Net Worth Updates

All Categories

Welcome to the Million Dollar Journey 2021 (Q3) Financial Freedom Update – the third update of the year! If you would like to follow my…

Read Full Article >>Welcome to the Million Dollar Journey 2021 (Q2) Financial Freedom Update – the first update of the year! If you would like to follow my…

Read Full Article >>Most Recent

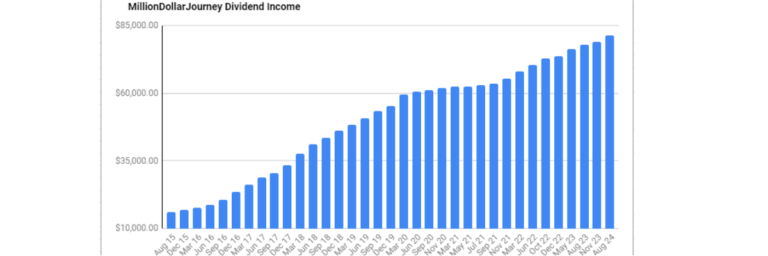

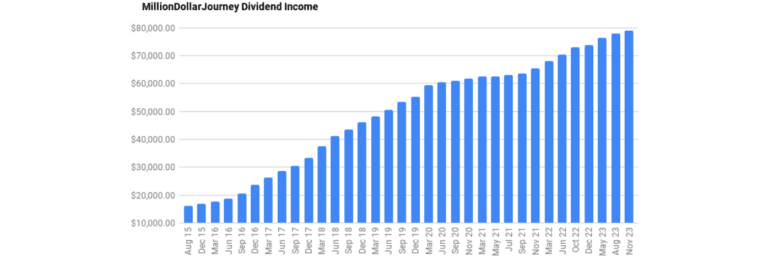

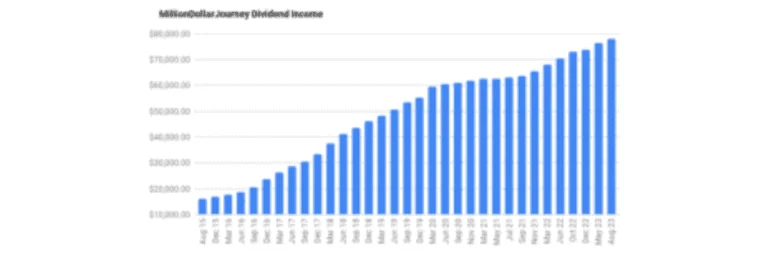

Financial Freedom Update August 2024 – $81.5k in Dividend Income!

Welcome to the Million Dollar Journey August 2024 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial…

How to Become a Millionaire in Canada

Most of us have wondered what it takes to reach millionaire status in Canada. We certainly don’t advise getting involved in any “get rich quick”…

Financial Freedom Update Nov 2023 – $78.8k in Dividend Income!

Welcome to the Million Dollar Journey November 2023 Financial Freedom Update – the third update of the year! If you would like to follow my whole financial…

Financial Freedom Update Aug 2023 – $77.8k in Dividend Income!

Welcome to the Million Dollar Journey August 2023 Financial Freedom Update – the second update of the year! If you would like to follow my whole financial…

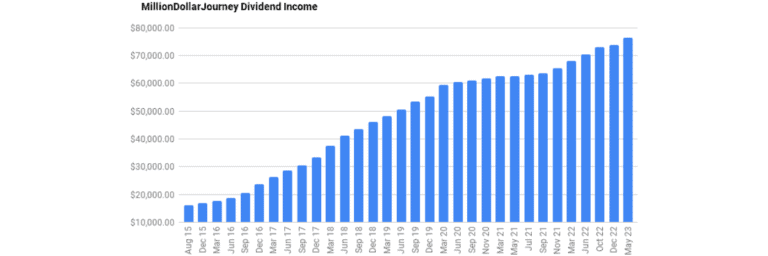

Financial Freedom Update May 2023 – First Update of the Year ($73.8k in Dividend Income!)

Welcome to the Million Dollar Journey May 2023 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial…

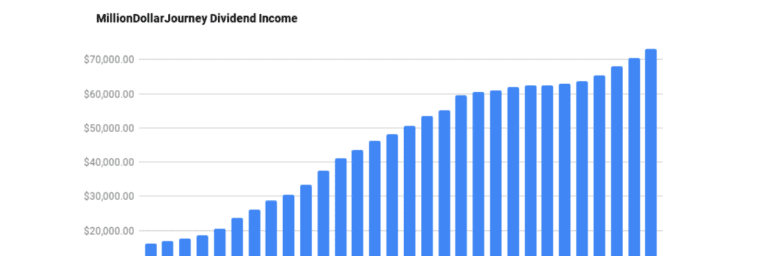

Financial Freedom Update Oct 2022 Update ($73k in Dividend Income!)

Welcome to the Million Dollar Journey Oct 2022 Financial Freedom Update – the third update of the year! If you would like to follow my whole financial…

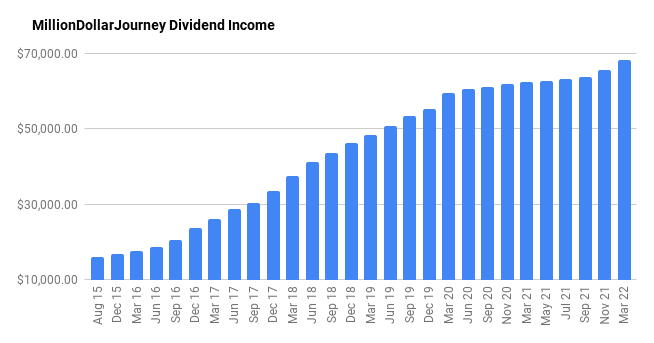

Financial Freedom Update March 2022 – First Update of the Year ($68,100 in Dividend Income!)

Welcome to the Million Dollar Journey March 2022 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial…

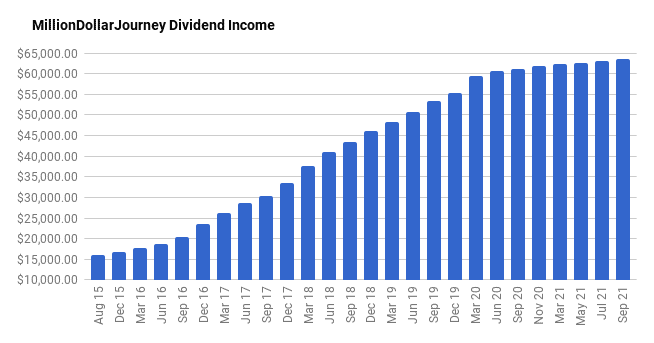

Financial Freedom Update Sept 2021 – Market Highs Edition

Welcome to the Million Dollar Journey September 2021 Financial Freedom Update – Market Highs Edition! If you would like to follow my whole financial journey, you can…

Financial Freedom Update (Q3) 2021 – Sequence of Returns Risk Edition

Welcome to the Million Dollar Journey 2021 (Q3) Financial Freedom Update – the third update of the year! If you would like to follow my…

Financial Freedom Update (Q2) 2021 – Portfolio All-Time High Edition

Welcome to the Million Dollar Journey 2021 (Q2) Financial Freedom Update – the first update of the year! If you would like to follow my…

Financial Freedom Update (Q1) 2021 – First Update of the Year

Welcome to the Million Dollar Journey 2021 (Q1) Financial Freedom Update – the first update of the year! If you would like to follow my…

Indexed Family Education Fund (RESP) Portfolio Update – 2021 Edition

Welcome to the annual Registered Education Saving Plan (RESP) update where I show transparency on our indexed investment strategy to help pay for our children’s…

Indexed Family Education Fund (RESP) Portfolio Update – 2020 Edition

During this time of uncertainty, many readers have contacted me for continued portfolio updates. One group in particular – parents – are asking me what…

Indexed Family Education Fund (RESP) Portfolio Update – 2019 Edition

It has been about a year since my last RESP portfolio update which is probably an appropriate time span since it’s a fairly steady portfolio that is…

Indexed Family RESP Portfolio Update – 2018 Edition

It has been about a year since my last RESP portfolio update which is probably an appropriate time span since it’s a fairly steady portfolio that is…

RESP Portfolio Update – February 2016

It’s been a little over two years since my last RESP portfolio update which is probably an appropriate time span since it’s a fairly steady portfolio that…

Completing The Million Dollar Journey

It’s been a long time coming, but we finally did it, we hit the million dollar net worth milestone. Our million dollar journey started in…

Net Worth Update April 2014 (+0.81%)

Welcome to the Million Dollar Journey April 2014 Net Worth Update. For those of you new to Million Dollar Journey, a monthly net worth update is…

"I've completed my million dollar journey...

Want some help with yours?”

Instantly download our free eBook on tips for how to organize your RRSP, TFSA, and other investments, in order to get the most out of your retirement at any age.