Canada’s Best Energy Dividend Stocks 2025

Investing in Canada’s best energy stocks have been a key part of my investing strategy for some time now.

A lot of people don’t remember this, but it wasn’t so long ago (August 2020) that a lot of folks were asking if Canada’s energy dividends were in trouble?

Of course, that was before energy prices and energy stocks dominated the headlines for the next couple of years. At the time, Canadian oil prices were about $30 a barrel and energy dividends were under a lot of pressure due to collapsed earnings.

Those lean times led to Canadian energy stock valuations that still haven’t fully recovered, despite substantial evidence that the best-in-class companies have really improved their operational efficiency. Even in 2023’s less oil-friendly environment, these companies were able to generate substantial free cash flow at $70 per barrel prices.

As we enter 2025 (with oil at $80 per barrel) there are some predictions that slowed global growth and the increased non-OPEC supply could take the price below $70, but I think one could safely ignore this short-term outlook. It’s obviously incredibly difficult to predict both the supply and demand for energy, but I’m betting that oil will be $85 or so by the end of 2025 – leaving plenty of room for dividend growth.

The following chart reflects the price of Canadian oil priced in U.S. dollars. In Canadian dollars the price is in the $57 range. With increase pipeline capacity, I’m hoping that we’ll see much less of a gap between US and Canadian oil profits per barrel.

Here is a video that explains the spread (difference in prices) between Canadian oil and U.S. oil.

Higher oil prices are wonderful for top Canadian energy companies, mostly operating or active in the Canadian oil sands, but many of the producers also have global operations. They have already become free cash flow gushers. More investors, fund managers and retail investors are going along for the ride.

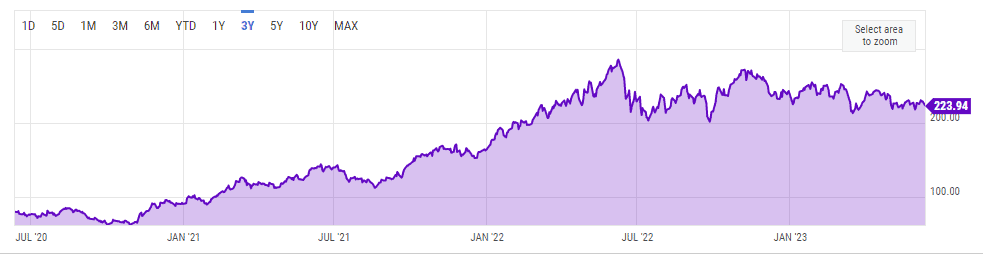

While the last year hasn’t exactly been spectacular (with the TSX Capped Index ETF XEG down 16%), I’m still up over 270% since I started writing about Canadian energy stocks in August of 2020. That’s before we really dig into the juicy dividend raises and special dividends that poured into my brokerage account over the last few years.

In October of 2020, on my blog, I had suggested that investors take a look at Canadian oil and gas stocks:

“The Canadian energy sector has been beaten up. Foreign investors have given up and so have many Canadian investors. Where there is incredible pessimism there can be incredible rewards. But there is certainly no guarantee that the pessimism for the Canadian energy patch is not deserved.

That said, it is also certainly possible that the pessimism has jumped the shark. There may be incredible value in the energy sector for Canadian investors.”

Canadian investors who went against the flow were rewarded handsomely, and it was not as big a risk as many would think. The macroeconomic and energy-specific story was quite simple.

Economic activity and energy usage was certain to pick up as we made our way through the pandemic. Canadian energy producers were made more lean and mean by the tough years in the energy patch. They had already spent the required amounts (CAPEX investments) to make their oil projects viable and profitable at lower oil prices. If prices do get to $50 a barrel and more, they have a license to print money.

Canada’s Largest Energy Stocks Comparison

Ticker | Company | Price | Market Cap | P/E | Dividend Yield |

ENB.TO | Enbridge | 48.79 | 103.30B | 32.51 | 7.51% |

TRP.TO | TC Energy | 53.08 | 54.64B | 51.92 | 7.05% |

CNQ.TO | Canadian Natural Resources | 88.98 | 97.50B | 14.03 | 4.43% |

SU.TO | Suncor | 45 | 58.72B | 7.32 | 4.81% |

IMO.TO | Imperial Oil | 78.77 | 42.66B | 8.95 | 2.51% |

CVE.TO | Cenovus Energy | 21.90 | 42.66B | 10.67 | 2.47% |

PPL.TO | Pembina Pipeline | 45.99 | 25.21B | 21.16 | 5.80% |

(Hidden, click for access) | ?????? (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ??.?? | ?.??% |

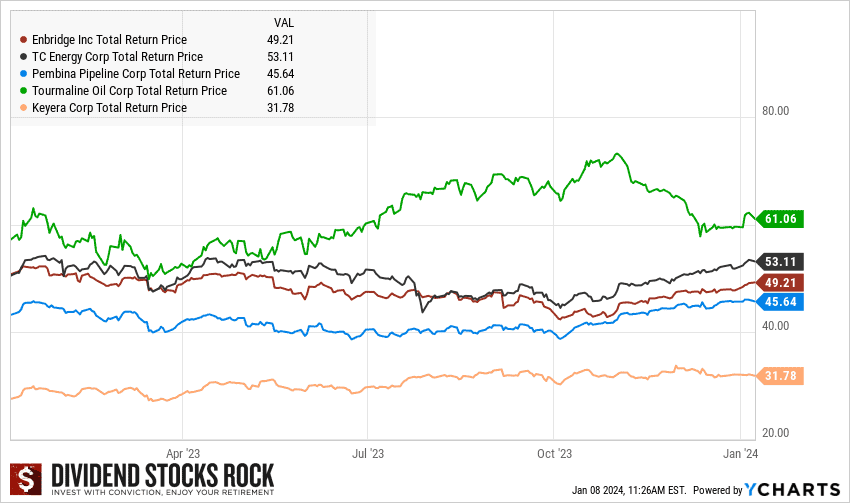

As you can tell from the chart above, if you’re a risk averse dividend investor, Canadian pipeline stocks are a much more stable bet (although potentially with much less of an upside) over the medium- and long-term.

Mike Heroux – the man behind DSR – is a CFA and has been studying Canada’s dividend players for several decades. His free webinars on the value of the mid-stream pipeline companies (they’re not building any more of them) versus the mercurial nature of the oil companies themselves really makes sense. You can read our full Dividend Stock Rocks review here.

The Long Term Strength of Energy Stock Dividends

The story on energy stocks has evolved, in that our green desires do not match the energy reality. Today there are reasonable fears of an energy crunch that could turn into an energy crisis. The renewable energy transition will take a decade or two.

In the meantime we have increasing demand for oil and gas and greatly decreased CAPEX – there’s little desire to look for more oil and gas. In fact, it’s politically unfashionable to suggest that we need more oil and gas, or to spend the time and money necessary to find and produce more oil and gas.

That sets up a secular and positive trend for traditional oil and gas. It is an unfortunate reality.

The story goes back to the most basic economic principle – supply and demand.

On the bullish side, Eric Nuttall, portfolio manager at NinePoint Partners suggests it is a generational investment opportunity. Eric often reminds us that the free cash flow that many of these companies produce is beyond generous, it is ridiculous. They can quickly pay down debt, buy back shares and return more value to shareholders by way of generous dividend increases.

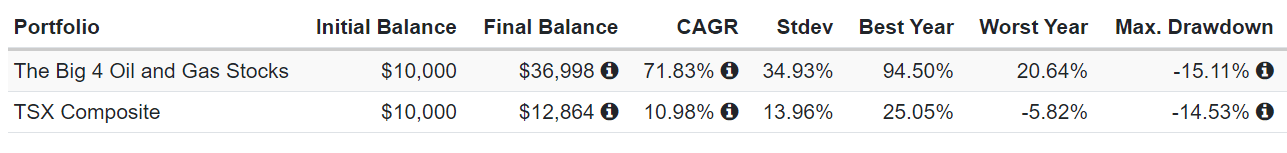

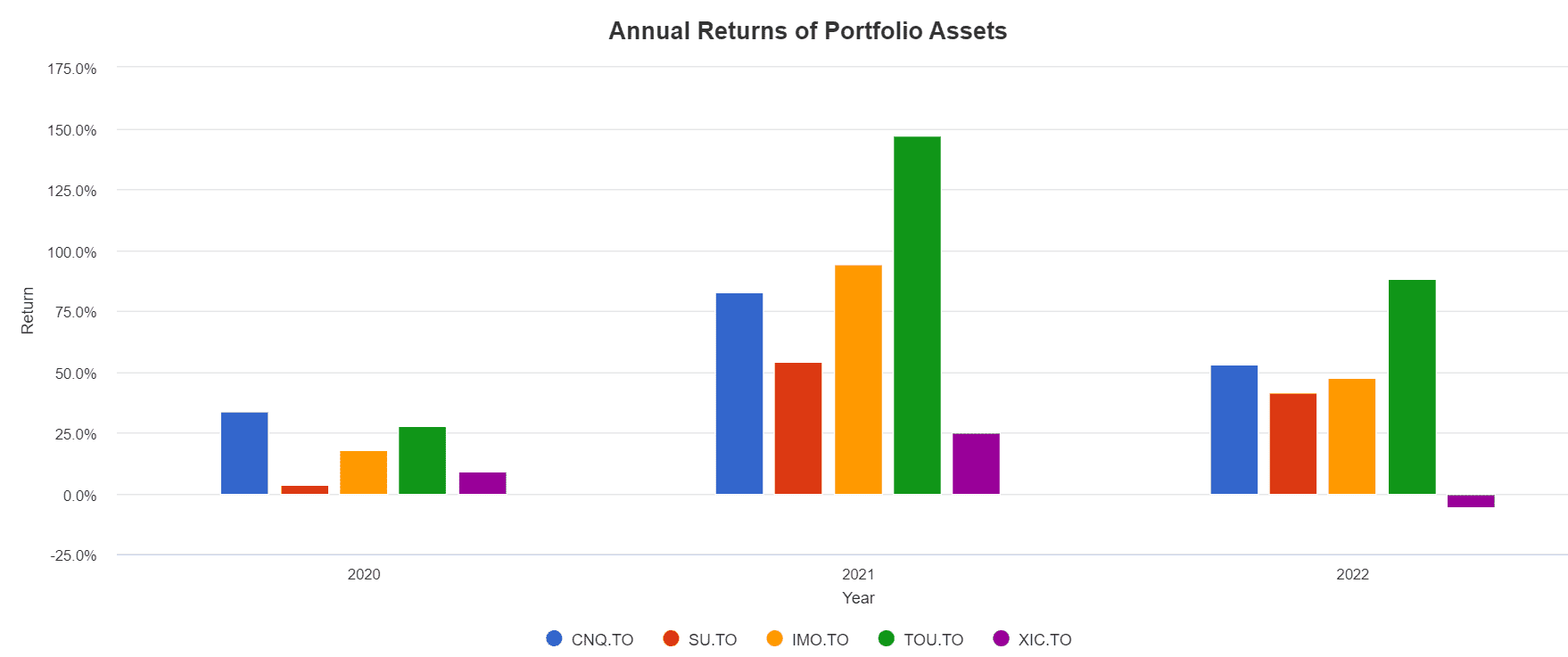

What if You Had Invested In the Big 4 Energy Stocks?

From the time of my original Best Energy Stocks in Canada post, you would have seen some generous (and growing) income. That said, you would also have total returns of 270% leaving the TSX Composite in the dust.

Adding the Best Canadian Pipeline Stocks to My Portfolio

In addition to my list of best oil dividend stocks, I also hold Enbridge (ENB) and TC Energy (TRP). You’ll find those companies in the portfolio that focuses on Canadian Wide Moat Stocks and are stellar Canadian dividend all stars.

As I have previously offered on Million Dollar Journey, pipelines can provide a modest inflation hedge. But they do not have quite the torque of the oil and natural gas stocks.

In the following evaluation I used Enbridge, TC Energy and Pembina (the big 3) for the pipeline group. Returns for 2022:

- The Big 4 – up 57.70%

- Pipelines – up 12.7%

- TSX Composite – down 5.8%

Of course, the best Canadian pipeline stocks are favourites of Canadian investors. The companies offer very generous and reliable dividends. The current yields available are very enticing, as well.

Back in 2020, I had suggested that I would stick with being a toll taker, collecting tolls and dividends by way of those pipelines that move the oil and gas around North America. Of course, Enbridge and TC Energy are much more diversified and do have energy producing operations as well.

But the energy dividend stocks story just became too overwhelming and obvious for me. While I was late to eat my own cooking, I started to build positions in the iShares XEG and Nuttall’s Ninepoint energy ETF.

We enjoyed very nice returns in the range of 100% to 150% in those accounts. But more important than the dividend and total return potential is the fact that we (my wife and family) are hedged against any energy crunch and crisis.

Escalating prices at the pump are not a risk for us. Our energy exposure pays for our gas bill, we then have very generous profits. We make money at the pumps.

My guess is that the greater theme of ongoing higher prices for oil and gas continue, and this may turn out to be a very solid and profitable portfolio bolt-on. It’s part of the explore within the core and explore portfolio approach. And again, I’d add the word hedge in concert with the explore notion.

Our energy producer and pipeline exposure works with our other commodities allocation that includes gold, gold stocks and the larger baskets of commodities. I will not get side-swiped by inflation or stagflation.

The Canadian Energy Stocks Dividend Portfolio

I’m happy to hedge inflation and accept those risks. I now have an 11% allocation – not including the generous toll-taking by way of my Canadian pipeline stocks. And given that I am in the semi-retirement stage (my wife is within 5 years of retirement) I am glad that I moved to the energy dividend stocks approach.

In addition to the Big 4, I also hold positions in Birchcliff Energy (BIR) Freehold Royalties (FRU) and Pine Cliff Energy (PNE). I also hold the Ninepoint Energy Income ETF (NRGI) that holds more U.S. stocks. I’m happy to have that added exposure.

Here’s a list of some current yields available in the space.

Canadian Energy Stocks By Dividend Yield

- Whitecap (WCP.TO) 8.11%

- Suncor (SU.TO) 4.81%

- Canadian Natural Resources (CNQ.TO) 4.43%

- Imperial Oil (IMO.TO) 2.51%

- Tourmaline (TOU.TO) 1.81%

I’ll admit to being a hybrid investor in retirement – embracing dividends and total return while managing the sequence of returns risk (adding bonds and cash). I believe that the energy stocks dividend income stream will help the retirement cause. The energy and commodities exposure is part of the all-weather portfolio approach.

And of course there is risk, Canadian oil and natural gas stocks are cyclical and can be at the mercy of economic weakness and recessions. Experts that I follow suggest that the dividends could come under pressure if oil stays in the $50 U.S. per barrel for too long. Personally, I will use the current price weakness to add to my energy dividend portfolio.

We have recently entered a period of unexpected inflation. That is not a friendly environment for most types of stocks. Of course, no one knows how long that may last, or how bad things may get.

If you want some inflation and stagflation protection, the top Canadian energy companies are a great hedge. You can also look at a diversified inflation-fighting hedge such as the Purpose Diversified Real Asset ETF – ticker (PRA). PRA was up 23.5% in 2021 and tacked on another 15.9% in 2022.

If you want some inflation and stagflation protection, the top Canadian energy companies are a great hedge. You can also look at a diversified inflation-fighting hedge such as the Purpose Diversified Real Asset ETF – ticker (PRA). PRA was up 23.5% in 2021 and tacked on another 15.9% in 2022. Despite oil prices taking a beating in 2023, it will almost break even by the end of the year.

Where to Buy Canadian Energy Stocks?

Canadian energy stocks, and the ETFs mentioned above, can be bought through any licensed broker or financial institution. Our top pick at the moment is Qtrade, but if you want to see more options then check out our full list of online brokers in Canada.

Best 2025 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by November 26, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Canadian Energy Stocks – FAQ

Best Energy Stock to Buy In 2025

Due to the oil price pullback in 2023, profits haven’t quite matched the bonanza of 2021 and 2022. Given that background, it’s no surprise that best-in-class company Canadian Natural Resources (CNQ) was the best oil stock in Canada for 2023. It’s tough to beat a 20% capital gain paired with a nearly 5% dividend!

That’s why CNQ is also my pick for best energy dividend stock in 2025! CNQ has simply proved over and over again that it is unmatched when it comes to disciplined growth over the long term.

Canadian Natural Resources has been near the top of my best energy stock list for several years now on the basis of its solid dividend (plus the free cash flow to back it up), along with its pipeline assets. Unlike many more oil-sand dependent companies, CNQ can still make money if the WTI oil price stays above $35.

Best 2025 Broker Promo

Up To $2,000 Cash Back + Unlimited Free Trades

Open an account with Qtrade and get the best broker promo in Canada: 5% cash back when you fund a new account!

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by November 26, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?