Closet Indexers vs. Stock Pickers – Truly Active Managers Outperform

This is the final installment of Ed Rempel’s series on active investing.

“If you can’t imitate him, don’t copy him.” – Yogi Berra

In the last article, we introduced the concept of “Active Share” – the degree to which the holdings in a fund differ from the index – based on a study by 2 Yale academics.

Here are some of the other valuable insights from the study.

Fund Manager Insights

The study identifies different types of fund managers and evaluates their success by comparing both Active Share and correlation to the index (“tracking error”):

- Low Active Share/Low Tracking Error: “Closet indexer”. These were the worst performers.

- Low Active Share/ High Tracking Error: “Sector bet”. These fund managers have many of the index holdings, but take big bets in sectors. These funds also underperformed with returns similar to “closet indexers”.

- High Active Share/Low Tracking Error: “Diversified stock picker”. They tend to have many holdings –but different ones than the index. They are often skilled stock pickers. Their funds move somewhat like the index just because they are quite diversified. They tended to outperform.

- High Active Share/High Tracking Error: “Concentrated stock picker:” They tend to have fewer holdings. These are the bravest fund managers, since it takes courage to both hold larger positions and be very different from the index. They tended to outperform.

Closet Indexers

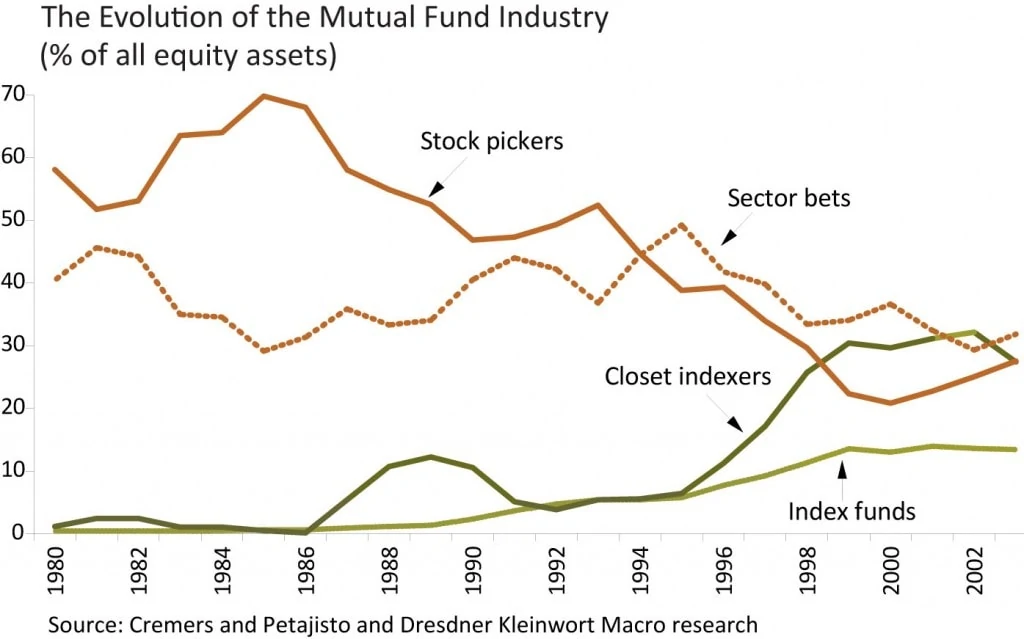

The study defines “closet indexers” as funds with an Active Share of 0-60%. The most negative aspect of the rise of index investing is that closet indexers have proliferated even more than actual index funds. They are now about 30% of equity mutual funds, up from virtually zero in 1980. In 1980, virtually all fund managers were truly active (very different from the indexes).

Closet indexers obviously underperform! Their holdings are similar to the index, and yet they generally charge similar fees to truly active funds. They are probably the worst choice of equity investments, since you are probably not getting either a skilled fund manager or a low cost.

I have to admit that my eyes glaze over when I look at a Canadian equity mutual fund with the top 10 holdings including 3 or 4 banks, plus a couple of the largest insurance, oil and gold companies. They have all the same holdings as the index, but a 2.5% MER! How can they possibly outperform?

One of the main conclusions of the Yale study is that really nobody should own a closet index fund. You should either have a truly skilled fund manager (with a high Active Share) or a low-cost index fund, but nobody should pay the full cost of a skilled fund manager for a closet indexer.

One common strategy for closet indexers is “window dressing”. They fill their top 10 holdings at month-end with popular stocks. Recently, Canadian banks have been popular so they may add them to their top 10 in the last day or 2 of the month, but then dump them right after month end.

Despite this, closet indexers have become very popular for many reasons. Investment salespeople like them because they are easy to sell. Investors like to see big, solid companies they know in the top 10 holdings and are more comfortable during market declines if everyone else is down at the same time. Investors tend to think they are “safer”, but the study showed they are no less volatile or risky than truly active funds with totally different holdings.

Most fund managers are just salaried employees trying to keep their jobs. They have learned that “You don’t get fired for owning Microsoft or Royal Bank”. They know that: “It is better to fail conventionally, than succeed unconventionally.” (John Maynard Keynes).

You can usually identify closet indexers by the way they talk about being underweight or overweight some sector. It is hard to argue that they even try to outperform, since they try to have similar holdings and sector weightings to their indexes with much higher fees.

This proves the saying: “You can only beat the index by being different from the index.”

Sector Bets

The study defines “sector bets” as funds that try to outperform by being in the right sector, as opposed to picking the rights stocks. These funds tended to own companies in the index, but were heavily overweight in some sectors. They may be “sector rotators” or “market timers”. Think of it somewhat like actively switching between several sector funds or sector ETFs.

Some investors today use a strategy like this by trying to market time ETFs in various sectors. The study showed that, while top fund managers can be great stock pickers, even top fund managers were not able to outperform by market timing sectors.

Active Share Predicts Outperformance for “Stock Pickers”

The hardest part of finding skilled fund managers is identifying them ahead of time. It is easy to look at recent returns and see who performed best in the past.

Part of the pitch by most investment salespeople to sell their investments is to show recent returns of the funds they are recommending. One of the main arguments for investing in index funds is that, while there are fund managers that outperform, how do you identify them ahead of time?

However the Yale study showed that: “Active Share predicts fund performance. Funds with the highest Active Share significantly outperform their benchmarks, both before and after expenses, and they exhibit strong performance persistence.”

Fund managers with high Active Share that outperformed the prior year and prior 3 years tended to continue to outperform, but this was not the case for funds with low Active Share.

In addition, fund managers tend to maintain their Active Share. For example, most of the funds with an Active Share of 90-100% stayed there over each of the next 5 years.

This does not mean that all managers with high Active Share outperformed, but the average fund in the group significantly beat their index even after all fees.

To be clear, “active” managing does not necessarily mean they are buying and selling a lot inside their fund. A high Active Share means they the fund manager is “actively” picking stocks (not passively being an index). “Active’ does not refer to activity level but the degree to which the funds’ holdings are different from their index.

Contributing Factors

The study does a long way to prove its credibility. The initial study was U.S. funds, which is the hardest place to beat an index. This is probably the most comprehensive study on the topic. It includes daily stock and fund values for 24 years, compares every fund to 19 different indexes, identifies index funds and closet indexers, and includes dividends and all closed funds (no “survivorship bias”).

I wondered at first whether there was some hidden factor that would explain this. For example, perhaps the fund managers with high Active Share are buying smaller companies? The study exhaustively evaluates the contribution from many possible factors to see how they contributed to outperformance and to Active Share.

They filtered the results for many factors, including size of holdings, size of fund, momentum, cash position, “tracking error” correlation to the index, turnover of holdings, expenses (MER), number of holdings, age of fund, manager tenure and cash in-flow/out-flow.

The results showed that fund managers with high Active Share tended to outperform significantly even after taking all these factors into account.

The other factors that contributed the most were:

- Size of fund: Managers with a high Active Share outperformed by wider margins with small and mid-sized funds, than in larger funds (over $1 billion).

- Expenses (MER): There was a slightly higher MER with managers with higher Active Share. Closet indexers tended to have MERs nearly as high as the top fund managers. You may have thought that lower fees would lead to higher returns, but the study showed that the top performing funds with high Active Share tended to have slightly HIGHER fees.

- Manager tenure: Experience makes a difference.

The study showed that combining factors can make a much bigger difference. For example, for the smallest 10% of funds that have an 80-100% active share and outperformed the prior year, they beat their index on average by 6.5%/year after all fees! That’s a lot.

The main conclusions of the study are:

- The more different a fund is from the index, the better it tends to perform!

- Nobody should own a closet index fund. You should either have a truly skilled fund manager (with a high Active Share) or a low-cost index fund, but nobody should pay the full cost of a skilled fund manager for a closet indexer.

About the Author: Ed Rempel is a Certified Financial Planner (CFP) and Certified Management Accountant (CMA) who built his practice by providing his clients solid, comprehensive financial plans and personal coaching. If you would like to contact Ed, you can leave a comment in this post, or visit his website EdRempel.com. You can read his other articles here.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

While this is an old post there was a new article in the Globe and Mail that relates:

http://www.theglobeandmail.com/globe-investor/investment-ideas/strategy-lab/value-investing/how-to-choose-the-right-actively-managed-fund/article14348422/?cmpid=rss1&utm_source=dlvr.it&_gi_utm_medium=twitter

Based on this paper which is a follow up from the 2009 paper:

http://www.petajisto.net/papers/petajisto%202013%20faj%20-%20active%20share.pdf

High Active Share mutual funds outperformed the index before and after fees and outperformed sector bets. Complicated study but the data speaks for itself.

Hi Aolis,

The purpose of this article is just to point out that too many people wrongly believe that nobody can beat the market, and that many people are buying the wrong mutual funds (such as closet indexers).

I also disagree that there is a need to study stocks when you invest in mutual funds. That is the whole point of investing with a good fund manager.

We focus on studying the fund managers. Once we have confidence in them, we let them make the specific investment choices.

There is no need for us to study the stocks they hold, except as part of understanding the process the fund manager is using.

Researching hundreds of stocks in a constantly changing environment to identify the best ones would be exhausting! We don’t spend time doing that because we are confident in our fund managers and they have already done far more research on stocks than most investors.

A good fund manager will do some real research. Doing a 100+ page report on every stock they own is common. What most amateur investors know about their stocks can usually fit on a post-it note and usually involves only looking at publicly-available information (such as anything you can find on the internet). Unfortunately, many investors underperform because their research is just looking at the same information that everyone else has.

Ed

Hi Dogsfan,

Your dividend strategy is quite sound. Many investors buy them when they are popular (like now), but then abandon them in strong growth markets when they lag. I can still remember the late 90s when investors dumped any stock that paid a dividend, because dividend stocks are not growth stocks.

If that is your strategy, stick with it, even in the next bull market.

Once you retire, you may need to look at other strategies. With the various clawbacks on government income programs in addition to income tax, dividends are taxed extremely highly for seniors in certain tax brackets. For example, for seniors with only CPP, OAS and dividend income, the first $10,000 of taxable dividends have a 72% GIS clawback in addition to income tax. That is not an issue for all tax brackets, though.

Your comments about mutual funds are not accurate, though. There is no need to time selling funds. There are various ways to get income from mutual funds. You can automatically sell a bit every month (SWP), receive a tax-efficient monthly distribution, or even get a 6% eligible dividend paid monthly – whichever makes the most sense in your situation.

By the way, studies partly support your comments are partly not. Local companies being “global” is not really relevant, since studies show that companies with international operations are usually just correlated to their local stock market, and not any foreign market.

However, studies also show that stock markets in high-growth countries do not out-perform stock markets in slower growing countries. I just wrote 2 articles about economies and the 2nd one explains this.

Ed

Ed Rempel,

If you are going to sell a service, then you need to show that you can accomplish the service. This involves more than a study showing that it is statistically possible.

“Our experience is that once you do extensive research once, you can have quite a lot of confidence in the experience, professionalism, integrity and work ethic of a top fund manager.

Then monitoring 2-5 fund managers is a lot less work than monitoring 20-100 individual stocks.”

Each of those stocks is run by an individual as well. Why don’t you just research the people running 2-5 companies and follow up on them?

You imply that everything is easier just by being a fund but underneath the blanket of each fund is many stocks. Investing in funds is actually harder because you have to understand both the fund management and all the stocks.

Hi Ed, you can call it what you like (closet-indexer), but I just have no interest in growth stocks, foreign stocks, story stocks. I have no intention of selling, just collecting growing dividend income for my retirement.

One of many problems with mutual funds is the fact that you have to sell them eventually when you need the retirement income. If you’ve just entered a market crash, or the market has gone sideways for years, where does that leave you when you need your money? The “all-star” funds may fair better than others, but that doesn’t help when you need to time the market to get your money out.

With growing dividend income, I can withdraw $30k – $40k every year during retirement without ever eating into my capital.

Yes, just buying Canadian blue-chip stocks is boring and I’m probably missing out on some terrific foreign stocks out there…but really, don’t be naive enough to think that local companies aren’t “global” too. They are diversifying themselves with investments across the globe, and are most likely much more skilled than I am. I’m going to stick with the companies that I know and that I do business with already, rather than throwing a dart at something in Brazil, Russia, India, China for their amazing potential – just so I can say I’m diversified.

There are more than enough great dividend paying stocks to choose from in Canada, and if you have the patience to wait for them to be value priced, and the patience to wait for their dividends to grow over 15-25 years, you will end up with a pretty attractive retirement.

DogsFan

Hi DAvid,

I take it you agree that “it’s not rocket science” to beat the index.

Do you find your method works, though? Are you not just choosing in hindsight? Just because a few popular stocks did well in a certain period in the recent past, does not tell you anything about potential future performance.

In fact, since the market goes through cycles, whatever stock you pick by that method is probably more likely to underperform going forward.

Even though you may be looking at a longer period of time, you are still selecting companies that have done well recently.

The fact that a company is well-known or thought highly of probably means it is over-valued. Buying just local companies excludes nearly all the best stocks in the world. (It was funny when we found that investors in Iceland have 80% of their holdings in Iceland companies.)

If you are going to buy individual stocks, we would suggest that 6-10 is not adequate diversification (studies say a minimum of 20) and you should do some real research.

For starters, make sure you are not just buying recent winners.

Ed

Hi Aolis,

You are really into “index-think”! Even when you look at top mutual funds, you want to buy all funds in the category. :)

Active Share is a good start, but there are many other factors in evaluating a good fund manager, so you should be able to narrow down the list.

We found the Active Share study very interesting. Too many people believe that nobody can beat the index and too many people invest in closet index funds.

We did find a lot of parallels with our approach in searching for All Star Fund Managers. You are right that they are not the same. The article is mostly about the study, but we have added comments from our experience to fill in gaps.

We know the Active Share for most of our fund managers and virtually every one is very high (between 80-100%). Even before we found this study, we avoided funds that were similar or even just somewhat close to the index.

Ed

Hi Rachelle,

Good comments. You’re right Active Share does not refer to active trading, but to holding companies very different from the index. This often means holding the opposite of what the index has, in order to own under-valued stocks.

As a general rule, the index will tend to hold more of the currently popular stocks. If the market cap (total value of shares traded) has gone up because of whatever made that stock popular, then it is more likely to be in the index. Generally, stocks jump about 10-20% when it is announced that they will be added to the index, so that is the premium investors have to pay for owning an index stock.

Meanwhile, most of the best investors are value style, which means they are buying undervalued companies and waiting for the market to recognize their value.

It’s interesting that you mention Warren Buffett’s latest addition being a railroad. He bought it shortly after the S&P500 removed it!

Your definition of an index is not correct, however. Most people seem to believe that an index is all stocks. It is generally only 5-10% of the publicly traded. For example, there are about 4,000 stocks traded on the TSX, but the index is only 60 stocks. There are about 30,000 in the US, but the main index has 500.

Indexes are essentially a mutual fund with specific principles – hardly any research, except size of company and number of shares traded, low cost, low turnover and diversification. But they are nowhere close to all stocks.

We actually agree with you that the average person that does not want financial advice should buy broad-based index funds and hold them forever. Trading them is usually a disaster, as is holding index funds or ETFs other than the broad-based ones.

I would not personally buy an index (and have never owned one), since I would be quite disappointed with index returns long term. We don’t recommend index funds to our clients for the same reason that nobody on our team has ever owned one – we are confident more confident in our fund managers.

However, we agree that the average investor that does not want advice should buy broad-based index funds and hold them forever.

Ed

Hi Dogs Fan,

If you are just choosing 10-20 blue chip, dividend-paying stocks in Canada, then are you not a closet indexer? Don’t you just end up with the index, (except much less diversification and excluding the growth stocks)?

Ed

Hi Alex,

You think picking and monitoring your own stocks is easier than choosing a fund manager?

Our experience is that once you do extensive research once, you can have quite a lot of confidence in the experience, professionalism, integrity and work ethic of a top fund manager.

Then monitoring 2-5 fund managers is a lot less work than monitoring 20-100 individual stocks.

I guess this is something that only comes from experience, but we have learned to have far more confidence in human beings than statistics when it comes to investments. Any statistics you research can change and most only reflect recent performance, but once you understand what a human being is about, you can have a lot more confidence in that.

In fact, analyzing an investment only by looking a the stats/statements is always questionable. For example, if you analyze mutual funds in depth by looking at 100 or more different stats, you will likely just end up with the ones with good recent performance because recent performance is a factor in many statistics. Then you end up buying the funds that are currently overvalued (in favour).

There is more an art than science to evaluating the best investments. I learned this earlier in my career when doing a ton of research kept just pointing to the recent performers, which often underperfomed as the market changed direction.

You can’t get away from this, even if you are picking your own stocks. To analyze a company, you should really analyze the top management in addition to the financial statements, statistics, etc. Company management probably changes much more than fund managers.

And to be diversified, you would need a lot more companies (20-100+) than funds (3-5+).

Active Share is not publicly published (yet), but you can estimate it relatively easily by going through the holdings. It is only one factor in evaluating investments, but we find a real confidence can develop over time with a great fund manager that you can’t get with a bunch of individual stocks or even an index.

Think of a person you know that you trust and have a lot of confidence in. Do you not find it easier to be confident in a person than a generality, such as the general benefits of an index?

This is something we’ve been thinking about recently and probably only comes from experience or perhaps relates to changing ways of thinking in an internet generation. But we find the best confidence in investing comes from having confidence in a human being.

Ed