TFSA Contribution Room In 2026 + TFSA Rules and Limits

That means that going back to 2009, the total eligible TFSA contribution limit is $109,000.

Contributing to your TFSA is one of the cleanest, least controversial moves in Canadian personal finance. No deductions to optimize. No income thresholds to dance around. Just one simple benefit that actually does what it says on the label:

Tax-Free Returns!

That single feature is why TFSAs punch so far above their weight. Any growth, interest, or capital gains you earn inside a TFSA stay yours – permanently. No CRA haircut today. No surprise bill later.

If you were 18 or older in 2009, you’ve been accumulating a TFSA contribution room for years whether you used it or not. As of 2026, that adds up to $109,000 in total contribution space. And if you’re starting late, don’t panic – unused room carries forward indefinitely, which means catching up is always allowed (and often very powerful).

Even if you turned 18 well after 2009, chances are you still have a meaningful chunk of tax-free space waiting to be used. Remember that the balance in your TFSA is NOT the same as your contribution room! You are quite likely to have more than $109,000 socked away if you have been consistently contributing. The stock market has basically been on an absolute tear since Jim Flaherty and the Harper government brought the TFSA in back in 2009 – so it’s quite possible you have $300,000+ in there if you invested it properly.

- 2009: $5,000

- 2010: $5,000

- 2011: $5,000

- 2012: $5,000

- 2013: $5,500

- 2014: $5,500

- 2015: $10,000

- 2016: $5,500

- 2017: $5,500

- 2018: $5,500

- 2019: $6,000

- 2020: $6,000

- 2021: $6,000

- 2022: $6,000

- 2023: $6,500

- 2024: $7,000

- 2025: $7,000

- 2026: $7,000

Since 2009, the contribution limit has increased according to inflation and rounded to the nearest $500, except for 2015 when conservatives ratcheted it up to $10,000. Unfortunately, the decision was reversed in 2016, but it’s good to see that the limit continues to rise, with 2024, 2025, and 2026 all having contribution limits of $7,000 each year.

Best 2026 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by January 5, 2026. Qtrade promo 2025: CLICK FOR MORE DETAILS.

TFSA Rules for Investing in Your Tax Free Investing Account

I’ve always thought that the Tax Free Savings Account was a terrible name for what the TFSA actually is. Many Canadians hear the keyword of “savings” and they think that the TFSA is simply a really souped-up version of a high interest savings account. Certainly it can be used that way. If you want the ultra-safety of a TFSA-sheltered high interest savings account, we recommend checking out our EQ Bank review for a look at the best online savings option in Canada.

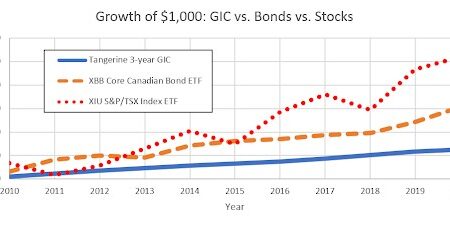

The far better option for most Canadians who are saving for the medium- to long-term however, is to use the TFSA as a Tax Free Investing Account!

See, tax sheltering is a beautiful thing. Watching your capital gains and dividends roll in while the tax man looks the other way is a great way to build wealth in Canada. The TFSA rules state that Canadians can invest in stocks, bonds, mutual funds, and more, just like you would be able to do with a regular (taxed) brokerage account.

Personally we recommend using an all in one ETF or specializing in dividend growth stocks (which also work great outside of your TFSA). Robo advisors such as Justwealth are also an excellent option for your TFSA if you’re looking for a quick-and-easy hands off solution. A broker like Qtrade is a better option for people who like a more DIY approach.

Qtrade Promo Offer: $150 Cash Back Signup Bonus!

No Code Required – Just Click the Button Below

TFSAs offer choice, flexibility, security, and save you money. As long as you keep in mind the TFSA total limit, yearly limits, and basic rules to follow, you’ll be well on your way to building tax-free wealth in no time.

Withdrawing From TFSA and Re-Contribution Rules

In addition to the annual contribution room that the government allows you to have in a TFSA, it is important to understand that you can re-contribute back any money that you withdraw from your TFSA.

BUT

(and this is a big BUT)

You can only re-contribute that money back during the following calendar year. This gets a bit confusing, but it’s worth understanding, because the penalties for over contributing to your TFSA by mistake are pretty harsh!

Let’s look at an example:

Jane is 34 years old and decided to open a TFSA account in 2020. She would have had $69,500 in TFSA contribution room at that point, but Jane is like most Canadians and did not have over sixty-nine thousand dollars just lying around. Instead she opened a TFSA account and contributed $10,000 to it. This left her with $59,500 in TFSA contribution room.

Over the next two years Jane got raises at work, and really prioritized savings in her life. She was able to contribute $15,000 to her TFSA in 2017 2021, and $20,000 in 2018 in 2022. In total, Jane would have now contributed $45,000. Since she also gained TFSA contribution room in each of those two years, Jane would now have $36,500 in leftover contribution room.

As a bonus for Jane, it has been a fantastic few years in our hypothetical stock market, and the overall value of her TFSA investments has risen to $65,000. How her investments perform is almost irrelevant to Jane’s contribution room at this point though.

In 2023 Jane contributes $43,000 to her TFSA, and thus maxes out her TFSA contribution room up until the year 2023. It was another good year in the stock market as well, and the total value of the tax-sheltered assets in Jane’s TFSA account grows to $120,000.

Go Jane!

In 2024 Jane withdraws $25,000 to purchase a used car. She sells $25,000-worth of investments, and then withdraws the money.

As 2024 rolls to a close, Jane gets back to her saving ways and also receives a bonus at work. It’s key for Jane to understand that the most she can put into her TFSA without incurring a penalty is $7,000. This is the 2024 TFSA contribution limit, and she has no other contribution room from past years.

HOWEVER

When the clock strikes midnight on December 31st, 2024, a whole new world of TFSA contribution room opens up for Jane.

Not only does Jane get her 2021 2025 TFSA contribution space ($7,000) but Jane would also be able to re-contribute the $25,000 that she withdrew in 2024 to purchase the car.

If instead of a car, Jane had sold all of her investments held within her TFSA in 2024, and cashed out the $120,000 to make a downpayment on a house – then in 2025 she would have been able to contribute her new 2025 TFSA contribution room ($7,000) PLUS the $120,000 that she withdrew the year before for a total of $127,000 in TFSA contribution room going forward.

You can see from the above example that investing in assets with a higher risk/reward profile than a high interest savings account, can have more benefits than what first meets the eye. In recent years as the FIRE movement has gained traction worldwide, many have been wondering about Withdrawing From RRSP/TFSA to Fund Early Retirement. The short answer is yes, you can do it, but there is a lot to learn and consider before doing so.

What if I Lose Money on TFSA?

If the value of the investments that are inside of your TFSA shrinks, you cannot claim a capital loss because a TFSA is a registered account. You also can’t “get your contribution room back” by cashing out and “starting over”.

Whatever money you take out, is the amount you’d be able to re-contribute the following year (plus your new TFSA contribution room for that calendar year).

Ultimately you want to avoid taking a large loss in your TFSA and then being forced to sell the investments and withdraw the money. The rule of thumb a lot of advisors use is that if you need the money in the next 5-7 years, your exposure to stocks should be fairly limited.

If you have a 30-year time horizon on your investments, a bad couple of years in the stock market shouldn’t really affect anything, as you’ll simply leave the investments in your TFSA so that they can re-grow away from the cold hands of the tax man.

What is the TFSA Over Contribution Penalty?

The Canadian Revenue Agency has some pretty strict taxation on over contributions to your tax-free savings account. If you go over your TFSA limit, anything in excess of the allowed tax-free contribution room is subject to a 1% penalty charged on a monthly basis on the highest excess tax-free savings amount.

Therefore, if over contributed from August to December (5 months) by $2,000 for the year, 1% of $2,000 would be charged, which equates to $100 in extra taxes.

In January, the amount you over contributed will be deducted from your contribution room for the new year so that it is no longer an excess.

It makes sense to be cautious, but if your tax-free savings account contributions and withdrawals have been difficult to keep track of, this begs the question,: How does one keep track of the TFSA contribution room?

How to Calculate Your TFSA Limit in 2026

Although the Canada Revenue Agency is pretty good about letting you know how much-unused tax-free savings account contribution room you have, sometimes it is difficult to keep track, especially if Notice of Reassessments are done and the “explanation of changes and other important information” appears different in your reassessment.

There is one easy way of accessing important information you may need throughout the tax year, and that is to use the Canada Revenue Agency’s My Account tool.

To register for My Account, all you need is:

- Your social insurance number

- Your Notice of Assessment (or Reassessment), specifically to access line 150 of the previous year’s tax return (which is your total income reported)

- Your birth date

You will then choose a sign-in option to register with:

- Sign-In Partner (bank, credit union, etc.)

- CRA user ID and password

- Provincial partner (BC, AB)

Once registered and logged in, My Account also gives you information on:

- Your RRSP contribution room for the current year

- The GST/HST credit you are eligible for

- Your eligibility for the Canada Child Benefit

Once you input these numbers, you will be able to access the tax-free savings account contribution room for the current year (not including the contributions already made in the current year).If you would rather speak to someone in person (after waiting on hold of course), calling the Canada Revenue Agency’s Tax Information Phone Service (TIPS) can also provide you with the same information. The phone number for TIPS is 1-800-267-6999.

Do TFSA Contributions or Withdrawals Affect CPP, OAS, or My Pension?

TFSA contributions are made with after-tax dollars. This means two important things for most people:

- You do not get a tax refund like you would if you contributed to an RRSP.

- When you withdraw money from your TFSA account, it is not counted as taxable income for that year like money from an RRSP withdrawal would be.

Consequently, TFSA contributions will never affect your CPP, OAS, or Pension.

It is a similar case when we look at TFSA withdrawal rules as well. This is where the TFSA really shines. Whereas withdrawing money from your RRSP can affect government benefits such as the Old Age Security, TFSA withdrawals are not counted as income in regard to eligibility for any pension program!

If you would like to learn more about how the TFSA and RRSP compare, check out our in-depth analysis in TFSA vs RRSP- Canada’s Registered Account Faceoff.

Is There TFSA Contribution Deadline or Withdrawal Deadline in 2026?

There are no TFSA contribution deadlines or a TFSA withdrawal deadline in the same way that the RRSP has deadlines. Your TFSA contribution limit represents a maximum contribution for the year, but it simply accumulates over time if you don’t use it.

Because there is no tax refund to worry about (like there usually is with an RRSP), there is no need to worry about taxable income coming in or going out of a TFSA. Really the only TFSA contribution rules that you have to keep track of, is:

- the total amount of money that you have contributed in a given year,

- your total amount of past TFSA contribution room that you haven’t used up yet,

- and how much TFSA cash you withdrew last year,

so that you don’t trigger the TFSA over contribution penalty as discussed above. If you still have TFSA contribution room in 2025 check out my review of the best discount brokers for TFSAs.

TFSA Contribution Limit – FAQ

Can you contribute to TFSA for past years?

Yes! This is one thing that really sets TFSA apart from the Roth IRA in the USA. If you were 18 years of age in 2009, regardless of whether or not you were employed at the time, you can make up for lost time and contribute the full amount. In other words, the TFSA contribution limit carries forward, so you can contribute up to $109,000 by the 2026 tax year. If you were 18 years of age after 2009, look at our contribution limits table to add up how much contribution room you have.

What is the TFSA Limit in Canada in 2026?

The contribution limit in 2026 will remain the same as in 2024 and 2025, which is $7,000.

What if I have maxed out my TFSA account?

It’s time to look at diversifying your portfolio. This can be as simple as opening another non-registered brokerage account through platforms such as Qtrade and Questrade and investing in stocks and ETFs not included in your TFSA allocation. We go into more detail on this topic in Maxed out RRSP and TFSA – Now What?

What happens if I overcontribute to my TFSA?

If you go over your TFSA limit, you will have a 1% penalty on the overcontribution, which is charged on a monthly basis.

What can I invest in through my TFSA?

The TFSA is just like any other brokerage account in Canada, meaning that once you set up your account, you can purchase stocks, bonds, ETFs, Mutual Funds, etc. The TFSA total limit for those who were 18 and older as of 2009 is $102,000 as of 2025, so if you have never contributed before, now is the time to start!

Can I open a joint TFSA?

No, you can not open a joint TFSA. You can only open an individual account.

Should I Be Contributing to a TFSA?

The short answer: You bet you should!

As we’ve explained, Canada’s Tax-Free Savings Account (TFSA) is an incredibly valuable tool. The fact that your earnings grow tax-free makes it a no-brainer to get started. Whether you’re saving for a specific goal or investing for the future, this account offers incredible flexibility and the potential for significant growth.

And don’t forget about the contribution room carry-forward – it’s another great benefit. If you haven’t started contributing yet or haven’t reached your limit, you can always catch up.

There’s no better time to start investing than now, so why wait? Start making use of your 2025 TFSA contribution room today and make the most of this opportunity to watch your savings grow without the tax man getting his hands on it!

Hello FT , In regards to the above mentioned scenario

“If instead of a car, Jane had sold all of her investments held within her TFSA in 2024, and cashed out the $120,000 to make a downpayment on a house – then in 2025 she would have been able to contribute her new 2025 TFSA contribution room ($7,000) PLUS the $120,000 that she withdrew the year before for a total of $127,000 in TFSA contribution room going forward”

What happens if anything if Jane can’t contribute the full $120,000 in the 2025. Say she can only replace $10,000 of the 127,000?

Can Jane pick away at replacing the $120,000 of room over the next 20 years? Thanks

Yes – Jane would keep that room and could “pick away” as you say Rando!

I arrived in Canada on work permit (new Immigratn) age 35 in 2016 by contribution room is around 36000 CAD$ is this room correct? does this count for new immigrants once they file their first tax return? I arrive in Nov 2016 and Filed by first Tax return in 2017.

Great information FT! Yes, we advise clients that a TFSA should always be MAXED

first before considering any other investments. Why? Simple: Tax Free Money for Life!

Cheers – Chris from ProLaunch in Ontario..

Qualified investment – an investment in properties, including money, guaranteed investment certificates, government and corporate bonds, mutual funds, and securities listed on a designated stock exchange. The types of investments that qualify for TFSAs are generally similar to those that qualify for registered retirement savings plans. For more information, see Income Tax Folio S3-F10-C1, Qualified Investments – RRSPs, RESPs, RRIFs, RDSPs and TFSAs

Are we able to withdrawal cash at anytime? I literally just heard of the TFSA account couple days ago and in my CRA account it says I got $52,000?? Am I able to withdrawal money from the TFSA account if I had absolutely nothing to contribute or whatever? I opened the TFSA account with my bank and it says my balance is $0.00 haha…What am I missing here??

Hi Eric, you have the contribution room, but you can only withdraw what you have in the account. :)

Is it allowed to have 2 Tfsa accounts in different banks?

Yes you can hold your TFSA in multiple accounts in multiple banks or trading companies..BUT you must NOT go over your limited total added together.

Each bank or company reports your deposit for the year to CRA.

Am I allowed to have 2 active tfsa accounts.

You can have as many active as you want BUT don’t go over your yearly contribution limit..simple? Put $55 in 10 accounts if you want but total not over $5500.

I am attempting to speak with someone regarding my TFSA contributions.

I have been given the number: 1-800-959-8281 to speak to someone in person.

I only receive a recording with no way of contacting a human person. Help please.

Adding up the contributions limit from 2009 – 2017 , it comes to 31500. Your comments say you will accumulate 52,000. What is the difference?

Hi Harry, perhaps the article should be more clear, the numbers are PER year. So from 2009-2012, it’s $5,000/year or $20,000 total.

I find it interesting that in my parents time of investment planning for the future they had the r r s p vehicle produced and endorsed by the Canadian government , Segway to 2009 and they introduce the t f s a….what be all and end all will our kids be introduced to in the future to power the government …..?

Hi! Thanks for the article … When will the cra update the informations to get the acurate contribution room availaible for 2017 when we log on our account on the cra website? its now jan. 22th and the infos has still not updated.