Best Canadian Dividend Stocks – January 2026

The 2025 standout performer was TD Bank. The bank stock absolutely destroyed the index, with a smoking-hot 50%+ total return. When I first started recommending TD, that dividend yield was up over 6%!

While TD has been an excellent return on a stock that I have been buying a ton of and recommending since 2022, I have to admit that my 2025 Canadian dividend stock pick of Sunlife didn’t turn out so hot. The theory was that other insurance stocks were roaring to life, and I wanted to stay ultra-safe at the start of 2025. While it wasn’t a disastrous year for Sunlife, and there are no dividend cuts on the horizon, Sunlife didn’t have anywhere near the returns of the broader market.

I take pride in keeping my Canadian dividend stock picks updated, and these numbers are current as we start 2026. Deciding where to place these blue chip companies often boils down to four key metrics

- Dividend Yield

- Dividend Growth Consistency

- Earnings Per Share

- Overall Company Revenues

Click here to jump straight to my top 10 dividend picks for January 2026.

While volatile economic deadlines have dominated the news so far in 2026, the Canadian stock market has remained pretty solid.

Given the strong earnings picture, and continued inflation moderation, Canadian dividend stocks look very attractive for the long term.

FT

You’ll see that many of the Canadian dividend picks below are in stable industries such as banks, insurers, pipelines, and utilities. I love these companies because they have such high barriers to entry. Good luck creating a pipeline from scratch in Canada these days!

Truthfully, I have no idea what artificial intelligence is going to mean for every company around the world. I think that it’s probable big companies like RBC and CNQ will figure out ways to get 3-5% more efficient using various types of AI to focus on more targeted marketing, getting more production out of fewer employees etc. That said, I don’t know where some of these bolder “10x” predictions are coming from.

Consequently, I think the trends from the second half of 2025 are a good bet to continue into 2026. In the latter half of last year we saw Canadian blue chip stocks substantially outperform the Nasdaq tech darlings.

In fairness, the big tech companies in the US have been on an incredible 10-year run, and are great companies – you just have to pay a very, very, high premium to buy a piece of them right now. Canada’s best dividend stocks aren’t valued nearly as high. While it’s possible (maybe even probable) we see a sideways market for the next 5+ years, those 4%+ dividends are likely to just keep rolling right along!

Mike Heroux over at the Dividend Stocks Rock platform confirmed what my instincts were telling me in regards to interest rate movements and current events at his last free webinar. As my go-to source for dividend info, I highly recommend checking out Mike’s Pro services as it makes organizing these dividend watchlists so quick and easy. For a limited time, MDJ readers get a 33% lifetime discount – your price will NEVER go up.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Best Canadian Dividend Stock To Buy Right Now

My National Bank stock pick from three of the last five years continues to tick along and reward my confidence. Together with TD (who seems to have moved on from their money laundering charges relatively unscathed), National Bank has really been a tentpole of my portfolio.

I’m hoping those recommendations have built some credibility despite the Sunlife pick.

I will say that for the first time in a while, I’m starting to see little cracks in the investment armour of all the Canadian banks. It’s not that they’re not excellent companies with solid dividends (they are). It’s just that they’re valued way above their historical averages right now.

The other news story that has me a bit worried is the re-emergence of the sovereignty discussion in Quebec. I think this is likely a 2026 story, but the market is often ahead of the news on these things. While I think any sort of serious discussion about Quebec leaving Canada is still a long shot, it’s a massive tail risk for a company like National Bank that is based in Quebec.

When it comes to 2026, I have to admit that I don’t have the strong conviction that I have had in the past. The Canadian stock market had an incredible 2025, and that comes on the heels of great years in 2024 and 2021 (with 2022 and 2023 basically cancelling each other out).

Consequently, I’m going with a very defensive stock pick in Fortis for the 2026 Best Canadian Dividend stock pick. I’m not sure how long the macroeconomic party can last – and consequently, I’m going with a boringly-dependable dividend stalwart.

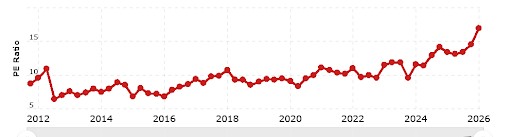

Just to give you some idea of how good things went last year, let’s take a look at RBC (at various times the biggest or second biggest stock in Canada over the last five years). RBC was up 35% in 2025, and it’s up about 120% over the last five years. While its earnings have grown in that stretch, they haven’t grown nearly as vast as the stock price. Resulting in the following P/E chart:

Paying that high a premium for the future stream of earnings doesn’t exactly scream “BUY NOW” to me (and there are many even more egregious examples of stretched valuations out there).

Good to Know:

Don’t only focus on dividend yield. A very high dividend yield can actually be a warning sign! If a stock’s yield is significantly higher than its historical average or sector peers, it could indicate financial trouble, a potential dividend cut, or a falling stock price. Our best high yield stocks in Canada goes into that in more detail.

Our Top 10 Canadian Dividend Growth Stocks (January 2026 Updated)

Here’s a look at our top 10 long-term Canadian dividend stocks in order of their dividend increase streak.

Ticker | Sector | Div Streak | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio | P/E | |

Fortis | FTS.TO | Utilities | 52 | 3.60% | 6.15% | 5.26% | 5.02% | 74.53% | 21.11 |

Toromont Industries | TIH.TO | Industrials | 36 | 1.24% | 7.90% | 14.45% | 10.90% | 31.06% | 27.66 |

Canadian National Railway | CNR.TO | Energy | 29 | 2.55% | 4.47% | 8.70% | 9.07% | 48.07% | 18.87 |

Canadian National Resources | CNQ.TO | Communications | 25 | 5.39% | 17.98% | 4.76% | 22.55% | 74.30% | 13.80 |

Emera | EMA.TO | Utilities | 17 | 4.33% | 8.37% | -4.87% | 3.07% | 167.81% | 18.31 |

National Bank | NA.TO | Finance | 16 | 2.84% | 9.96% | 10.53% | 10.79% | 45.77% | 17.33 |

Alimentation Couche-Tard | ATD.TO | Business | 16 | 1.17% | 10.73% | 2.15% | 21.88% | 19.58% | 19.42 |

Brookfield Corp. | BN.TO | Finance | 16 | 0.49% | 3.93% | -28.67% | -5.59% | 104.65% | 102.42 |

Waste Connections | WCN.TO | Finance | 15 | 0.82% | 11.43% | 25.52% | 10.73% | 48.94% | 72.47 |

?????? (Hidden, click for access) | (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ?.??% | ?.??% | ?.??% | ?.??% | ???.??% | ??.?? |

For my full 32-stock list of Canadian dividend earners that I’m buying today – as well as the 74-stock list of US Dividend all stars that I recommend – check out the platform that I personally use to do my dividend stock research.

Note: Data on this article updates periodically. If you are looking for real time data and guidance, read our recommendation below.

Good To Know:

When evaluating dividend stocks, also consider Dividend Payout Ratio. This ratio indicates the percentage of earnings a company distributes as dividends. A lower ratio suggests that the company retains more earnings for growth, which can be a positive sign for long-term investors.

Up to Date Dividend Stock Data & Picks

The easiest way to keep up to date with the best dividend stock picks, is by signing up with Dividend Stock Rock. DSR is not just a weekly newsletter with stock picks. It’s a program that will help you manage your portfolio and improve results using unique and sophisticated tools.

The person behind DSR is Mike, the most prominent and active dividend stock blogger in Canada and is a certified financial planner since 2003.

You can first read our detailed DSR review, or sign up now by clicking the button below. Our readers are eligible for an exclusive 33% off discount using code MDJ33.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

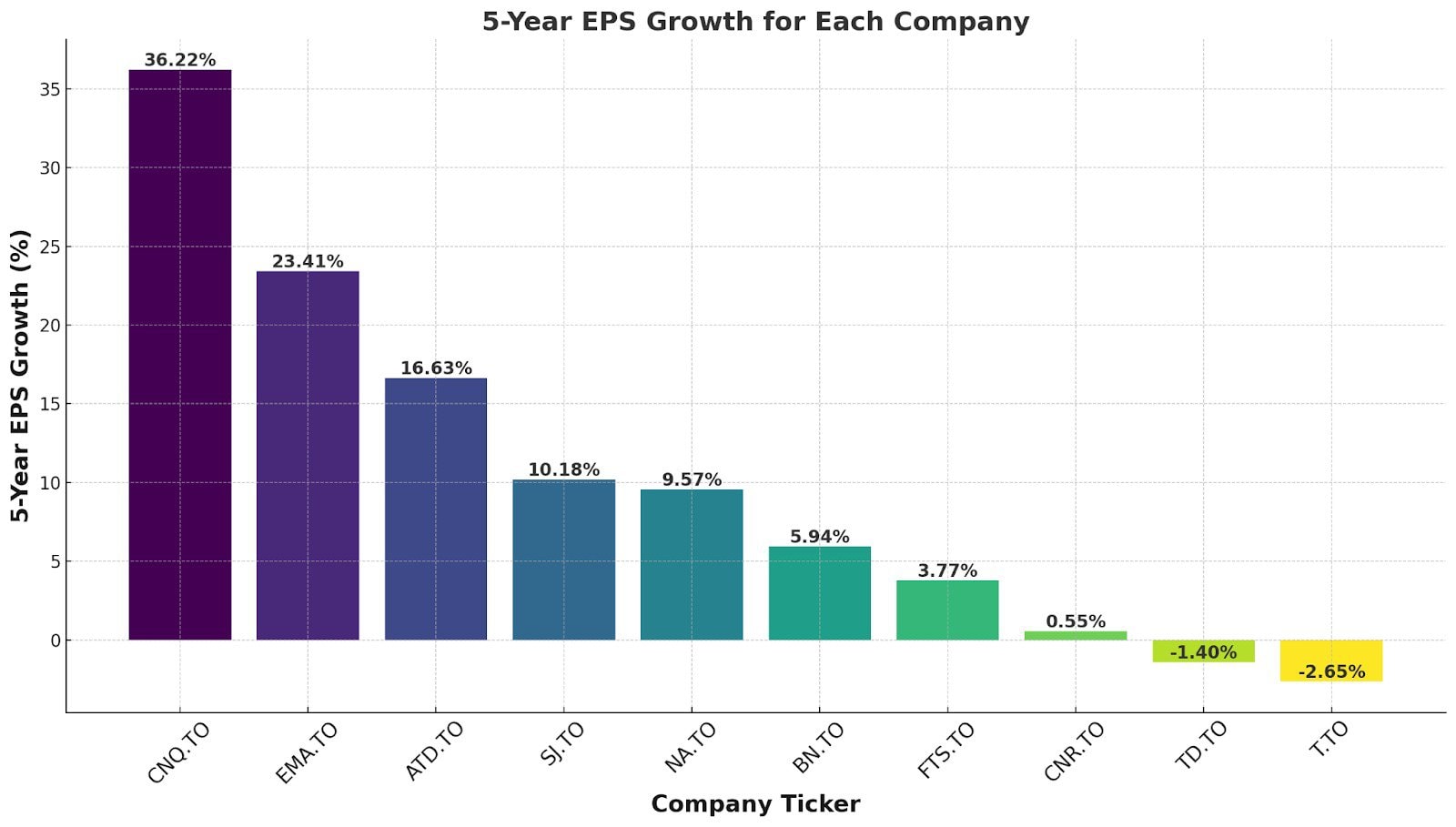

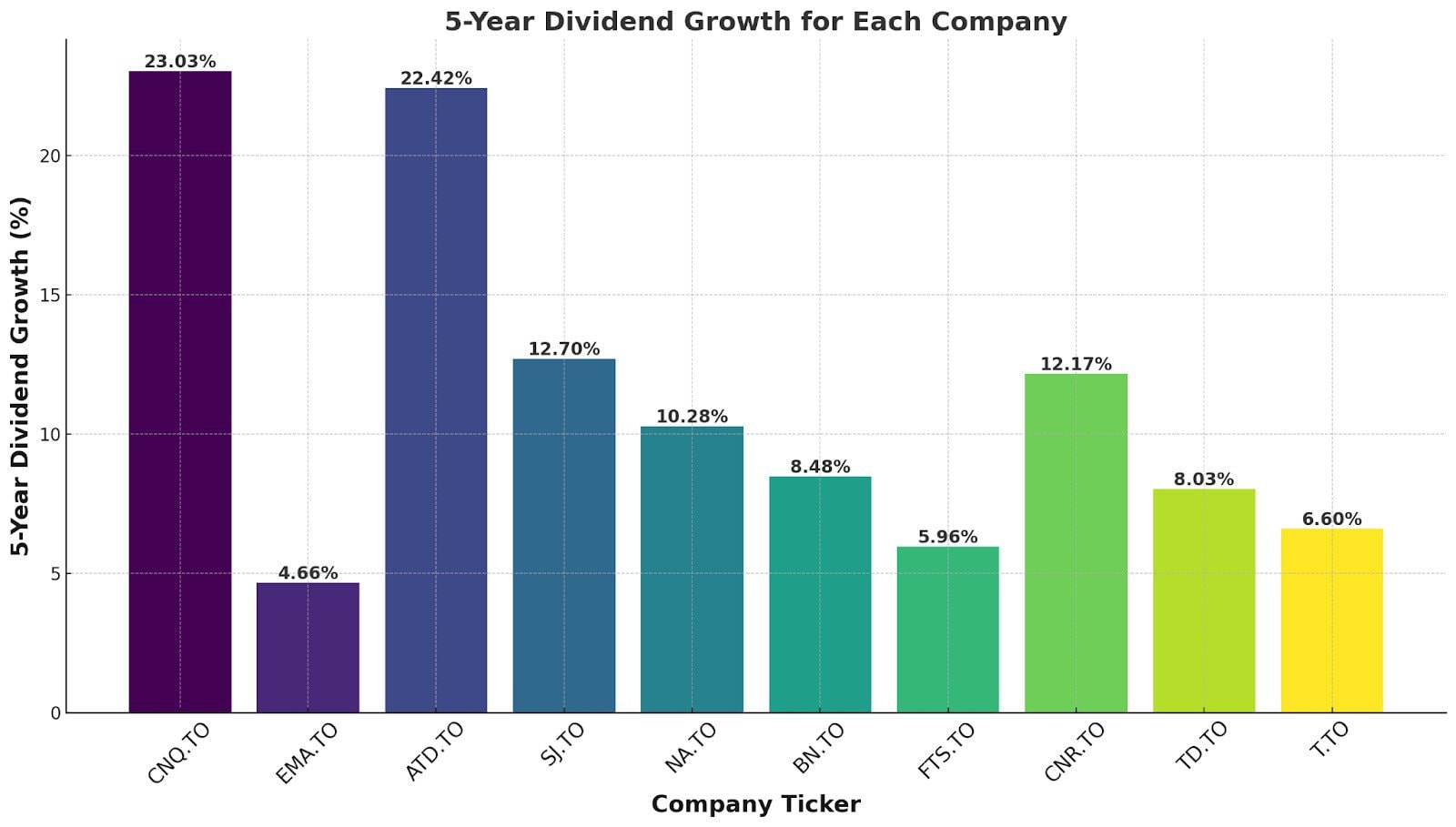

Canadian Earnings Per Share vs Dividend Growth in 2026

Because I’m looking to invest in Canadian dividend stocks for the next several decades, I like to look at medium- and long-term trends when it comes to the company’s earnings and their dividend growth. These metrics tell me two important facts:

1) Is the company generally making more money each year?

2) Does management believe in rewarding shareholders with dividend increases on a consistent basis?

Here’s a look at how our top Canadian dividend stocks stack up over these two metrics (click each image to view in full size).

Now of course, 5-yr dividend growth and 5-yr earnings growth are not the only criteria that matters. It has to be taken in context.

For example when we look at the two charts above, the following facts jump out at me:

- CNQ has obviously benefitted big time from increased oil prices the last few years. This likely isn’t sustainable over the long term.

- ATD has been an earnings beast given that they’re a retail stock built for steady long-term growth. There’s a reason why this is Mike’s favourite stock.

- EMA, SJ, NA, BN, and FTS have the earnings growth to support their aggressive dividend growth policies.

- CNR, TD, and Telus, all bear closer scrutiny. Higher interest rates and large capital expenditure costs have weighed on the earnings of CNR and Telus over the past few years. Those expenses should go down, and the assets should continue to grow earnings – but they’re definitely on my “close watch” list.

- TD is another story entirely, and despite their short term earnings missteps (which are substantial), I simply believe their competitive moat in Canada’s banking oligopoly, as well as their conservative payout ratio give me reason to delay panic… for now. As interest rates come down, TD will need to prove that they can increase earnings sooner rather than later.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Rogers, Bell, Telus Stocks in 2026

Let’s be honest. If you told a Canadian investor in 2016 that the Big 3 telecoms would be stuck in the mud only 10 years later, they would’ve laughed. After all, they had a profit-gushing oligopoly going.

Telecom stock prices didn’t fall apart because Canadians stopped using their products. It stumbled because the sector ran head-first into a perfect storm of too much debt, too much capital spending, and too much price competition – all while interest rates moved sharply higher.

That combination exposed just how fragile the old “telecom dividend = bond substitute” narrative really was.

In May 2025, BCE slashed its dividend by more than half, dropping the annual payout from just under $4 per share to about $1.75. It was the first cut in nearly two decades – and it immediately changed how investors think about Canadian telecom dividends.

I’d been uneasy about Bell for years due to its payout ratio and balance sheet pressure, which is why it hasn’t shown up on my top dividend stock lists since 2020.

To be clear, the cut was probably the right long-term decision. It gives Bell breathing room to reduce debt and redirect cash toward more productive uses. But for investors who relied on that income, it was still painful — and it permanently shattered the idea that telecom dividends are untouchable.

Once one member of an oligopoly cuts, the psychological safety net disappears for the rest.

I’m still a fan of Telus over the long term.

The case for the share price to up from here is straightforward:

- rein in capital spending

- grow free cash flow

- keep the payout ratio in a defensible range

- benefit from easing interest rates over time

Management has been explicit in saying that the dividend is now framed around free cash flow, not accounting earnings. They’ve laid out targets for moderate dividend growth starting in 2026 and a plan to steadily improve free cash flow over the next few years.

That’s the right framework.

The issue isn’t whether the yield is attractive – at 9% it clearly is. The issue is that there are a lot of people out there that don’t think they’re going to be able to keep that dividend flowing (especially in light of what happened to Bell). The dividend looks fine if free cash flow grows as planned. If it doesn’t, Telus suddenly starts to resemble the same math problem Bell just admitted it had.

Telus can still work as an income stock in 2026. But it’s no longer a “set it and forget it” holding. It’s a position you need to monitor.

Rogers doesn’t really belong in the same dividend stock debate as Bell and Telus anymore.

The dividend hasn’t been growing aggressively, but it also hasn’t been under the same level of scrutiny. Rogers has stuck with a steady payout while focusing on digesting past acquisitions and stabilizing the balance sheet.

That makes Rogers the most boring dividend story of the three – but maybe that’s a good thing.

Name | Ticker | Price | Dividend Yield | Payout Ratio | P/E | Market Cap |

Telus | T.TO | 18.21 | 9.18% | 233.03% | 34.49 | 28.29B |

BCE Inc. | BCE.TO | 32.33 | 5.44% | 2216.56% | 4.84 | 29.97B |

Rogers | RCI.B.TO | 50.70 | 3.90% | 61.59% | 4.11 | 27.82B |

Why telecom struggled so badly in 2024 and 2025

- Telecom companies require massive upfront capital investment, with returns spread over decades. Rising interest rates made that model far less forgiving.

- The 5G rollout was extraordinarily expensive, and the expected pricing power never really showed up. Consumers got faster speeds, but not higher bills.

- Competition intensified. Promotional pricing became the norm, not the exception, putting ongoing pressure on margins.

- Traditional TV assets continue to bleed subscribers as cord-cutting becomes the default, not a trend.

A reasonable argument can be made that much of the long term pain is already reflected in telecom share prices. Capital spending should gradually come down, interest rates are no longer moving up, and free cash flow should improve as the heavy lifting winds down. Maybe pricing power can reassert itself going forward.

But investors are no longer willing to take management at their word.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

My Top Canadian Dividend Stock Recommendations

Sorted in order of dividend streak:

Fortis (FTS.TO) – 52 Years of Dividend Growth

- 3.59% Dividend Yield

- 6.15% 5 Year Revenue Growth

- 4.81% 5 Year Dividend Growth

- 74.53% Payout Ratio

- 21.11 P/E

Investment Thesis:

Fortis has continued to do exactly what regulated utilities are supposed to do – steadily grow its rate base, invest in essential infrastructure, and convert that spending into predictable cash flow. As of its most recent filings, Fortis expects its regulated rate base to grow at roughly 6% annually through 2028, driven primarily by transmission and distribution investments rather than higher-risk generation projects.

The company is currently executing a $25 billion capital plan covering 2024 through 2028, an increase from its prior plan as grid hardening, reliability upgrades, and customer growth continue to demand capital. About 99% of Fortis’ assets are regulated, and roughly two-thirds of earnings now come from U.S. utilities, providing geographic and regulatory diversification that Canadian-only peers simply don’t have.

Financing remains conservative. Management expects approximately 55–60% of capital spending to be funded through cash from operations, with the remainder split between modest equity issuance and debt. Importantly, Fortis has avoided levering up aggressively at a time when higher interest rates are punishing capital-intensive businesses. Its credit metrics remain solid, with a BBB+ / A- range credit profile depending on the rating agency.

Renewables are not the headline story here, but Fortis continues to gradually increase exposure to cleaner energy and transmission assets tied to electrification. Clean energy and related infrastructure still represent a single-digit percentage of total assets, and management has been clear that returns and regulatory clarity come before optics. This measured approach has helped Fortis avoid the earnings volatility seen at more aggressive utility peers.

Dividend Growth Perspective:

Fortis remains one of the most reliable dividend growth companies in the Canadian market. The company has increased its dividend for 52 consecutive years, placing it in extremely rare territory even by global standards. Over the past five years, the dividend has grown at an average annual rate of approximately 6%, fully in line with management’s long-standing guidance.

Looking forward, Fortis continues to target 4–6% annual dividend growth, supported by expected earnings per share growth of roughly 6% per year driven by regulated rate-base expansion. The payout ratio remains reasonable for a utility, sitting in the 70–75% range, which provides enough room to fund growth while maintaining dividend stability.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Toromont Industries (TIH.TO) – 36 Years of Dividend Growth

- 1.24% Dividend Yield

- 7.90% 5 Year Revenue Growth

- 10.90% 5 Year Dividend Growth

- 31.06% Payout Ratio

- 27.66 P/E

Investment Thesis:

Toromont is one of those quietly excellent Canadian compounders that doesn’t always get grouped with “dividend stocks,” but behaves like one over full cycles. The business is built around two durable engines: the Equipment Group, which operates one of the largest Caterpillar dealership networks in North America, and CIMCO, its industrial and recreational refrigeration business.

The Equipment Group drives the bulk of revenue from construction and mining activity. Rentals, parts, and product support tend to be steadier and higher-margin parts of the business, and they provide a cushion when construction or commodity markets cool. That recurring service component is a big reason Toromont has been able to navigate cycles better than a pure equipment seller.

CIMCO adds a second layer of stability. Industrial refrigeration, cold storage, and recreational ice systems don’t move in lockstep with mining or construction, which helps smooth results over time.

Toromont has also been deliberate with acquisitions. Its long-standing Caterpillar dealership expansion laid the foundation, and more recent moves have added exposure to power systems manufacturing and data-centre-related infrastructure through AVL Manufacturing.

AVL has been ramping production, expanding capacity in the U.S., and broadening Toromont’s footprint beyond its traditional markets. Importantly, these acquisitions have been bolt-ons rather than empire-building deals.

Dividend Growth Perspective:

Toromont is a dividend growth stock, not a high-yield income stock.

What matters for dividend growth investors is sustainability. Toromont does not have to stretch its balance sheet to support the dividend, and management has consistently returned capital to shareholders while still reinvesting heavily in the business. Dividend growth tends to track long-term earnings growth rather than short-term swings in equipment sales.

Like any industrial stock, Toromont is not immune to economic cycles. A slowdown in mining or construction will impact results. That said, the combination of rentals, parts, service, and refrigeration work helps keep cash flow resilient enough to support ongoing dividend increases through most environments.

Canadian National Railway (CNR.TO) – 29 Years of Dividend Increases

- 2.55% Dividend Yield

- 4.47% 5 Year Revenue Growth

- 9.07% 5 Year Dividend Growth

- 48.07% Payout Ratio

- 18.87 P/E

Investment Thesis:

Canadian National Railway has long been considered best-in-class when it comes to operating efficiency, and while peers have narrowed the gap over the past decade, CNR still sits near the top of the industry. In recent years, its operating ratio has generally hovered in the low-60% range, even as inflation and labour costs have pressured margins across the sector.

CNR owns one of the highest-quality rail networks in North America, with a unique footprint connecting the Atlantic, Pacific, and Gulf of Mexico. That network is virtually impossible to replicate today, creating an enormous economic moat (alongside its competitory over at CP). Rail remains the lowest-cost and most fuel-efficient way to move bulk commodities and heavy freight over long distances, which supports long-term volume demand and pricing power, even if growth comes in cycles.

From a cash flow perspective, CNR continues to convert a large portion of its revenue into free cash flow. Annual revenues have generally remained in the $16–18 billion range in recent years, with operating cash flow consistently exceeding $6 billion. That level of cash generation gives management flexibility to reinvest in the network, raise dividends, and buy back shares.

Dividend Growth Perspective:

Railroads are capital-intensive businesses, and CNR is no exception. Maintaining and expanding a continent-scale rail network requires billions in ongoing capital spending each year. CNR typically invests around $3-4 billion annually in maintenance and growth projects, which is necessary to preserve service reliability and long-term competitiveness.

Despite that heavy reinvestment burden, CNR continues to generate ample cash to support dividend growth. The company has increased its dividend for 29 consecutive years, and over the past decade the dividend has grown at a double-digit annualized rate. More recently, dividend growth has moderated into the high single-digit range, which is more sustainable given the company’s size and maturity.

The payout ratio remains conservative by dividend stock standards, generally sitting in the 35–40% range of earnings. That low payout provides a meaningful buffer during freight slowdowns and allows management to prioritize network investment without putting the dividend at risk.

Canadian National Resources (CNQ.TO) – 25 Years of Dividend Increases

- 5.39% Dividend Yield

- 17.98% 5 Year Revenue Growth

- 22.55% 5 Year Dividend Growth

- 74.30% Payout Ratio

- 13.80 P/E

Investment Thesis:

Canadian Natural Resources remains one of the highest-quality oil and gas producers in Canada, but the investment case looks different today than it did during the post-2020 rebound. With West Texas Intermediate generally trading in the $65–75 US range over the past couple of years, CNQ has proven it can generate strong cash flow without needing a commodity price boom.

The company’s biggest strength continues to be its cost structure. After years of heavy capital investment, CNQ has driven its corporate breakeven oil price down to roughly the mid-$30s. That margin of safety allows CNQ to remain profitable and free-cash-flow positive even during weaker oil markets.

Production is highly diversified across the oil sands, conventional heavy oil, light crude, and natural gas, which helps smooth results across cycles. Total production now exceeds 1.3 million barrels of oil equivalent per day, giving CNQ massive operating leverage when prices rise, but also scale advantages when they fall. Capital spending has normalized after years of aggressive growth.

Environmental and long-term demand concerns haven’t gone away. Oil sands assets are capital intensive and carbon heavy, and global energy policy continues to tilt toward electrification and renewables. That said, CNQ’s assets have extremely long reserve lives and low decline rates, making them well suited to a world where oil demand plateaus rather than collapses. As long as oil remains a necessary input to the global economy, low-cost producers like CNQ are likely to be the last ones standing.

CNQ’s share price has already reflected much of the post-pandemic recovery, more than doubling from 2020 lows. From here, returns are likely to be driven less by valuation expansion and more by disciplined operations and cash returns to shareholders.

Dividend Growth Perspective:

Canadian Natural Resources has quietly built one of the strongest dividend track records in the Canadian energy sector. The company has increased its dividend for 24 yeras, including through oil downturns that forced many peers to cut or suspend payouts.

The step-change came after 2021, when CNQ aggressively increased its base dividend while also layering on variable returns through share buybacks and special dividends. The dividend was increased by double-digit percentages in both 2022 and 2023, reflecting management’s confidence in the durability of cash flows at mid-cycle oil prices.

Today, the base dividend is deliberately set at a conservative level, with a payout ratio that typically sits well below 50% of free cash flow at $65–70 WTI. Excess cash is prioritized toward balance sheet strength and opportunistic buybacks, which gives CNQ flexibility if oil prices soften.

This approach makes CNQ less of a “pure income” stock and more of a total return dividend grower. Dividend growth will ebb and flow with the commodity cycle, but the underlying business has demonstrated it can support and grow payouts without relying on heroic oil price assumptions.

Emera (EMA.TO) – 17 Years of Dividend Increases

- 4.33% Dividend Yield

- 8.37% 5 Year Revenue Growth

- 3.07% 5 Year Dividend Growth

- 167.81% Payout Ratio

- 18.31 P/E

Investment Thesis:

Emera remains a diversified regulated utility with a solid footprint on both sides of the border. That translates into steady cash flows over the long term. Its core operations are anchored in Nova Scotia and Florida, with additional regulated utilities across several Caribbean jurisdictions.

Florida continues to be the centre of gravity for Emera’s growth. Tampa Electric now accounts for the majority of earnings. Florida’s population growth, rising electricity demand, and generally constructive regulatory environment have made it one of the more attractive utility markets in North America. You factor in new data centre electricity needs and you have yourself an excellent recipe for relatively safe returns.

Emera is in the middle of a large capital investment cycle focused on grid modernization, reliability, and cleaner generation. Over the 2024–2028 period, management expects to invest roughly $8–10 billion, with approximately two-thirds of that spending directed to Florida. These investments are heavily weighted toward regulated transmission and distribution assets rather than merchant power, which keeps risk contained.

Emera’s balance sheet remains the main point to watch. The company carries higher leverage than some Canadian utility peers following years of capital spending and acquisitions. Management has acknowledged this and has been prioritizing balance sheet stability as capital spending moderates. As interest rates remain higher than the pre-2022 era, disciplined financing will be key to protecting shareholder returns.

Dividend Growth Perspective:

Emera has increased its dividend for nearly two decades, maintaining a steady record of income growth through multiple economic cycles. Dividend growth has slowed in recent years, reflecting the company’s focus on funding capital projects and managing leverage, but the commitment to annual increases remains intact.

Management continues to guide toward 4-5% annual dividend growth. The payout ratio target remains in the 70–75% range of adjusted earnings, which is typical for a mature regulated utility but leaves less margin for error than lower-payout peers.

At recent prices, Emera’s dividend yield has generally sat in the 4-5% range. That yield reflects both the company’s stable cash flows and some lingering investor caution around debt levels and capital intensity.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

National Bank (NA.TO) – 16 Years of Dividend Growth

- 2.84% Dividend Yield

- 9.96% 5 Year Revenue Growth

- 10.76% 5 Year Dividend Growth

- 45.77% Payout Ratio

- 17.33 P/E

Investment Thesis:

My personal Canadian dividend stock pick in 2021, 2022, and 2023!

National Bank has established itself as one of the two strongest performers among Canadian banks over the past decade, and the reasons for that outperformance remain largely intact. Rather than trying to outgrow the Big Six through sheer volume, NA has focused on higher-return business lines such as capital markets, wealth management, and private banking.

Private Banking 1859 has grown into a meaningful contributor to earnings, particularly among high-net-worth and entrepreneurial clients. National Bank has also expanded its private banking presence outside Quebec, including targeted growth in Western Canada, which has helped diversify its revenue base without diluting its core strengths.

While the bank remains heavily concentrated in Quebec, that exposure has historically been a feature rather than a flaw. Quebec has provided a stable deposit base and strong client relationships, while National Bank has supplemented that regional focus through partnerships and credit exposure tied to Power Corporation-affiliated investment and insurance businesses. That said, given the talk of Quebec referendums rearing its ugly head, I’m increasingly worried about the tail risk here.

National Bank has also shown a willingness to pursue non-traditional growth vectors. Its majority stake in ABA Bank has turned Cambodia into a surprisingly meaningful earnings contributor, now accounting for roughly 15% of net income in stronger years. Unlike some international expansions by Canadian banks, ABA has delivered consistent profitability.

Dividend Growth Perspective:

Like all banks, National Bank is exposed to economic cycles. Rising unemployment, slower credit growth, or a prolonged market downturn can pressure earnings. Capital markets revenue, in particular, remains volatile and can swing meaningfully from quarter to quarter if equity issuance, M&A activity, or trading volumes dry up. Given the outsized impacts of tariffs on Quebec, National Bank is a bit exposed there as well.

That said, National Bank’s balance sheet looks quite solid. Its capital ratios remain comfortably above regulatory minimums, and its dividend payout ratio has generally stayed in the 40–50% range of earnings. This provides room to absorb earnings volatility without putting the dividend at risk.

National Bank has increased its dividend every year for more than a decade, and its combination of revenue growth, earnings growth, and dividend growth continues to form one of the strongest dividend triangles in the Canadian banking sector.

Alimentation Couche-Tard (ATD.B.TO) – 16 Years of Dividend Growth

- 1.17% Dividend Yield

- 10.73% 5 Year Revenue Growth

- 21.88% 5 Year Dividend Growth

- 19.58% Payout Ratio

- 19.42 P/E

Investment Thesis:

Alimentation Couche-Tard has built a dominant position in the global convenience store industry by sticking to a simple but hard-to-execute playbook: buy smart (don’t overpay), integrate quickly, and relentlessly improve operation margins. That formula has driven steady revenue and earnings growth for more than a decade and continues to underpin the long-term investment case today.

Couche-Tard now operates over 17,000 stores worldwide, primarily under the Circle K banner, with a strong footprint across North America and Europe and a growing presence in select international markets. The business generates revenue from a mix of fuel sales, in-store merchandise, and food service. Fuel remains a major traffic driver and profit contributor, but management has spent years deliberately reducing reliance on any single category.

Organic growth has become increasingly important. Initiatives such as Fresh Food Fast, improved pricing and promotions, expanded private-label assortments, and tighter cost controls have helped lift margins and same-store performance. At the same time, Couche-Tard has been investing in digital tools and loyalty programs to better target promotions and optimize merchandising, quietly improving profitability across its store base.

Longer term, management has laid out an ambitious but credible roadmap through its “10 for the Win” strategy, which targets more than $10 billion in EBITDA by 2028. Acquisitions remain the company’s biggest differentiator. Couche-Tard’s ability to integrate acquired stores, extract synergies, and improve returns has consistently set it apart from peers.

While its high-profile failed pursuit 7-Eleven grabbed headlines in late 2024, history suggests investors shouldn’t fixate on any one deal. Management has repeatedly shown discipline at the negotiating table, walking away when valuations don’t make sense and pivoting back to smaller, high-return acquisitions when necessary.

Concerns around electric vehicles and declining cigarette sales are real, but they are not new. Couche-Tard has been planning for these shifts for years by expanding fresh food offerings, experimenting with new store formats, and rolling out EV charging infrastructure across select locations. Fuel demand isn’t disappearing overnight, and Couche-Tard’s scale and adaptability position it well to manage a gradual transition rather than be blindsided by it.

Dividend Growth Perspective:

Couche-Tard is a textbook example of a dividend growth stock that prioritizes compounding over yield. The dividend has grown at a double-digit rate over long periods, supported by steady earnings growth and an extremely conservative payout ratio.

That payout ratio typically sits below 25% of earnings, giving management significant flexibility. Cash flow is first allocated to reinvestment and acquisitions, with dividends rising as a byproduct of a growing business rather than as a constraint on it. This approach has allowed Couche-Tard to increase dividends aggressively without stretching the balance sheet or sacrificing growth opportunities.

For income-focused investors, Couche-Tard requires patience. The current yield is modest, but the combination of strong free cash flow generation, disciplined capital allocation, and consistent execution has historically delivered excellent total returns.

As long as management continues to follow its proven playbook, Couche-Tard remains one of the strongest long-term dividend growth stories in the Canadian market.

Brookfield Corp – 16 Years of Dividend Growth

- 0.49% Dividend Yield

- 3.93% 5 Year Revenue Growth

- -5.59% 5 Year Dividend Growth

- 104.65% Payout Ratio

- 102.42 P/E

Investment Thesis:

I’ve been a bit tentative when it comes to the Brookfield family of companies, as it can be quite difficult to really dig into their quarterly statements due to their size and complexity. That said, their past results and unique corporate structure have ensured access to billions of dollars in liquidity to finance its projects.

Unlike Brookfield Asset Management, which operates as a largely asset-light fee manager, BN is asset-heavy by design. It not only earns fees on assets under management, but also deploys its own capital alongside clients, allowing it to participate directly in capital appreciation and long-term value creation.

That dual role is central to Brookfield’s strategy. BN invests across real estate, infrastructure, private equity, renewables, and private credit. The company has access to billions of dollars in liquidity through permanent capital, long-duration funds, and institutional relationships, which allows it to act decisively during periods of market stress when capital is scarce.

Asset recycling is a core part of the playbook. Brookfield routinely sells mature assets at attractive valuations and redeploys that capital into distressed or undervalued opportunities. In simple terms, it tries to buy when others can’t, improve assets operationally, and sell when demand returns. That cycle has been repeated across multiple market downturns and is a major driver of long-term compounding.

Brookfield is also positioned to benefit from a structural shift in global investing. Management estimates that alternative assets could grow from roughly 25% of global asset allocations today to as much as 60% by 2030. Whether or not that exact number is reached, institutional investors continue to increase exposure to infrastructure, private credit, and real assets – areas where Brookfield has decades of experience and scale.

Dividend Growth Perspective:

Brookfield Corporation is not an income stock. Following the restructuring and separation of Brookfield Asset Management, BN’s dividend yield has remained low, generally under 1%, and is not the primary reason to own the shares.

Management has signalled an intention to grow the dividend over time, supported by fee-related earnings, asset monetization, and balance sheet strength. However, dividend growth is secondary to capital deployment and long-term value creation.

Investors looking for higher current income may prefer Brookfield Asset Management, which earns recurring fees on assets under management. Brookfield Corporation, by contrast, offers a blend of fee income, asset ownership, and capital appreciation. BN is best viewed as a long-term compounding vehicle rather than a traditional Canadian dividend stock.

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Waste Connections – 15 Years Of Dividends Growth

- 0.82% Dividend Yield

- 11.43% 5 Year Revenue Growth

- 10.73% 5 Year Dividend Growth

- 48.94% Payout Ratio

- 72.47 P/E

Investment Thesis:

Waste Connections is one of the best examples of a “boring business” that can still deliver not-so-boring shareholder returns. Garbage pickup is about as recession-resistant as it gets. Municipalities and businesses don’t really have the option to pause service when the economy slows.

The company’s edge comes from vertical integration and market selection. As of the most recent full-year reporting, it operated roughly 113 landfills, 222 transfer stations, and 89 recycling facilities. Owning scarce, permitted disposal capacity matters because it gives the company leverage in pricing, routing, and long-term planning. It also makes it brutally difficult for competitors to replicate the business in any meaningful way (good luck permitting a new landfill in 2026).

Management has also built the business around secondary and rural markets rather than fighting constant price wars in the most competitive urban cores. The company’s mix includes a meaningful base of exclusive or franchise-style markets, with the remainder largely in competitive markets where it tends to have high market share.

Financially, the model has continued to do what you want it to do. In 2024, Waste Connections generated about $8.9 billion in revenue and roughly $2.9 billion in adjusted EBITDA, with an adjusted EBITDA margin around 32.5%. For 2025, we saw $9.45 billion and adjusted EBITDA around $3.12 billion, showing margin improvement toward 33%.

That’s a pretty clear signal that pricing and operating discipline are still doing their job, even as costs move around. Adjusted free cash flow has been running in the $1.2 to $1.3 billion range, which is the real fuel that powers acquisitions and shareholder returns.

Acquisitions remain a big part of the compounding story. Waste Connections has a long track record of buying smaller operators, integrating routes, improving pricing, and raising margins over time. Over the last five years, it has completed more than 100 acquisitions totaling roughly $2.2 billion in annualized revenue. That’s not “one big bet” M&A. That’s a steady roll-up machine.

Waste Connections is a cash flow business with pricing power, high barriers to entry, and a disciplined acquisition engine. It’s not flashy. It just tends to keep compounding.

Dividend Growth Perspective:

Waste Connections is another stock that isn’t going to pop up on a lot of dividend lists due to its relatively low yield – but it’s an excellent dividend growth story. The yield typically sits under 1% because the stock has compounded so well (not because the dividend is neglected).

Management has been raising the dividend at a double-digit clip for years, and in October 2025 the company increased its quarterly dividend by 11.1% to US$0.35 per share (up from US$0.315). That brings the annualized dividend to about US$1.40 per share.

This is the kind of company that will usually prioritize reinvestment and acquisitions first (because the returns can be excellent), then steadily grow the dividend alongside earnings and cash flow. If you’re building a dividend growth portfolio and you want exposure to a defensive, infrastructure-like business with real pricing power, WCN fits beautifully.

Canadian Dividend Stocks with 10 Years of Dividend Increases

The last few years have seen intense change and turmoil. First the pandemic caused widespread panic and made folks sell off their portfolios. Then we had meme-stock mania and a small bubble in certain markets. Finally, we’ve been dealing with inflationary effects over the last 18 months that have increased interest rates and led to smaller overall margins due to increased debt costs.

Throughout all of this, there are 38 companies in Canada that have just boringly raised their dividends year after year. Click below for the list of Canadian dividend growth stocks that weren’t shaken by the pandemic, bubbles, panic, inflation, or interest rates.

Canada’s 38 Dividend Growth Stocks

(Ten Years or More Dividend Increases)

Click below to find all the new additions to the previous top Canadian stocks. The following have been handpicked for their ability to face the economic lockdown and thrive going forward.

Dividend Investing in Canada – Frequently Asked Questions

“How do dividend stocks work?”

Simply put, dividends are the payment that businesses make to their owners after expenses have been paid for during a specific time period. Some companies produce yearly dividends, but most pay “quarterly” (every three months).

Most dividend-heavy companies (certainly all of the Canadian dividend stocks on the list above) announce their dividend intentions for the next year, and then split up their after-tax profit between dividends and retained earnings. The retained earnings are put back into the company in one form or another, while dividends are simply paid out to shareholders.

Companies can “slash” or cut their dividend whenever they wish – there is no law saying they must pay out a certain percentage of profit or anything like that. Consequently, there is often an emphasis on long-time dividend growth stocks that have a proven track record of not only paying out dividends, but increasing them as time goes on, and thus rewarding shareholders.

“How is a dividend being paid?”

Dividends are paid to shareholders. They are paid out on a per-share basis, and for each share you own as an investor, you get paid a certain amount. This amount is most commonly expressed a percentage of the current price of a stock.

So for example, you might hear, “Enbridge currently has a dividend ratio of 8%.” This simply means that if Enbridge’s current stock price was $40, (.08 x 40 = $3.20) an investor would expect to earn $3.20 in dividends from Enbridge for the upcoming year. That $3.20 would likely come to them in four separate installments of $0.80.

Companies can also announce “Special Dividends” at any time. In this situation, there is a unique one-time payout to shareholders.

In order to qualify for a dividend you must purchase a share before the “ex-dividend date” – which is announced by each company fairly far in advance.

“How to buy dividend stocks in Canada?”

While you can still buy dividend stocks through the old fashioned telephone brokerage systems, the vast majority of investors now purchase dividends as DIY investors using their discount brokerage accounts.

At Million Dollar Journey, we have put together dozens of reviews and comparisons pieces destined to provide our readers with insights regarding the best Canadian broker for long term investing.

Good to Know:

Many Canadian dividend stocks offer DRIP (Dividend Reinvestment Plans), which automatically reinvest dividends into additional shares without paying trading fees. This can accelerate your portfolio growth through compounding.

Read about the most popular brokers like Qtrade and Questrade as well as robo-advisors like Wealthsimple and learn how to maximize your savings in that regard.

The other common way to get portfolio exposure to Canada’s best dividend stocks is through dividend-ETFs on the Toronto Stock Exchange (TSX). Using a dividend ETF provides your investment dollar with instant diversification to companies that have a strong dividend profile.

“When to buy dividend stocks?”

The honest answer is: “Any time you have the investing funds available to do so”. There are many folks out there who think that they can time the market and purchase stocks at the absolute perfect time. Despite that belief, there is very little evidence that this is true.

It’s also quite difficult to time when stocks are nearing the peak. Consequently, the most successful dividend investors that I’ve seen are folks who stick to a pre-planned strategy and simply invest their surplus funds as soon as they are able, into shares of dividend-payers that they have done their homework on and anticipate holding for the long term. We have a whole article dedicated to when is the right time to buy dividends stocks.

“When is the time to sell dividend stocks?”

If you are like Warren Buffett and buy stocks that, “You want to hold forever” – then the answer to when you should sell your dividend stocks is: Never! In practice, there are a few times over the past 15+ years when companies have significantly cut their dividend, and to me, this is a flashing red sign that something is majorly wrong with the company.

Cutting a dividend is usually seen as a last resort because it has such a dramatic effect on the stock price. Major shareholders hate the idea of sacrificing that cashflow – so when the decision is made, I usually sit up and take notice.

That said, I prefer to do my homework before purchasing any single stock. Consequently, I almost never sell my dividend stocks, because I am quite confident in their long-term growth. You can read my articles about Canadian dividend kings and beating the TSX for some specific suggestions.

The statistics around trying to jump in and out of the market just aren’t very good, and it really pays to be confident in your reasons for choosing a stock – so that you can not only hang on to your shares during tough times in the market – but also “Be fearful when others are greedy” and buy more shares of your favourite dividend stocks when prices are down.

“What are the best dividend stocks?”

Well, clearly if you’ve read this far into our article you know what our choices are for best Canadian dividend stocks! After years of personal dividend investing and research, I’ve come to the conclusion that the Dividend Stocks Rock way of judging dividend stocks by their “Dividend Triangle” is the best long-term way to value solid Canadian companies. The main idea is to equally weight a company’s overall revenues, their Earnings-Per-Share (EPS), and their commitment to dividend growth over the long term.

I used to simply look at dividend yield as the “be-all and end-all” of dividend investing, but Mike has convinced me over the years that your long-term dividend payouts and capital gains are more secure by focusing on the three metrics of revenues, earnings, and dividend growth.

Good to Know:

Not all dividend-paying stocks are Dividend Aristocrats! A Dividend Aristocrat is a stock that has increased its dividend for at least 25 consecutive years, while a general dividend growth stock may have a shorter but still strong history of increasing payouts.

“Are there tax benefits for dividend stock investing in Canada?”

Gaining income from dividend stocks is one of the most tax-efficient ways that you can put your

money to work for you. This is especially true at lower income levels (such as those that many retirees typically account for at the end of the year) when the dividend tax credit really shines.

If you’ve never heard of the dividend tax credit or the dividend gross up, here’s the basic idea:

1) There are actually two different dividend tax credits: the Provincial Dividend Tax Credit and the Federal Dividend Tax Credit

2) The reason for these tax credits is rooted in the idea of tax fairness. Because businesses pay corporate taxes before money is disbursed to shareholders, there is a process where your dividend income is “grossed up” and then a tax credit applied.

3) What this so-called “gross up + tax credit” often looks like in practice is that your income gets artificially inflated, but then a very generous amount of your taxes owing is cancelled by the government.

Here’s an example:

If I owned 1,000 shares of Enbridge (ENB) during 2020, and earned $3.20 for each share, then my dividend income would be $3,200.

Now, depending on what other income that I had, I would be placed in a specific tax bracket. Obviously I might have dividend income from other stocks, I might also have worked for a living and have earned income.

If I made $60,000 in earned income, and Enbridge was the only stock that I owned, then the following calculation would be made for my dividend income:

$60,000 of earned income would be taxed by the federal government at a rate of 0% on the first $13,000, then a rate of 15-20.5% on the rest. My $3,200 in Enbridge dividends would only be charged a tax rate of 7.56% after the dividend gross up and dividend tax credit were applied.

Looking at the provincial side of the equation. If I lived in Ontario, my $60,000 of earned income would be taxed at a rate of 0% on the first $10,000, then a rate of 20-30% on the rest. My $3,200 in Enbridge dividends would only be charged a tax rate of

For many retirees, who no longer earn a paycheque, it’s possible to actually experience a negative tax rate on the first $30,000 or so of dividend payments – less than a 0% tax rate!

Most Recent News on Canadian Dividend Stocks

With the Canadian election in the rearview mirror, Trump’s tariffs and tough talk are ready to once again take centre stage. Canadian dividend stocks are feeling the ripple effects. Even the most stable names in utilities, pipelines, and telecoms aren’t immune to the relentless hum of economic uncertainty.

Over the last couple of years, all that “higher for longer” interest rate chatter definitely put a dent in sentiment around top Canadian dividend stocks. I mean, if you could lock in a GIC at 5.25% with zero risk [See: Best GIC Rates in Canada], then taking a chance on equities – even blue-chip ones -suddenly looked a lot less appealing.

But fast-forward to today, and those GICs are back down to 3.5%. Not only that, but I’d argue that given the Trumpian hit to our economy, the chances of interest rate cuts are growing substantially. All of a sudden, those 4%+ dividend yields are looking a whole lot more attractive again.

Good to Know:

When interest rates rise, dividend-paying stocks may become less attractive compared to fixed-income investments like bonds. However, high-quality dividend growth stocks tend to outperform over the long term due to their ability to increase payouts even in tough economic conditions.

That’s nothing to sneeze at, and it’s a trade-off a lot of folks near or in retirement are happy to make – especially after watching tech get pummeled back in 2022.

The core reason I stay bullish on these boring-but-profitable stocks? Durable competitive advantage.

Think about it – getting one pipeline built in BC has taken decades of political trench warfare, and that was along an existing route. Good luck launching a new one. The same logic applies to Canada’s utilities, telecoms, and banks. These aren’t sectors where new competition magically appears and eats market share overnight.

Yes, telecoms have hit some rough waters lately due to 5G costs and falling profit margins, but over the long haul, they’ve delivered reliable cash flow. Those long-term competitive advantages are worth banking on.

And here’s an angle I don’t see discussed enough: the rise of the U.S. Dollar has actually been a hidden win for Canadian companies. Sure, it stings when you’re planning a Florida trip or importing a new iPhone. But for our exporters, it’s a huge tailwind. Canadian goods and services are effectively on sale when priced in USD, which is great news for companies competing south of the border.

That currency edge also works in favour of financials and utilities doing business in the U.S. Their revenues in greenbacks translate into stronger earnings once they’re converted back into loonies. Tariffs or not, service-based sectors are skating around the trade drama pretty cleanly so far.

At the end of the day, I still stand firm in my dividend growth strategy. The companies I own continue to deliver – quarter after quarter, year after year. Their advantages are too entrenched, the valuations too reasonable, and the management too consistently effective for me to question the long-term legitimacy.

My Recent Dividend Track Record

I started making public dividend stock picks beginning in 2021. That year, I predicted that Canada’s midstream companies were getting way too much bad press and that their value was being driven down by the underlying price of commodities like oil and natural gas.

We thought there was a market inefficiency there as the pipelines only have a loose relationship between commodity prices and their profit margin. Our top Canadian dividend stock pick was Enbridge, and it has paid off quite well for us. We sold about 10% before the stock hit the top and haven’t added to our position since. It has consistently paid out an excellent dividend ever since.

More recently, my Canadian dividend kings pick for BOTH 2022, 2023, and 2024 was National Bank, and I’ve been very happy with its overall performance. So while my Sun Life stock pick didn’t measure up in 2025, I’d say I’ve steered more folks right than wrong over the years.

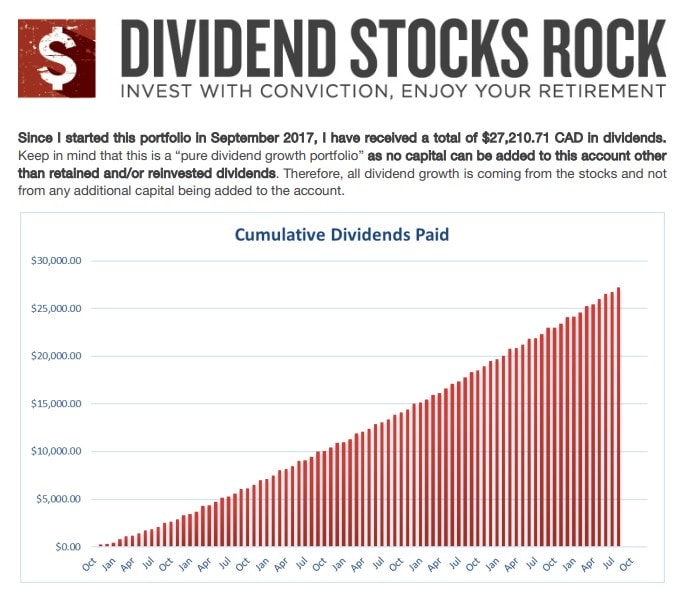

I’m stacking up well against the benchmarks, and I’m even beating my dividend buddy Mike Heroux for a couple of his portfolios. Here’s a cool look at Mike’s public dividend stock portfolio since he started the DSR service back in 2017 (and made his picks 100% public knowledge the entire way).

Further Research on Top Canadian Dividend Stocks

When it comes to building a consistent long-term income strea, my focus is usually on Canadian dividend growth stocks. But when I want deeper insights – whether it’s about U.S. dividend stocks, undervalued dividend plays, or sector-specific opportunities – I turn to Dividend Stocks Rock (DSR), run by Mike Heroux.

Mike and I have been in the personal finance space for about the same length of time (maybe that’s a nice way to say that we’re old), and he brings a unique perspective as both a CFA and former wealth manager. Over the years, I’ve subscribed to premium research tools like the Globe and Mail’s investment channels and widely respected newsletters like Morningstar – but Mike’s DSR service continues to stand out.

He’s not just an analyst; he’s an excellent communicator, breaking down complex dividend investing strategies into practical, easy-to-follow insights. Whether you’re looking for the best Canadian dividend stocks or need a data-backed strategy for international exposure, Mike’s got you covered.

I also appreciate how often Mike does webinars for his subscribers. During these exclusive online meetings he answers live questions from whoever shows up and really showcases his thorough knowledge in a way that I’ve never seen a columnist or newsletter writer do!

*Free signup with access to stock tips & webinars + 60 days money back guarantee on the pro version.

Can you comment on the argument that focusing on “dividend” stocks distracts from companies that do not pay dividends but are similarly successful conservative investments whose total growth is just as or more reliable than that of dividend growers? Are we limiting our universe to Canadian energy/utilities/finance for the most part, and missing out on other good opportunities? The argument is that if companies didn’t pay a dividend, their share price/value would increase by the amount of the dividends paid.

Hey Paul,

FT doesn’t really stop by the comment sections these days, but there is definitely some validity to that argument. For me, what it really boils down to is the idea of behaviour modification. A lot of people are just really really motivated by building up the dividend stream – and then staying the course NO MATTER WHAT. Focusing on that dividend usually results in less panic selling. That said, the math-based idea that reinvesting money into the company (to make a more valuable company) or buying back stocks with profits, is essentially just as good as paying out the dividend – is sound to me. There’s also some good tax-based reasons for dividends in a non-registered account.

FYI: In the first table the tickers for CNQ and CNR are reversed. Might want to update.

Thanks Dave!

ATD.TO when does a growth stock cease being one ?

How does an UNDER 1.5% dividend put Stella Jones anywhere CLOSE to being on your list of “Best Canadian Dividend Stocks”.

It’s not all about the dividend – but total return as well Michael.

It’s either a “Best Canadian DIVIDEND Stock” or it isn’t.

If I’m looking for a list of “Best Canadian Capital Gains Stocks”…….that’s what I’ll type into my search bar.

Thanks FT, Particularly enjoyed “Most recent news “

Any thoughts on what government policy towards transitioning from natural gas to electricity will do to companies like Fortis? (and to a lesser extent, pipelines and other oil utilities?) I’m wondering if they may no longer have as solid a future as once believed.

About 2 years ago, the City of Vancouver changed the building code to; no more heating of newly constructed homes by nat/gas. Apparently there is now a problem getting power turned on for occupancy due to BC hydro being overwhelmed. Allegedly, the City now has reversed their thoughts on no more nat gas for heating new homes!

Does Algonquin count as a eligable dividend for a non registered account? It pays its distributions in USD no? So is there the 15% withholding tax? Wondering about using it in a smith manoeuvre

No withholding tax. Buy it on the TSX and you’re good to go!

how does the pe ratio play ? what should we be looking at in a pe ratio

Thank you so much for the list ! what are your thoughts in regards to BCE and Telus payout ratio you think the dividends are safe even though they both are paying aprox 130% ?

New to this board. Just curious about the energy space further to Paul N and FT comments in Sept. I got burned in the downturn with energy (ie opportunity cost of holding a under-performing sector only to be hit by the coronavirus cyclical downturn that may last years). There is no question that the sector was cheap before the downturn, but thanks to the green folks, ESG investors, and the Canadian government, I am not sure that in the long term a proper multiple will ever return. I have no doubt that earnings and cash flow will return, as well as probably $100 oil due to chronic under investment, but it appears to me that these stocks – even SU and CNQ – are no longer buy and hold investments, but have become more like trades on the hopes of a large and quick spike in oil price. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. Ultimately the sentiment could spread to TRP and ENB despite stable outlook (I still hold the pipelines though).