, your gain is not quite so spectacular. You might normally buy 100 shares of ABC at $50 dollars, and then just turn around and sell those shares at $60/share when they appreciate.

Your initial outlay would have been $5,000 (100 shares x $50/share).

Your sale proceeds would have been $6,000 (100 shares x $60/share).

There was no premium paid for any contracts, so that’s it. You would’ve had a gain of $1,000 on $5,000 – or 20%.

Remember though, we have just looked at the “rosy” side of things – you need to weigh the options (pun totally intended) of the other two outcomes.

Scenario 2: ABC stays at $50 up to the Expiry Date

In this case, the April 55 Call would be “out-of-the-money”. The value of the option would slowly dwindle down to ZERO by the expiry date. The reason it has any value at all during this time is due to the fact that the further away we are from the expiry date, the more chance there is of ABC getting to its strike price. This is actually known as the TIME VALUE OF THE OPTION.

Warning: Tangent Beginning…

Actually, now is a good time to make a segway about the pricing of options. The price of an option is made up of two components:

- The Time Value of the Option

- The Intrinsic Value of the Option.

The Intrinsic Value of the Option is quite easy to calculate. It is simply the difference between the underlying stock’s price and the strike price whenever the option is “in-the-money”. So if ABC were $60 – the intrinsic value of the option is $5.

Simple as that.

The Time Value of the Option is a *bit* more tricky.

You see, you can’t really quantify the time value of the option in and of itself, but you can figure it out based on the difference between the option contract’s price and the intrinsic value of the option. So if the option contract is priced at $5.50 (when you own an Apr 55 Call on ABC and ABC is $60/share) then you know the intrinsic value is $5 – therefore the time value is $0.50.

If you bought the Apr 55 Call contract on ABC when ABC was at-the-money (i.e. the strike price is the same as the share price) and the price of the contract was $2.50, then $2.50 would be the time value of the option. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price.

Tangent Over! :)

Okay, so back to our example, if ABC never appreciates (or in other words, never gets to the strike price) then the option contract will expire worthless! That means that you are out the $2.50 contract premium you paid and you have lost 100% of your money or $250 (100 shares x $2.50)!

Compare this to just going out and buying the 100 shares for $50/share and then selling them for $50/share. You spent $5,000 and got back $5,000 (well, I suppose you would be out a few bucks for commissions, but for the sake of our argument – let’s omit commissions for now). In this case you still have your entire principal.

So – all of a sudden, the world of options is losing some of its luster, n’est-ce pas?

Scenario 3: ABC goes down to $40

Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter what. So you still have lost 100% of your money by buying the Call Option Contracts in this case. It doesn’t matter if ABC becomes delisted – you can only lose 100% of your money when buying a Call Option Contract.

But for the investor who goes out and buys 100 shares of ABC at $50/share and then sells them for $40/share, they will have lost $1,000 on their initial $5,000 outlay – for a total loss of 20%.

But while a 20% loss sounds better than a 100% loss – in this case the option contract holder only lost $250 while the traditional method yielded a loss of $1,000. So the absolute loss is greater than with the traditional method in this case.

Buying Call Options?

Discover Canada’s best online brokers below and avoid overpaying on a derivative which is expensive to begin with.

Are Calls, Puts, and Hedging for You?

Okay, so now you have seen the mechanics behind how call options work. I think I have presented a balanced view of how they can work (or backfire) for an investor.

So who buys options?

Well there are two main reasons for buying call option contracts.

1) High potential leverage – when a stock only has to appreciate by (in the example case) 20% to yield a 100% return on your money – well that’s quintessential leverage isn’t it?

2) Limited risk – Maybe that sounds paradoxical when you can lose 100% of your investment, but consider the absolute value of the loss can be small (the value of the contract purchase) which in our sample case was $250.

If you have a theory or a speculation that a stock is going to appreciate, buying an option allows you to leverage your long position in that stock for a quick and large gain… in theory.

In reality, when you are buying a stock option call or put, you are in fact paying a hefty premium and particularly in times like today in which the volatility is at peak as also reflected on the VIX (which measures volatility expectations by measuring the premium rates on puts – if the VIX is high it means that put premiums are high). As of today, taking significant positions will be very expensive to do and while your loss in buying options is capped you still have a spread to beat.

The best way to explain this concept is with an example.

Let’s look at June 20, 2020, for SPY (SPDR S&P 500 ETF). Let’s assume you think that by Jan 15, 2021, the market will drop. You are either trying to defend your long portfolio by betting in the opposite direction, or simply making a speculation.

The current SPOT for SPY is 308 (exactly 10% of the SPX), and you think it will drop a hefty 20% by then to 277. So you buy put options for a 277 strike for Jan 15, 2020.

A single option will run you $17.56 and one contract consisting of 100 options will cost you $1,756. That means that you only start earning when SPY drops below 260 points (deducting the spread cost from the actual strike)… and even if that happens, a single contract isn’t going to defend much of your portfolio!

Even if SPY drops to 240 which is a very drastic scenario, that contract is only going to net $2,000 in profit (or $3,756 in total return, which includes your initial costs).

So to protect a sizable portfolio you will need to buy a good number of such contracts, and that capped/limited loss concept is voided because you’ll be risking a substantial amount of your portfolio into that option.

Hence, the conclusion is that if you were to buy put options to hedge your portfolio or a specific investment, you should do it before the entire world is submerged in option buying and every second headline on the television speculates where the stock market is heading, because then premiums will be at their absolute PEAK making your so-called “insurance options” quite useless.

Options Selling / Writing

You should know that investors have the option of SELLING call options too.

This is commonly referred to as Call Option WRITING. In this case you would sell the contract and collect the premium (as opposed to BUYING the contract and PAYING the premium).

The option buyer would have the option of buying your shares before the expiry date, and you would be OBLIGATED to sell your shares to them. If the stock never reaches the strike price, the contract expires worthless to the option holder (although you will have kept the premium no matter what – and still own the stock in the case of a “covered” call write).

Buying Put Options?

Discover Canada’s best online brokers below and avoid overpaying on a derivative which is expensive to begin with.

Covered Call Writing

In my opinion, Covered Call Writing is one of the best option trading strategies. As opposed to naked call buying, it has one particularly interesting use:

It is an alternative way to set a “limit sell order”.

Instead of instructing your broker to sell when your stock gets to a certain point, you can just WRITE or SELL a call option and pick up some additional revenue (the price you get for the contract) to boot. When the stock reaches the strike price, the option holder will exercise their right to buy the shares and you will be forced to sell – again: great if you were instead planning on setting a limit sell order.

This is probably the most common “entry point” when it comes to using options for the average investor.

For example if you bought a stock for $50 and thought that when/if it reaches $60 would be a good time to sell, you might instruct your broker (or trading platform) to automatically sell at $60. In that case you will have made a gain of 20% ($10 gain on $50 investment – ignoring commissions).

On the other hand, if you bought the stock for $50 and instead WROTE a call option with a strike price of $60 and sold that contract for $2.50 – then assuming the stock appreciated to $60, the option holder would exercise their option to buy at $60, and you would be forced to sell.

You will have collected a $10 gain from the stock AND the $2.50 premium from selling the option contract for a total gain of 25% as opposed to 20%. An extra 5% gain, with the only added risk being that you could miss out on a big-gaining stock (which you would have anyway if you had a sell order in place).

In fact, the gain could be higher if the call option expires before reaching the stock price. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. If the second call option you wrote was exercised then your gain would be 30% ($10 gain from the stock + [ 2 x $2.50 per contract ] ).

Many investors will just keep writing covered calls and collecting the premiums over and over again.

When a contract expires, they will turn around and write another one. If you have used this strategy on BCE for the last 8 years you would have collected not only the healthy dividend from BCE’s stock, but also the ongoing premiums for countless expired call option contracts that you wrote time after time. This would have taken away a lot of the sting of BCE’s share price falling.

This is called “COVERED Call Writing”. “Covered” means that you own the stock.

If you did not own the stock it would be called “Naked Call Writing”. Naked Call Writing can be a VASTLY RISKIER proposition because if the stock’s price increases dramatically you will be forced to sell shares at the strike price (by short selling – like in The Big Short) and then covering your short at a higher stock price.

Let’s look at an example of Naked Call Writing:

You do not own ABC – which is trading at $50, but you decide to write a naked call option contract with a strike price of $54 and an option premium of $2, expiring in 4 months. If ABC doesn’t get to $54 within 4 months, you will have pocketed the $2 – all while putting down none of your own money!

BUT, let’s say that ABC shoots up one day to $60.

In this case, if the option holder exercises their option of buying ABC at $54, then you must provide ABC to them at $54/share. In order to deliver the shares, you will need to buy ABC on the open market at $60/share. Therefore, you bought at $60, and sold for $54 for a $6 loss. You still pocket the $2 for selling the option contract in the first place, so that reduces your loss from $6 to $4.

You can see from this example that if the stock moves significantly, your losses can be extreme!

Writing Covered Calls?

Discover Canada’s best online brokers below – discover reliable and fast platforms that enable you to do so.

How to Write a Covered Call Option in Practice

Let’s assume that you have an equity that you are willing to write a call option against.

Here’s the steps you would follow:

1) Pick a stock or ETF that you want to write a call on.

2) Read the option table. Options expire the third Friday of the month and there is a constantly evolving set of “betting lines” in regards to what the value will be for that stock or ETF on that day.

3) Choose a strike price. The strike price is the price you are willing to sell your stocks at. If you sell a call for $50, it means that you are willing to sell your stock or ETF for $50 if the buyer pays you a premium of $$$.

4) If on that date the stock is worth more than $50, then you will be forced to sell the stock for $50 – but you still get to keep your premium. If it is worth less than $50, no stocks trade hands and you walk away with your premium.

5) Remember that one contract equals 100 shares of underlying stock.

6) For transaction type, selecting “Sell to Open”. This simply means that you are selling the option to open the position. If you want to buy back the option that you sold, or buy any option “long”, you choose “buy to close”.

The Equity Collar – Another Risk Reduction Options Strategy

Speculation and hedging are the two main reasons for using derivatives. Speculation is the taking on of risk, and hedging is the reduction of risk.

Within both broad options trading categories, there are varying degrees of each. The Equity Collar is very much a hedging strategy designed to reduce risk.

An Example

Perhaps as a means to facilitate understanding I will start with an investor profile and then work in the strategy as a solution to the problem. Let’s say that Sally is 64-years-old and has accumulated a sizable portfolio that is strictly invested in an ETF that tracks the entire stock market.

Let’s say that this stock market is trading at 10,000 right now and the ETF’s unit value is $100. The markets have pulled back recently, and Sally is unsure if we have hit bottom or if there is more downside to the markets.

She would like to retire at the end of this year (nine months from now). At which point she has decided she will then switch her portfolio to 50% equities and 50% fixed income. She owns 5,000 units of the ETF for a total portfolio value of $500,000.

She feels strongly that with the recent pull-back in the markets that if we are at a bottom, the market will have a positive year and end up at maybe 10,800 points, or up 8%. At the same time, she realizes that in the short term the markets can pull back further and doesn’t want to erode her retirement savings any further if that were to happen as she is nine months away from retirement as mentioned.

If she wanted to protect her portfolio (or insure it from further losses) she could buy a put option on the ETF with a strike price of $100. This put option gives Sally the right (but not the obligation) to sell her ETF shares at the strike price of $100/unit up until the option contract expires. This now protects her from losses in her portfolio up until the expiry date of the option (which in her case would be 9 months from now).

So for example, at the end of the year if the market had dropped from 10,000 down to 9,200 (a loss of 8%), her ETF units would have similarly dropped from $100/unit to $92/unit. However, Sally could exercise her right to sell her units for $100/unit. Therefore she protected her portfolio from loss.

Of course – as with any insurance there is a cost involved – which I have omitted up to this point. Let’s assume that the cost of the put options are $2/share to purchase. In this case, to completely protect her portfolio she would need to buy 50 put option contracts (an option contract is for 100 shares) to insure her entire $500,000 portfolio. This would cost her $10,000 in total ($2/share x 5000 shares). Once you factor in this cost, then really the portfolio is insured to not fall below $490,000 because you would have to pay this $10,000 cost no matter what happened.

For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. If Sally were to turn around and SELL a call option (this means she is giving someone ELSE the right, but not the obligation, to buy her units) for a strike price of $110, she might get $1.50/share from the sale of that contract. This is what is known as writing a covered call.

In this case, if she wrote (sold) 50 call option contracts with a strike price of $110/unit, she would receive $7,500 in premiums ($1.50/share x 5,000 shares). This could be used to offset the purchase of the put options of $10,000 for a net cost to Sally of $2,500 versus $10,000.

The trade-off is that she is now guaranteed no more than a 10% gain on her portfolio as the call option holder would exercise their right to buy Sally’s shares once they reached over $110/unit.

The Results

What is the end result?

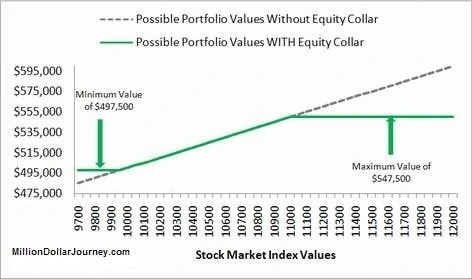

Sally is guaranteed to have between $497,500 and $547,500 by the time she retires. That guarantee has cost her $2,500.

She has protected her portfolio from a loss of no more than 0.50%, but has limited herself to a maximum possible gain of 9.5%.

It is possible to completely offset the bought put options’ premiums with the sold call options’ premiums if Sally were to lower the strike price on the call options she sells to perhaps $108.

In this case she might command a higher premium of $2/share for selling the call options which would completely offset the cost of the put options. In this case her portfolio would be bound between $500,000 and $540,000 (guaranteed return between 0% and 8%). Again though, Sally is trading off even more upside potential for her portfolio.

The simultaneous purchase of a put option with the sale of a covered call option is known as the Equity Collar.

Important: Live Rates are CRITICAL

A common mistake novice options traders make is relying on platforms like Yahoo for option chain prices or using a broker like Interactive Brokers without the proper subscriptions for real-time data. Because option prices can move extremely rapidly (that by not using algorithmic trading you are already at an inherent disadvantage).

Hence, depending on delayed or outdated information can lead to major errors. For instance, options might swing 50% in a matter of just five minutes. If you’re using stale data, you might end up bidding at a price that’s no longer valid or paying significantly more than you should have.

Another issue for those transitioning from “plain vanilla” stock trading is automatically paying the Ask price rather than bidding at a set price they’ve determined. They assume a 5–10 cent difference per contract won’t matter, but with the leverage involved in options, it certainly can.

If the next trade occurs at 10 cents below your filled order, you’re already at a theoretical loss, even though the underlying asset’s price hasn’t changed. Plus, when factoring in the not-insignificant costs of buying options, you could be looking at a MAJOR loss before the asset price moved (particularly true for OTM cheap options).

Options Trading in Canada – FAQ

Bottom Line on Options Trading in Canada

Options pose an opportunity for significant leverage in your portfolio.

It enables the “sophisticated investors” to hedge potential losses or, alas, to increase the level of speculation risk (compared to stocks and ETFs).

Selling options and particularly covered options is a solid way of collecting premiums at a reasonable risk (as long as they are COVERED). In the right hands, options are a powerful tool. Large financial institutions (full of math PhDs) use them en mass – which can attest to their validity as a usable derivative.

Again, we’re not big fans of options investing for the average Canadian. That said though, if you have made up to your mind to dip your toe in these waters, make sure that you understand your Canadian options trading platform and the associated fee structure.

Discover exactly what the Best Canadian Online Brokers can offer in terms of day trading and more in our full write up.

Written for MDJ by a variety of writers including FT and Preet Banerjee – Canadian financial author and fintech entrepreneur.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

NBDB’s minimum is $6.25. Been paying $12.5 round trips.

If using the SM, can you sell naked puts to acquire the stock and sell covered calls for increased income generation along with having other steady dividend stocks in the portfolio to satisfy CRA’s rules?

Wow, there’s so much to learn when it comes to options! This article is definitely a great place to start.

Hi,

Great article. Thank-you.

Can you use a call contract on an underlying security as the basis of a covered call?

Naturally, the underlying call contract would need to have a lower strike price and longer expiry date than the “covered” call contract.

Cheers,